Flashback

Enthusiast

- Joined

- Oct 29, 2006

- Posts

- 13,682

ING VISA - CITI MC

Makes sense in the variation then as each one does differ.

ING VISA - CITI MC

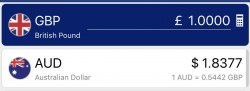

Note that Visa uses the day of transaction for the FOREX rate and Mastercard use those of the day the day prior.

Here's where you get them:

Currency Converter - Exchange Rate Calculator | Visa

Currency Converter from Mastercard | Foreign Currency Exchange Rate Calculator

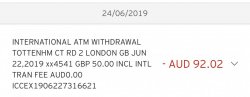

One thing that Puzzles me - 24th June is Tomorrow!

Again, my Citibank Debit Card failed to work last week in VietnamRelied on +1s Ing Orange card which was fortunate as every ATM we used in Vietnam had an ATM fee which Ing Orange refunds

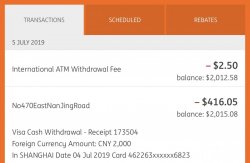

. I know it is a pain, but making 5 transactions and the mininum $1000 deposit the month before is a minor inconvenience to get the ATM fee refunded so I have just applied for an Ing Orange card for my next OS trip next month!...and have emptied ny Citibank card!!

Funny, have never had an issue anywhere using Citibank Plus. The only people I know who had a problem ignored the instructions and selected Savings/Transaction account instead of selecting Credit/Visa at the ATM.

Citi has o/s ATM transaction fees? I have never been levied an ATM fee?