The entire “system” has been made to appear, and has been constructed to actually be, confusing, hard to navigate and complex. Unnecessarily in most parts in my view. And the “industry” perpetuates the notion of it being a “complex system” so they can not only charge excessive fees directly to fund members but also hide fees away and out of sight to “help members navigate the complexities of superannuation”.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Superannuation Discussion + market volatility

- Thread starter JohnK

- Start date

tgh

Established Member

- Joined

- Apr 23, 2006

- Posts

- 3,762

Over the years a simple concept of saving for retirement has been fiddled , politicised and "enhanced" so much that the annual return

for even a simple smsf like ours requires a lot of professional input , partly because of the complexity and partly because of the audit requirements

to ensure we do not keep a cent more than we are entitled to...

for even a simple smsf like ours requires a lot of professional input , partly because of the complexity and partly because of the audit requirements

to ensure we do not keep a cent more than we are entitled to...

SydneySwan

Established Member

- Joined

- Jan 12, 2014

- Posts

- 4,233

- Qantas

- LT Silver

- Virgin

- Red

I have been with the same industry super balanced fund for 20 years and it has served me very well. I won’t be moving into an smsf anytime soon.

- Joined

- Jan 26, 2011

- Posts

- 30,211

- Qantas

- Platinum

- Virgin

- Red

Yes. We moved from our SMSF just around Covid. SMSF served us well, bought and sold a block of land in it that was very successful, shares - I lost the will to keep actively researching. Went with HESTA to start and that was fine until they did their thing back in March and we changed immediately to Aus Super.I have been with the same industry super balanced fund for 20 years and it has served me very well. I won’t be moving into an smsf anytime soon.

HESTA has had limitations just placed on their operations through APRA decisions on what they did in April for 6 weeks. I contacted every authority I thought relevant back in March trying to prevent HESTA from their changeover. Didn't get one response. APRA only acted after the damage was done to the members. How poor is that!

APRA imposes additional licence conditions on HESTA | APRA

APRA has imposed additional licence conditions on H.E.S.T Australia Ltd (HESTA) to address concerns regarding HESTA’s risk management and board governance during its recent transition of outsourced administration providers.

Last edited:

- Joined

- Jan 26, 2011

- Posts

- 30,211

- Qantas

- Platinum

- Virgin

- Red

Totally agree that rankles. Directors cut.I don't like where industry funds get fined and the investors pay the fines rather than the fund directors. That should change.

Particularly when so directly related as above..."APRA has identified deficiencies in HESTA’s board governance", and the HESTA Chairperson is on the Governance CommitteeI don't like where industry funds get fined and the investors pay the fines rather than the fund directors. That should change.

I presume APRA (like Courts) can choose to fine directors personally, but choose not to.

SydneySwan

Established Member

- Joined

- Jan 12, 2014

- Posts

- 4,233

- Qantas

- LT Silver

- Virgin

- Red

Let us not single out industry super funds. I don’t like it where companies like Qantas and ANZ and Westpac and CBA , etc get fined and shareholders pay the fines rather than the CEO and the directors.I don't like where industry funds get fined and the investors pay the fines rather than the fund directors. That should change.

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,375

They can't anymore than the ACCC can impose finespresume APRA (like Courts) can choose to fine directors personally, but choose not to.

The regulatory bodies can only request a fine be imposed by taking a case before the federal Court. It's the Court who imposes the fine

So they aren't fines then, it was "payment of an infringement notice"?They can't anymore than the ACCC can impose fines

The regulatory bodies can only request a fine be imposed by taking a case before the federal Court. It's the Court who imposes the fine

Such as this one (of many) https://download.asic.gov.au/media/d1bbccok/infringement-notice-hesta-s02181251.pdf

MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,381

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

Infringement notices are fines by another name (basically, 'cough up or we prosecute').So they aren't fines then, it was "payment of an infringement notice"?

Such as this one (of many) https://download.asic.gov.au/media/d1bbccok/infringement-notice-hesta-s02181251.pdf

As the trustees don't seem to have any skin in the game under the current arrangements, because it comes out of members' pockets, they presumably paid. If super funds are being treated like regular companies, this is problematic as the trustees aren't really like company directors (who are voted in by shareholders, meaning it's reasonable if the company gets stung with fines).

- Joined

- Jun 24, 2008

- Posts

- 4,726

- Qantas

- Gold

- Virgin

- Red

And paying them is generally not an admission of guilt .Infringement notices are fines by another name (basically, 'cough up or we prosecute').

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,375

As I said they can't impose the fine. It is important to note that an infringement notice is just an allegation of a contravention. They can send a notice and if the entity pays, it does not go to court. Or if there is no payment, it goes to court and the matter is contestedSo they aren't fines then, it was "payment of an infringement notice"?

Same as traffic infringement notice - it's an allegation of for example, that you exceeded the speed limit. You can elect not to pay it and elect to go to court.

MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,381

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

Semantics much?As I said they can't impose the fine. It is important to note that an infringement notice is just an allegation of a contravention. They can send a notice and if the entity pays, it does not go to court. Or if there is no payment, it goes to court and the matter is contested

Same as traffic infringement notice - it's an allegation of for example, that you exceeded the speed limit. You can elect not to pay it and elect to go to court.

In the legal lingo, one is a court-imposed pecuniary penalty while one is a pecuniary penalty paid as a consequence of receiving an infringement notice.

But both examples are 'fines' though in the popular lingo.

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,375

You might think so, but again there is an important distinction as I've explained aboveSemantics much?

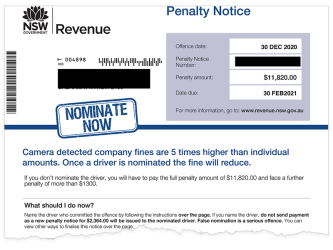

So this penalty is not a fine, even though it states "camera detected company fines...the fine will reduce"You might think so, but again there is an important distinction as I've explained above

Attachments

MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,381

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

There really isn’t! This is one of the more silly hills I’ve seen people want to die on. Should @Brissy1 have said ‘issue an infringement notice to’ rather than ‘impose a fine on’? Sure, but we got the idea.You might think so, but again there is an important distinction as I've explained above

At the end of the day, both result in a person being penalised financially which is the very definition of what a ‘fine’ is. The law itself does not make a distinction; legally speaking, ‘fines’ are not restricted to court-imposed penalties.

The only difference in the form of fines is that one is imposed by a regulator with the agreement of the person alleged to have done it (either because they actually did it or because it’s cheaper/easier to make the problem go away) and one is imposed by a court.

The worrying bit is that super fund trustees in either case don’t really have incentives for the funds to avoid being penalised as they themselves don’t get whacked in a lot of instances.

Last edited:

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,375

So this penalty is not a fine,

Again you can call it what you like. At the end of the day one can be contested and the other notAt the end of the day, both result in a person being penalised financially which is the very definition of what a ‘fine’ is.

MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,381

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

The question of whether or not fines can be contested was, and remains, irrelevant to the discussion at hand and I don't understand why you're making such a big thing about it...Again you can call it what you like. At the end of the day one can be contested and the other not

The original quote by @Brissy1 was "I presume APRA (like Courts) can choose to fine directors personally, but choose not to."

This points to a very valid question in the context of superannuation about whether it should be directors of the trustee companies for superannuation funds who are whacked with fines for contraventions of relevant legislation rather than the companies themselves.

While there are covenants that the company and its directors must adhere to (e.g. sections 52 and 52A of the Superannuation Industry (Supervision) Act 1993), it seems unfair that members of the funds, who typically are not shareholders and don't get a say in the selection of directors, bear the financial brunt of any wrongdoing the directors may cause the company to engage in.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- MooTime

- Ktan89

- Beer_budget

- AIRwin

- pyusha

- Scash

- Noah Count

- Hawk529

- dajop

- DirectConnect

- tombob

- RB001

- featheast

- Foreigner

- *A Flyer

- MEL_Traveller

- madrooster

- http_x92

- Pvcmenace

- jrfsp

- pjm99au

- plokert99

- Pele

- A321

- fasola

- funnybrus

- MVM

- nickfromeastryde

- ShelleyB

- kerfuffle

- larry40

- Bindibuys

- BrianQQ

- bluecoconut

- billmurray

- offshore171

- jabba

- RadioBusinessTraveller

- jswong

- Justinf

- Mutilla2

- markis10

- cambriamarsh

- defurax

- sietes

Total: 967 (members: 55, guests: 912)