Hi all, first time poster - long time follower.

I've been a Qantas Ultimate holder since late 2018 and have an annual spend of about $100k through the card (have earned circa 630k points in total since having it). I'm originally from the UK and was previously an Emirates Skywards Silver Member so my idea was to get the card to be able to still fly Emirates when travelling to/from the UK at least once a year.

Obviously this year with airfares going up and Qantas now generally always being the most expensive, I've started looking elsewhere to fly, and have actually booked a one way with a different airline as it was significantly cheaper and there are very rarely any classic rewards flights. I don't normally do a lot of interstate travel in Aus, but I recently just used up the $450 travel credit/70k points on an interstate trip for 4 to bring down the costs. Most of my travel is normally international where I'd use some Qantas Points to offset some of the flight costs (for 2), but it's at a point now where it's still cheaper to fly elsewhere even after doing that.

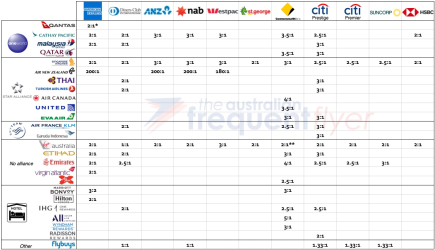

I'm now wondering whether it's worth ditching the Ultimate and switching to an Explorer, for more flexibility with booking through different airlines using Membership points/$400 travel credit and the ability to also transfer to points to a different Airline (although that's unlikely given it's probably the worst use of points). I don't know exactly how much those Membership points work out using Points + Play through AMEX travel to be able to judge which makes it hard to guage.

I'm keen to hear what people think. I know some believe that AMEX Travel isn't amazing, but I just want to actually be rewarded for what I spend so I can save on Travel essentially.

Thanks in advance!

Side Note: I also have an Altitude Black Qantas Mastercard to maximise Qantas points earning which I'd look at moving, too.

I've been a Qantas Ultimate holder since late 2018 and have an annual spend of about $100k through the card (have earned circa 630k points in total since having it). I'm originally from the UK and was previously an Emirates Skywards Silver Member so my idea was to get the card to be able to still fly Emirates when travelling to/from the UK at least once a year.

Obviously this year with airfares going up and Qantas now generally always being the most expensive, I've started looking elsewhere to fly, and have actually booked a one way with a different airline as it was significantly cheaper and there are very rarely any classic rewards flights. I don't normally do a lot of interstate travel in Aus, but I recently just used up the $450 travel credit/70k points on an interstate trip for 4 to bring down the costs. Most of my travel is normally international where I'd use some Qantas Points to offset some of the flight costs (for 2), but it's at a point now where it's still cheaper to fly elsewhere even after doing that.

I'm now wondering whether it's worth ditching the Ultimate and switching to an Explorer, for more flexibility with booking through different airlines using Membership points/$400 travel credit and the ability to also transfer to points to a different Airline (although that's unlikely given it's probably the worst use of points). I don't know exactly how much those Membership points work out using Points + Play through AMEX travel to be able to judge which makes it hard to guage.

I'm keen to hear what people think. I know some believe that AMEX Travel isn't amazing, but I just want to actually be rewarded for what I spend so I can save on Travel essentially.

Thanks in advance!

Side Note: I also have an Altitude Black Qantas Mastercard to maximise Qantas points earning which I'd look at moving, too.