lakeman

Member

- Joined

- Oct 5, 2006

- Posts

- 229

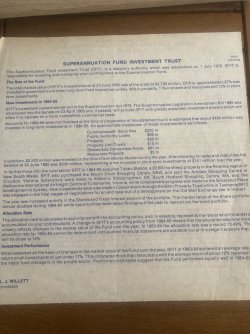

In the draft proposal there were several examples for vanilla cases with standard super but I couldn’t see any for DB cases.I'm probably not across all the aspects of the DB pension schemes but I had understood that the new legislation applied to the growth within the fund rather than the capital. I had assumed the calculated capital and growth equivalent of a DB would be treated similarly. Could you explain (apologies if I've missed the explanation already) how it's different?

Noting:

Most people with large standard funds will have some taxed non-concessional component to their capital also

Also not sure how the tax treatment of DB withdrawals is related to the new legislation rather than due to more long-standing differences

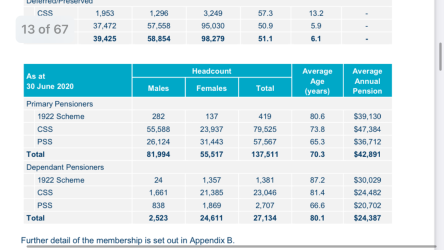

By my maths, a $3m standard fund providing a tax-free withdrawal at 5% is $150k p.a compared to a 14x calculated $3m DB fund providing a fully taxed pension only provides $214k gross/$142k net p.a (though at 13x it gives $151k net and gets better as the multiplier drops with age).

DB doesn't have the benefit of retaining any capital value after death of spouse but does offer guaranteed income in event of poor market returns

Perhaps there are too many permutations to do this but on fishing around google I found many further examples for “normal” funds but also couldn’t find any for DB cases.

I didn’t realise how much tax DB pensioners had to pay,certainly takes the shine off the headline amounts.

If the DB calculations under div296 follow the standard cases ,they would not be liable for 15% tax on their whole account but only on a proportion of the calculated number greater than $3000000 ,as andye has suggested