- Joined

- Jun 20, 2002

- Posts

- 17,848

- Qantas

- LT Gold

- Virgin

- Platinum

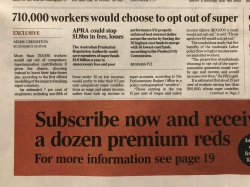

Good article on the front page of The West Australian today about the loss of franking credits - it’s the only plank that LNP have to de-rail Labors chances but I fear it’s not enough. After the result in Vic over the weekend, it’s almost an unloseable election for Labor, regardless of when it’s called (Anthony Green is plumping for May).

Perhaps I’ll be changing my own share ownership strategies

Perhaps I’ll be changing my own share ownership strategies