flypriority

Newbie

- Joined

- Oct 12, 2025

- Posts

- 1

Hi everyone

Long-time reader, first time poster. What a great community!

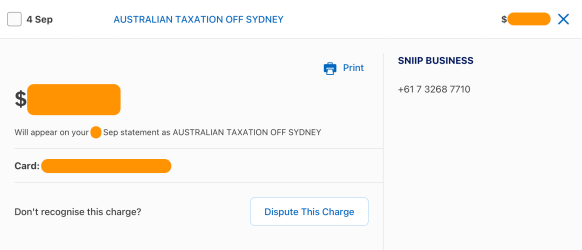

Does anybody have experience of whether Amex treats payments on its plat cards (personal or business) made to the ATO via a payment service (pay.com.au/YakPay) as government spend? I've had no issue with this on my Amex QBR card to date, but am wanting to confirm before I open a new card.

The T&Cs for the personal Platinum relevantly state:

Subject to the Terms and Conditions of the Membership Rewards program available here. You will earn 1 point per dollar spent with Merchants classified as 'government', including the Australian Taxation Office, the Australian Postal Corporation (Australia Post), Federal/State and Local Government bodies, including where you use a payment account, payment aggregator, services of a third party or online retailers that sell goods for another merchant.

The business Platinum T&Cs state:

Subject to the Terms and Conditions of the Membership Rewards program available here. Merchants classified as “government“ include the Australian Taxation Office, the Australian Postal Corporation (Australia Post), Federal/State and Local Government bodies. Industry specific earn rate may apply when you use a payment account, payment aggregator, services of a third party or online retailers that sell goods for another merchant. For example a payment made to Local Government bodies processed through a payment aggregator may earn rates at the government earn rate. There may be tax implications associated with participation in the Membership Rewards program. You are advised to check with your accountant or tax adviser for further information.

Many thanks in advance.

Long-time reader, first time poster. What a great community!

Does anybody have experience of whether Amex treats payments on its plat cards (personal or business) made to the ATO via a payment service (pay.com.au/YakPay) as government spend? I've had no issue with this on my Amex QBR card to date, but am wanting to confirm before I open a new card.

The T&Cs for the personal Platinum relevantly state:

Subject to the Terms and Conditions of the Membership Rewards program available here. You will earn 1 point per dollar spent with Merchants classified as 'government', including the Australian Taxation Office, the Australian Postal Corporation (Australia Post), Federal/State and Local Government bodies, including where you use a payment account, payment aggregator, services of a third party or online retailers that sell goods for another merchant.

The business Platinum T&Cs state:

Subject to the Terms and Conditions of the Membership Rewards program available here. Merchants classified as “government“ include the Australian Taxation Office, the Australian Postal Corporation (Australia Post), Federal/State and Local Government bodies. Industry specific earn rate may apply when you use a payment account, payment aggregator, services of a third party or online retailers that sell goods for another merchant. For example a payment made to Local Government bodies processed through a payment aggregator may earn rates at the government earn rate. There may be tax implications associated with participation in the Membership Rewards program. You are advised to check with your accountant or tax adviser for further information.

Many thanks in advance.