Just received my ITIN as well. The W7 was sent to the IRS on 13 March so just under the 7 week timeline (although for the IRS that it is impressively quick given that is tax season).

I used someone off Fiverr who was exceptional and was cheaper than SH Studios. If anyone is interested, DM me and I will share a link to his ad and a referral.

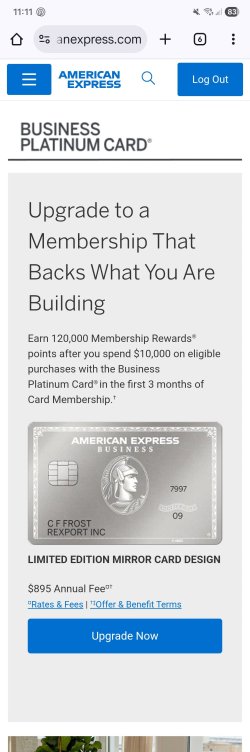

Question in the meantime, should I still apply for my first Amex using GT and not quote my ITIN? My plan is to apply for a Personal Gold using GT and then apply for a Hilton Amex (probably the free one or Surpass) using my ITIN 3 months later (unless anyone thinks it’s worthwhile applying sooner).