P2 finally got the IHG Premier card after nearly 10 phone calls, with a starting limit of $20k. However, there have been all kinds of difficulties registering for online banking. Tried registering over the phone, but the card got frozen twice. The most recent time it was frozen, they said they couldn’t call my phone number (could not verify my number), and they cant ask public record questions either.. Now I have to wait 24–48 hours for security system to reset.. I tried using the “plugin method,” but after logging in at

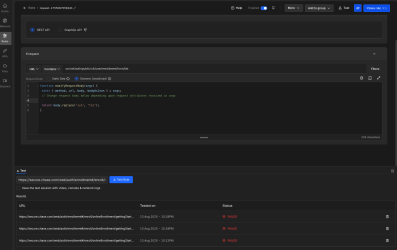

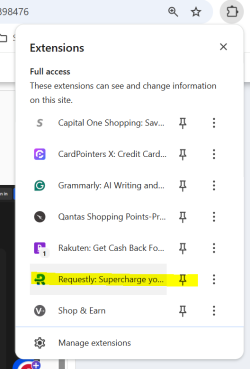

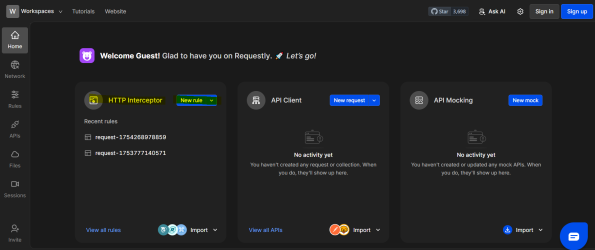

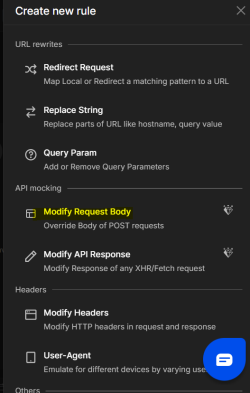

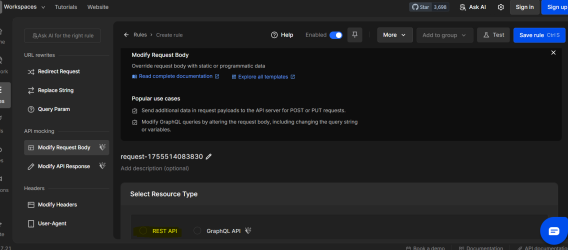

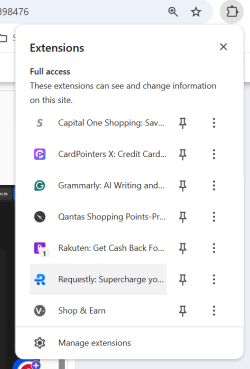

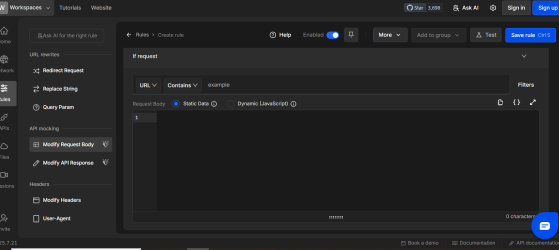

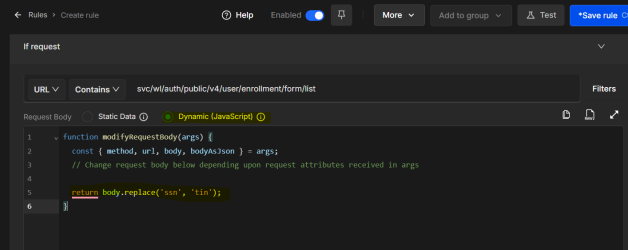

https://app.requestly.io/home, the interface looked different from the tutorial.

On my screen, there are two options: REST API and GraphQL API. I tried both, but neither worked. I’d really appreciate guidance from someone experienced with the plugin method

. The card has been used for a few transactions these past two days, but it’s currently frozen. When I registered my own card for online banking before, it was fairly easy—I just did phone registration.

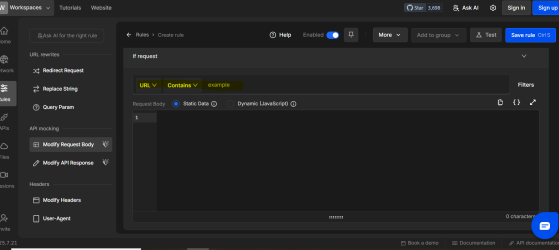

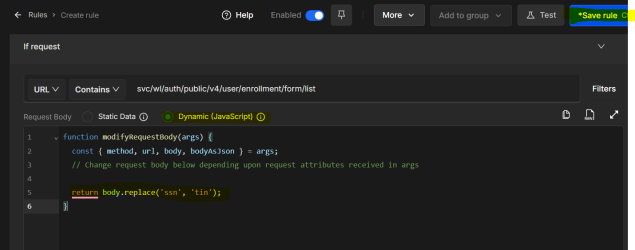

Below are screenshots of me trying the plugin method. The interface looks different from the tutorial, and I’m not sure what the issue is. Any advice would be greatly appreciated

.