ellen10

Established Member

- Joined

- Jul 18, 2008

- Posts

- 3,793

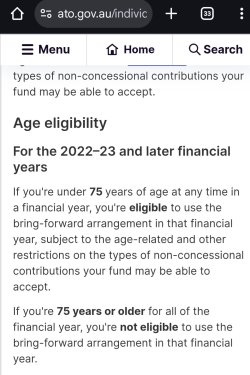

Yes they open a new separate fund, to recontribute to.Do you recontrivute to a separate super fund to keep all the newly converted non concessional funds separate from the existing concessional funds?.