CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,646

My pension super fund hit its most recent peak in early January and as at today is down 7.2%

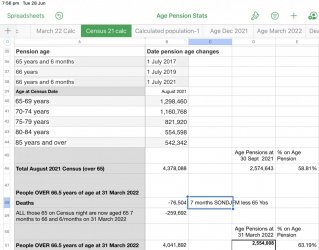

So what should I do - ride it out or go to cash? I have a friend who went to cash in Feb 2020 and was very pleased with himself as the markets tumbled in March / April 2020. He kept telling me I should have listened to him but then he missed the rapid rise in 2020 and is still in cash. Because of monthly pension payments his fund balance is now much lower than when he first went to cash in Feb 2020. Despite my monthly pension payments my balance is now much higher despite undergoing whiplash in 2020.

Each to his own but most of the investment mistakes.....

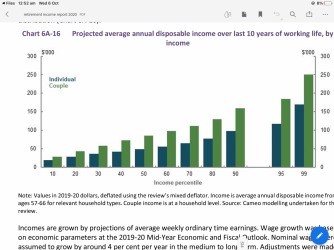

in light of my earlier post about cash and investment rates over the past decade for my fund (2011-12 to 2020-21), its a no brainer,

Sometimes it’s a case of “can‘t see the wood for the trees”

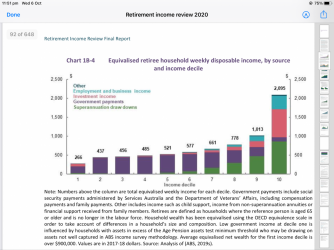

I am ever grateful for the Amazing boost up from 1988-92 from the share market proceeds where earning rates year to year were in the range 18-23%. Prior to then super funds “had to invest” in govt bonds (in effect cash) earning say 3-5%. The table above tells us cash will simply not deliver sufficient earnings to sustain the capital available to fund future pension requirements, and a good inheritance for the children.... UNLIKE your cash only friend and their severe depletion of the capital lump sum resulting in much lower inheritance.... (PS And your Mr/s Cashman friend ought be truly grateful for the SAFETY NET of Age Pension!)

Last edited: