You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Virgin Australia IPO Discussion

- Thread starter cove

- Start date

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,470

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

Bain will want some trades to occur so that the fresh sellers can celebrate their profits. I just want to get some at what is expected to be the “ground floor pricing” as this first IPO is cheap.

Ords and Wilson’s are not brokers that we have used.

Our bid is thru Crestone to Barrenjoey and so far I have been told that they were heavily over subscribed.

Ords and Wilson’s are not brokers that we have used.

Our bid is thru Crestone to Barrenjoey and so far I have been told that they were heavily over subscribed.

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,470

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

For such a widely anticipated event with so much discussion beforehand, there seems remarkably little discussion about it here now. or is there another thread that I have missed? I'm on the road.

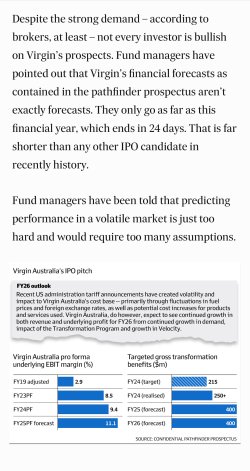

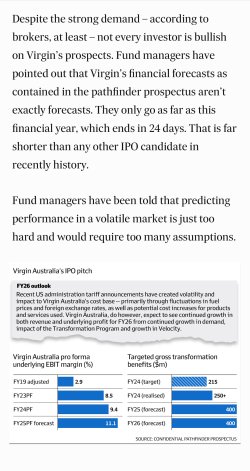

i’ve just been catching up with a few online articles and this one from the AFR seems to have a good overview of the good and bad of the float and the stocks prospects.

www.afr.com

www.afr.com

A few snippets:

Sowhat do people think of the airline as revealed in its pathfinder Prospectus?

i’ve just been catching up with a few online articles and this one from the AFR seems to have a good overview of the good and bad of the float and the stocks prospects.

Inside Bain’s Virgin pitch, and the one number investors will fear

A tightly held pathfinder prospectus reveals all the key financial metrics that the airline’s potential new shareholders can look forward to.

A few snippets:

Sowhat do people think of the airline as revealed in its pathfinder Prospectus?

Last edited:

I think they are on a solid position moving forward financially as long as they don’t do anything stupid. I’m still somewhat skeptical about this business as they have often got distracted in the past and costs have blown out, debt simply got out of hand. Financial discipline has been more top of mind in recent years so I hope they can stick to that.

The E2 is an expensive bit of tech, I hope they can make it work, we have seen this equipment before and it didn’t work.

More capital will be needed on the IT front. Still questionable standards. Converting the whole fleet to MAX over time also appears to be costly. Let’s see how that plays out. Need to see a few years of balance sheets to get an idea if it’s going to go south again.

Balance sheet discipline was never a Virgin strength.

The E2 is an expensive bit of tech, I hope they can make it work, we have seen this equipment before and it didn’t work.

More capital will be needed on the IT front. Still questionable standards. Converting the whole fleet to MAX over time also appears to be costly. Let’s see how that plays out. Need to see a few years of balance sheets to get an idea if it’s going to go south again.

Balance sheet discipline was never a Virgin strength.

Well Qantas are running very old planes so their allure and gloss on domestic flights has reduced a lot.Qantas is selling more business class tickets but that may reduce if they don’t lift their game with product improvements.

The Virgin float is done and dusted and there should be a profit for any stags.

The Virgin float is done and dusted and there should be a profit for any stags.

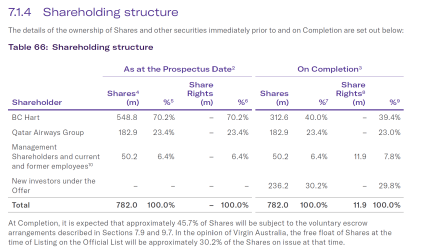

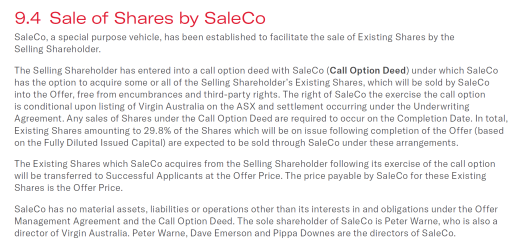

I looked up Peter Warne and he was previously Chairman of Macquarie Bank and was impressive at their AGM when he was there. We are shareholders of IPH so we we expect to see him there too.

It is expensive but necessary to have so many advisors to get the first tranche of this business listed with so many getting paid in the fully underwritten float.

Currently Qantas are trying to get some Airbus 321 models fitted with Recaro seats so they won’t be streets ahead with product once their A330s with sleeper seats are gone.

Sure Qantas has better lounges and more frequent flyers but sometimes they are way out on pricing. Also Qantas points for frequent flyers have been reduced in value dramatically.

Joyce lowered the Qantas product and it takes years to recover.

It is expensive but necessary to have so many advisors to get the first tranche of this business listed with so many getting paid in the fully underwritten float.

Currently Qantas are trying to get some Airbus 321 models fitted with Recaro seats so they won’t be streets ahead with product once their A330s with sleeper seats are gone.

Sure Qantas has better lounges and more frequent flyers but sometimes they are way out on pricing. Also Qantas points for frequent flyers have been reduced in value dramatically.

Joyce lowered the Qantas product and it takes years to recover.

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,470

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

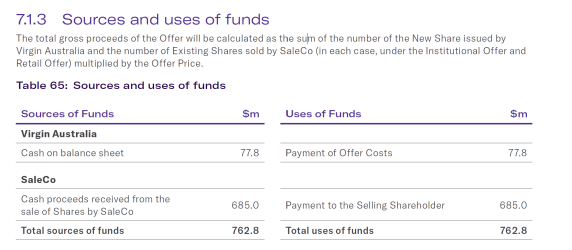

I can't imagine this is all going to the bankers, accountants and lawyers.

I used to work in M&A Advisory - you better believe it!! Especially when there are multiple Advisors etc. in a fully underwritten float, as Cove pointed out. Plus, don't forget the IPO has been 'under way' for several years, so the pigs have had their snouts in the trough for longer than usual.

There are lots of other costs, such as listing fees, registry etc but the groups you mentioned would be the bulk. I can imagine KPMG getting at least $5 million for its independent accountant's report. The cost of getting something wrong in these things is extraordinary, so you charge for 'belt and braces' several times over.

moa999

Enthusiast

- Joined

- Jun 23, 2003

- Posts

- 13,730

Not above 10% though.you better believe it!!

A US offering (where there is actually a bit more meaningful risk on the underwrite) might be 7% but Aus offerings are much lower.

I suspect an additional fee to Bain and probably also management is wrapped up in that.

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,470

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

if I knew, I wouldn’t say and I’ll be a lot richer in a month or soRoo what is your view on this. Which way do you think it will go once it launches?

I think the smart thing they’ve done is to do it in several tranches and to price the first one low (as in a lower PE then Qantas by a fair margin). Meaning - if you want to buy an airline share you would now choose Virgin over Qantas because it’s better value for money on the forecast (but ignoring particular risks etc). Not only did it result in very strong uptake, I believe the brokers and Instos will be expecting the second trench to be priced higher, therefore they will be encouraging their clients to “hold“, restricting supply and so supporting the price.

Given all of that I would expect the price to jump a fair bit on the first day, then maybe retreat a bit over the next week or so. but hey, I’m not rich so you can take that opinion as you like.

- Joined

- Mar 1, 2019

- Posts

- 3,086

- Qantas

- Qantas Club

- Virgin

- Platinum

For simplified opinion.

Opens at bit over 3bux, goes to close to 4bux, sell.

If you can drop 30k to gain 10k take away tax holding under 12months to pocket 5k.

I think that scenario may happen price wise, but not willing to take the punt on a PE exit strategy.

Just my 2c.

GYG

Opens at bit over 3bux, goes to close to 4bux, sell.

If you can drop 30k to gain 10k take away tax holding under 12months to pocket 5k.

I think that scenario may happen price wise, but not willing to take the punt on a PE exit strategy.

Just my 2c.

GYG

Last edited:

SCM

Active Member

- Joined

- Dec 23, 2021

- Posts

- 577

- Virgin

- Platinum

I think VA needs a lot of capital investment to take on what Qantas will be in 10 years time when they finally have some new planes. Surprising that they are not raising any capital, I just don't see a good long-term picture here.

They will have some portion of the high-profit domestic market, but that doesn't mean any kind of inherent growth.

They will have some portion of the high-profit domestic market, but that doesn't mean any kind of inherent growth.

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,470

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

Have you read the prospectus?I think VA needs a lot of capital investment to take on what Qantas will be in 10 years time when they finally have some new planes. Surprising that they are not raising any capital, I just don't see a good long-term picture here.

BTW equity capital is expensive - and dilutionary. Debt capital is cheaper. Equity capital wants a return better than other available options. Debt capital is ultimately tied to the bond rate, almost always a few points lower.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Pete98765432

- Denali

- Peter D

- FF98

- burneracc

- ols

- Nic

- blacksultan

- cartz

- flyingfan

- Austman

- Noel Mugavin

- madrooster

- LionKing

- antycbr

- Tazza_0712

- Beer_budget

- ma1tr!x

- StayGoldPonyboy

- Dr4manyspecies

- craven morehead

- james1

- Chris Panda

- Grrr

- offshore171

- hydrabyss

- Ikara

- shadowground

- Quickstatus

- AndrewCowley

- jase05

- markis10

- mviy

- Stone

- cjd600

- brissie

- aplmac

Total: 1,213 (members: 46, guests: 1,167)