They send a cheque for the closing account balance.Do they send you a cheque, or just pocket your deposits ?!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

nthd_nthd

Active Member

- Joined

- Oct 29, 2023

- Posts

- 706

Yep, noted, Thanks for DP on Chase on BOANice. Don't leave any money in C1. Shutdown is real possibility.

I got 300 from chase last week for an IBKR xfer.

Waiting on BOA.

Post automatically merged:

applying for HSBC premier in Aus then applying for HSBC U.S as an Oversea Premier customer.Sorry I am a bit confused, whats HSBC route? Did you apply c1 checking via email invitation?

I see. For your c1 checking, did you receive invitation for opening c1 checking by email and applied there or did you just applied @ online banking pls.Yep, noted, Thanks for DP on Chase on BOA

Post automatically merged:

applying for HSBC premier in Aus then applying for HSBC U.S as an Oversea Premier customer.

Revenge

Member

- Joined

- Aug 17, 2016

- Posts

- 321

- Qantas

- Silver

- Virgin

- Silver

- Star Alliance

- Silver

I just did this. Amex even refunded the prorated difference in the annual fee.This [downgrade from Gold to Green]. The annual fee is not outrageous, and you no longer need to jump through all the hoops you would when starting from scratch outside the US

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 931

Was just approved for CSP after doing a product change to Classic Freedom. It was the easiest app so far out of 7. Still had to call 3 times but it was the first time Chase didn't ask me to upload any documents.

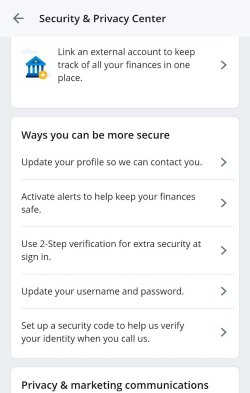

I set up a security code in the app at Settings --> Security & Privacy --> Set up a security code to help us verify your identity when you call us.

After setting up this security code, Chase sent a push notification for verification while on the call instead of SMS (that never works), public record questions or a call back. I used Android so iOS might be slightly different. One user reported not seeing this option on iOS but the account was new. You can try check yours. It was quite convenient.

I set up a security code in the app at Settings --> Security & Privacy --> Set up a security code to help us verify your identity when you call us.

After setting up this security code, Chase sent a push notification for verification while on the call instead of SMS (that never works), public record questions or a call back. I used Android so iOS might be slightly different. One user reported not seeing this option on iOS but the account was new. You can try check yours. It was quite convenient.

Attachments

Good to learn this thanksWas just approved for CSP after doing a product change to Classic Freedom. It was the easiest app so far out of 7. Still had to call 3 times but it was the first time Chase didn't ask me to upload any documents.

I set up a security code in the app at Settings --> Security & Privacy --> Set up a security code to help us verify your identity when you call us.

After setting up this security code, Chase sent a push notification for verification while on the call instead of SMS (that never works), public record questions or a call back. I used Android so iOS might be slightly different. One user reported not seeing this option on iOS but the account was new. You can try check yours. It was quite convenient.

The reason they gave was due to account activity. I never even activated my card or put through any activity which is why I consider it a BS reason.Do you mind sharing BS reason and did you try to solve with C1?- just wanted to understand for myself and everyone else if we encounter any issues like you

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,631

Works similarly for iOSWas just approved for CSP after doing a product change to Classic Freedom. It was the easiest app so far out of 7. Still had to call 3 times but it was the first time Chase didn't ask me to upload any documents.

I set up a security code in the app at Settings --> Security & Privacy --> Set up a security code to help us verify your identity when you call us.

After setting up this security code, Chase sent a push notification for verification while on the call instead of SMS (that never works), public record questions or a call back. I used Android so iOS might be slightly different. One user reported not seeing this option on iOS but the account was new. You can try check yours. It was quite convenient.

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 931

Works similarly for iOS

Did you apply and get a push notification? I'm trying to work out why this time they didn't need any documents. Wonder if it was because I applied in the app at the Explore new product section or because of this push notification or the combination of both.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,631

Not at application but at regular calls .Did you apply and get a push notification? I'm trying to work out why this time they didn't need any documents. Wonder if it was because I applied in the app at the Explore new product section or because of this push notification or the combination of both.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,631

Datapoint - as per my experience once the 10 day period is up one can request a replacement Amex card automatically via app even to Australia ( provided your oz address is listed of course ).

I am getting my US Amex replaced and so I received a message telling me the day my new card would arrive.

Have been using my AA Miles card from Citi as I am getting 5 AA miles per dollar on most things in their promo.

Now I had been excluded in Australia but was able to take up the offer once we arrived in California.

Have been using my AA Miles card from Citi as I am getting 5 AA miles per dollar on most things in their promo.

Now I had been excluded in Australia but was able to take up the offer once we arrived in California.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,631

Is that the Aa biz card ?I am getting my US Amex replaced and so I received a message telling me the day my new card would arrive.

Have been using my AA Miles card from Citi as I am getting 5 AA miles per dollar on most things in their promo.

Now I had been excluded in Australia but was able to take up the offer once we arrived in California.

furiousmango

Junior Member

- Joined

- May 12, 2017

- Posts

- 25

I've had a decent run lately - just approved for the CSP 100K offer after getting the Bonvoy Brilliant at the end of the March. My second Chase card after the IHG Premier and I needed to phone in for verification like a few people here - went pretty smoothly with a push notification, after verifying my ITIN

burneracc

Member

- Joined

- Oct 27, 2024

- Posts

- 293

- Qantas

- Gold

- Oneworld

- Sapphire

Wanting to make sure before I go for a GT that I can actually pay the thing off - is a Wise ACH transfer from the US bank details that they give you in the app a valid way to pay AMEX bills? I can see in the UI that it says this but I want to be extra sure that it works with AMEX:

ACH debits availableMake regular payments. Works with Amazon, PayPal, Stripe and more.pyramidforce

Member

- Joined

- Jan 19, 2023

- Posts

- 321

I think it depends on what type of Wise US checking you have. Old ones yes, new ones recent data says no IIRC. You can set up a non-resident alien checking account with Alliant, a few other ways have been discussed in this threadWanting to make sure before I go for a GT that I can actually pay the thing off - is a Wise ACH transfer from the US bank details that they give you in the app a valid way to pay AMEX bills? I can see in the UI that it says this but I want to be extra sure that it works with AMEX:

ACH debits available

Make regular payments. Works with Amazon, PayPal, Stripe and more.

Applied for my first chase card - Chase Ink Business and got the message saying application cannot be approved and to wait for the letter.

Anyone know if they send an email as well? Want to see if recon line can help but need the App number for that I presume.

Anyone know if they send an email as well? Want to see if recon line can help but need the App number for that I presume.

nthd_nthd

Active Member

- Joined

- Oct 29, 2023

- Posts

- 706

You can reconsideration without letter. Punch in your ITINApplied for my first chase card - Chase Ink Business and got the message saying application cannot be approved and to wait for the letter.

Anyone know if they send an email as well? Want to see if recon line can help but need the App number for that I presume.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.