Melburnian1

Veteran Member

- Joined

- Jun 7, 2013

- Posts

- 26,488

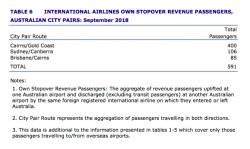

BITRE released the above this morning.

While passengers to and from mainland China rose 18 per cent (compared to September 207), Air China only carried 9.4 per cent more into or out of Oz, China Eastern 2.3 and China Southern 8.3 per cent more.

From a much smaller base, Capital Airlines had growth of around 39 per cent, Hainan Airlines 33 per cent while Donghai and Tainjin were not flying to Oz a year ago, but are both relatively small, especially the latter. Xiamen Airlines was up 23 per cent.

QF loads to and from mainland China were only up about 3 per cent while Cathay's decreased to and from the SAR by a similar percentage.

Maybe other carriers such as SQ snagged a few more of these mainland Chinese patrons? The figures do not enable that to be calculated.

Malindo Air grew hugely, up 44 per cent in Sept 2018 against Sept 2017.

China Airlines had 86 per cent growth to Taiwan (and 75 per cent to NZ). I've not been on it (but have on Eva Air) with both not as well known as they ought be to Australians.

AirAsiaX carried 26.5 per cent fewer passengers to or from Malaysia. Irrespective of what Geoffrey Thomas says re safety, this airline remains on my no fly list but that's subjective.

Emirates carried 18 per cent more pasengers to or from UAE given that QF ceased to operate there. However EK's loads to and from NZ were down almost 74 per cent as it instead favoured nonstop DXB to NZ flights.

Darwin continues to lose passengers as an international airport with the Bali route badly down (and Manila PR having ceased). In contrast, Cairns is again growing, though at around 2.5 per cent, not hugely. Perth slightly dropped but with mining again showing signs of confidence, a brighter outlook may be on the way. Melbourne continued to grow strongly, up 9 per cent, while Sydney given its constraints showed impressive 5 per cent Sept 2018 v Sept 2017 growth.

Cebu Pacific experienced more than 55 per cent traffic growth as it began flying to Melbourne thrice weekly in September. The market for MEL - MNL grew markedly compared to Sept 2017. Overall, Philippine Airlines' passenger numbers hardly dropped, suggesting that the new carrier to MEL has increased overall demand rather than just cannibalising other operators' passengers.

Qantas' passenger numbers to and from Hong Kong dropped 9.9 per cent while Virgin Australia's rose 132.9 per cent (latter due to commencement of Sydney toHong Kong VA flights). This does not disclose anything about yields that have probably dropped for all three including CX.

In September, MEL - SIN - MEL became the busiest Oz international route (for passenger numbers), eclipsing SYD - SIN - SIN.

Seat utilisation on Sri Lankan's MEL - CMB flights continues to be good. I don't know what yields are like but this may be one of the more successful launches (in its case, relaunch) of a new route into and out of Oz for some years.

Royal Brunei's passenger numbers were disappointing. It only flies to and from MEL, and at the end of October radically altered its northbound schedule to provide connections to the new nonstop BWN to LHR flight. Previously it was two stops via DXB. The change means no southeast or north Asian same day connections northbound ex MEL, so passengers who previously used it to travel to BKK, HKG or MNL may use competitors.

QF's seat occupancy to and from Santiago (SCL) was excellent. One wonders, subject to yields and equipment availability if QF might at some stage increase frequencies on this route.

While passengers to and from mainland China rose 18 per cent (compared to September 207), Air China only carried 9.4 per cent more into or out of Oz, China Eastern 2.3 and China Southern 8.3 per cent more.

From a much smaller base, Capital Airlines had growth of around 39 per cent, Hainan Airlines 33 per cent while Donghai and Tainjin were not flying to Oz a year ago, but are both relatively small, especially the latter. Xiamen Airlines was up 23 per cent.

QF loads to and from mainland China were only up about 3 per cent while Cathay's decreased to and from the SAR by a similar percentage.

Maybe other carriers such as SQ snagged a few more of these mainland Chinese patrons? The figures do not enable that to be calculated.

Malindo Air grew hugely, up 44 per cent in Sept 2018 against Sept 2017.

China Airlines had 86 per cent growth to Taiwan (and 75 per cent to NZ). I've not been on it (but have on Eva Air) with both not as well known as they ought be to Australians.

AirAsiaX carried 26.5 per cent fewer passengers to or from Malaysia. Irrespective of what Geoffrey Thomas says re safety, this airline remains on my no fly list but that's subjective.

Emirates carried 18 per cent more pasengers to or from UAE given that QF ceased to operate there. However EK's loads to and from NZ were down almost 74 per cent as it instead favoured nonstop DXB to NZ flights.

Darwin continues to lose passengers as an international airport with the Bali route badly down (and Manila PR having ceased). In contrast, Cairns is again growing, though at around 2.5 per cent, not hugely. Perth slightly dropped but with mining again showing signs of confidence, a brighter outlook may be on the way. Melbourne continued to grow strongly, up 9 per cent, while Sydney given its constraints showed impressive 5 per cent Sept 2018 v Sept 2017 growth.

Cebu Pacific experienced more than 55 per cent traffic growth as it began flying to Melbourne thrice weekly in September. The market for MEL - MNL grew markedly compared to Sept 2017. Overall, Philippine Airlines' passenger numbers hardly dropped, suggesting that the new carrier to MEL has increased overall demand rather than just cannibalising other operators' passengers.

Qantas' passenger numbers to and from Hong Kong dropped 9.9 per cent while Virgin Australia's rose 132.9 per cent (latter due to commencement of Sydney toHong Kong VA flights). This does not disclose anything about yields that have probably dropped for all three including CX.

In September, MEL - SIN - MEL became the busiest Oz international route (for passenger numbers), eclipsing SYD - SIN - SIN.

Seat utilisation on Sri Lankan's MEL - CMB flights continues to be good. I don't know what yields are like but this may be one of the more successful launches (in its case, relaunch) of a new route into and out of Oz for some years.

Royal Brunei's passenger numbers were disappointing. It only flies to and from MEL, and at the end of October radically altered its northbound schedule to provide connections to the new nonstop BWN to LHR flight. Previously it was two stops via DXB. The change means no southeast or north Asian same day connections northbound ex MEL, so passengers who previously used it to travel to BKK, HKG or MNL may use competitors.

QF's seat occupancy to and from Santiago (SCL) was excellent. One wonders, subject to yields and equipment availability if QF might at some stage increase frequencies on this route.

Last edited: