Wait a few more days. I booked a flight and the credit came 8 days later.I booked a flight on 22nd from jetstar. Still not get the credit yet today. Not sure what happened. Club jetstar member is not fully used the 50 credit. Did you just claim partial? Thanks

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

_TheTraveller_

Established Member

- Joined

- Dec 16, 2011

- Posts

- 1,578

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

Anyone had experiences applying for a card after an address update? My Equifax credit report is still showing my old address as "current" and new address as "former".

Not sure if all my cards need to be reported in order to have the new address updated as current? My Chase and Amex accounts have already been updated and I think only 1 card hasn't reported to Equifax yet which my explain why but curious to hear other experiences.

Not sure if all my cards need to be reported in order to have the new address updated as current? My Chase and Amex accounts have already been updated and I think only 1 card hasn't reported to Equifax yet which my explain why but curious to hear other experiences.

anyonebutqantas

Member

- Joined

- Jan 22, 2023

- Posts

- 395

I have on a UK card. You don't actually end up dealing with Amex, but the insurer - usually their requirement is that you start and end the trip in your country of residence, which I did (Australia). My claim was in Canada, the proof I provided was an outbound ticket MEL-NRT and a return HKG-MEL, no part of my proof indicated I was even in North America, although I was and I'm guessing they were satisfied with that, given the rental agreement...and proof of residence was probably satisfied by an Australian driver licence with a corresponding home address in the state where the origin/destination airport is located.

I haven't tried this on a US card, so it might be worth comparing the T&Cs (I'm quite familiar with the UK terms, because I use an ICC US$ Platinum card as my and my OH's travel/rental car insurance (US$550 vs the small fortune an Australian insurer asks for is a no brainer). I have also claimed using an actual UK £ denominated Platinum card when I still had one (same insurer of course).

The only issue is that, despite the card being a US$ denominated card, they pay out in £. I'm not sure if you can change that, but it was simpler for me to just give them UK account details and take it from there. Although if you have a US Amex, you likely have a US bank account of some sorts in order to pay it, so that probably won't be an issue.

Post automatically merged:

Exactly this

US cards ordinarily have insurane terms about trips starting/ending in US though. Sounds like ICC is a better deal in that regard.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

You can set up a gbp denominated account with Citibank or wise etc .US cards ordinarily have insurane terms about trips starting/ending in US though. Sounds like ICC is a better deal in that regard.

Franko Costa

Active Member

- Joined

- Aug 18, 2011

- Posts

- 831

I might have already asked, but anyone has any use for the uber and restaurant credits that come with US Amex Gold card? My annual is up in a couple of months and can't seem to use them. Was thinking of maybe buying US uber vouchers by making a US uber account (min voucher is $25)

_TheTraveller_

Established Member

- Joined

- Dec 16, 2011

- Posts

- 1,578

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

I might have already asked, but anyone has any use for the uber and restaurant credits that come with US Amex Gold card? My annual is up in a couple of months and can't seem to use them. Was thinking of maybe buying US uber vouchers by making a US uber account (min voucher is $25)

Doesn't work in Aus. If you visit the US, they'll work. Doesn't matter where your uber account is created.

you can buy US Uber voucher? I have $15 credits each month from my Amex Platinum (I only use them when I'm in the states for Uber eat)Doesn't work in Aus. If you visit the US, they'll work. Doesn't matter where your uber account is created.

Post automatically merged:

Is the US Capital One card any good? anyone with the Capital One here? Thanks

_TheTraveller_

Established Member

- Joined

- Dec 16, 2011

- Posts

- 1,578

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

you can buy US Uber voucher? I have $15 credits each month from my Amex Platinum (I only use them when I'm in the states for Uber eat)

Don't believe so. Uber is not a statement credit. Uber is $10 in your Uber account.

They're quite fickle with approvals. There is a pre-approval tool that seems to be moderately accurate. There's a specific one for the Venture X somewhere if that's the card you're looking at.Is the US Capital One card any good? anyone with the Capital One here? Thanks

Once I go under 4/24 mid next year, I'll probably have a crack at the Venture (not the Venture X as the $300 travel credit is now a hassle to use — can't cash it out anymore). $95USD for 75K points that can be transferred to all the major airlines is pretty good.

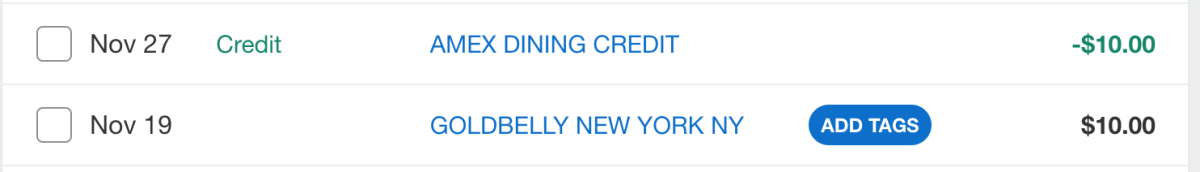

Is this just via the Goldbelly website buying their digital gift cards?I buy a $10 Goldbelly gift card per month to use the restaurant voucher. I'll eventually cash them in for one overpriced gift for someone in the US.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

Have you been receiving the credit ? This site mentions you are not elegible :Trying out the Amex Gold dining credit at all 6 merchants - The Points GuyI buy a $10 Goldbelly gift card per month to use the restaurant voucher. I'll eventually cash them in for one overpriced gift for someone in the US.

I know a few people have been asking about MS methods in this thread.

So I've been diving down the rabbit hole of MS of US cards over the past 6-9 months. Decided to ramp things up over the past month. Put through $USD55K of spend in the last four weeks, hit all sorts of fraud alerts, triggered a financial review on my wife's account, survived the financial review, earned about ~800K MR/UR & $USD2K in cash profit (ie $AUD15K in tax free money if all the points were cashed out at the lowest 1c/pt valuation). It has been an absolute rollercoaster ride. I do not recommend trying to ramp up at the pace I did! Anyway, still in the midst of it. When it slows down, I will write up a long report with my take away points, but safe to say MS on US cards is well and truly possible sitting from your home in Australia.

So I've been diving down the rabbit hole of MS of US cards over the past 6-9 months. Decided to ramp things up over the past month. Put through $USD55K of spend in the last four weeks, hit all sorts of fraud alerts, triggered a financial review on my wife's account, survived the financial review, earned about ~800K MR/UR & $USD2K in cash profit (ie $AUD15K in tax free money if all the points were cashed out at the lowest 1c/pt valuation). It has been an absolute rollercoaster ride. I do not recommend trying to ramp up at the pace I did! Anyway, still in the midst of it. When it slows down, I will write up a long report with my take away points, but safe to say MS on US cards is well and truly possible sitting from your home in Australia.

- Joined

- Feb 23, 2015

- Posts

- 6,870

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

Looking forward to the write up.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

Hi thanks . Will you share details of your methods ? If not on the post at least via PM ?I know a few people have been asking about MS methods in this thread.

So I've been diving down the rabbit hole of MS of US cards over the past 6-9 months. Decided to ramp things up over the past month. Put through $USD55K of spend in the last four weeks, hit all sorts of fraud alerts, triggered a financial review on my wife's account, survived the financial review, earned about ~800K MR/UR & $USD2K in cash profit (ie $AUD15K in tax free money if all the points were cashed out at the lowest 1c/pt valuation). It has been an absolute rollercoaster ride. I do not recommend trying to ramp up at the pace I did! Anyway, still in the midst of it. When it slows down, I will write up a long report with my take away points, but safe to say MS on US cards is well and truly possible sitting from your home in Australia.

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,793

I won't have the cash flow you do, but I would love to know some tricks to at least make minimum spend on those Ink cards.I know a few people have been asking about MS methods in this thread.

So I've been diving down the rabbit hole of MS of US cards over the past 6-9 months. Decided to ramp things up over the past month. Put through $USD55K of spend in the last four weeks, hit all sorts of fraud alerts, triggered a financial review on my wife's account, survived the financial review, earned about ~800K MR/UR & $USD2K in cash profit (ie $AUD15K in tax free money if all the points were cashed out at the lowest 1c/pt valuation). It has been an absolute rollercoaster ride. I do not recommend trying to ramp up at the pace I did! Anyway, still in the midst of it. When it slows down, I will write up a long report with my take away points, but safe to say MS on US cards is well and truly possible sitting from your home in Australia.

Patience Grasshopper.. . Will you share details of your methods …

I find the points guy to be too commercialised and focused on churning articles and getting referrals as opposed to actually focusing on points hacking. Sites like Frequent Miler and DoC are much better sources of information for hacking and have actual data points. Just my 2c.Have you been receiving the credit ? This site mentions you are not elegible :Trying out the Amex Gold dining credit at all 6 merchants - The Points Guy

Edit: Frequent Miler does have data points for getting the $10 dining credit by getting a Goldbelly gift card.

Franko Costa

Active Member

- Joined

- Aug 18, 2011

- Posts

- 831

Congrats! I assume most of it is with UR as opposed to Amex as the look through Amex can see more than a Visa/MC. There are options in Australia, but never as big as too many cards have points caps otherwise I would put through 1m through my ANZ cardI know a few people have been asking about MS methods in this thread.

So I've been diving down the rabbit hole of MS of US cards over the past 6-9 months. Decided to ramp things up over the past month. Put through $USD55K of spend in the last four weeks, hit all sorts of fraud alerts, triggered a financial review on my wife's account, survived the financial review, earned about ~800K MR/UR & $USD2K in cash profit (ie $AUD15K in tax free money if all the points were cashed out at the lowest 1c/pt valuation). It has been an absolute rollercoaster ride. I do not recommend trying to ramp up at the pace I did! Anyway, still in the midst of it. When it slows down, I will write up a long report with my take away points, but safe to say MS on US cards is well and truly possible sitting from your home in Australia.

I am trying to get approved from Chase at the moment, but it is annoyingly difficult.

Melbourne is a long way from everything in the US

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Flyfrequently

- JohnM

- Big John

- Pete98765432

- cambriamarsh

- JoMcA

- Nickor

- downgraded

- AussieTim

- MELso

- joelby

- seandenn

- RooFlyer

- dajop

- Hawk529

- offshore171

- QFFHntrGthr

- There'sOnlyOneJimmy

- Black Duck

- Montien

- TheRealTMA

- Harrison_133

- Koosc

- Up in the clouds

- jase05

- clifford

- RB001

- goosh

- FrustratedQP

- ccevans

- pauldab

- Chrizztofa

- redmaxo

- sudoer

- wenglock.mok

- Melissa Harris

- Nanachi

- Dmac59

- Tindersinder

- drmatte

- burmans

- N0mad

- Mother

- ant-au

- Anastascia

- QF WP

- Lux

- Tonkatough

- baragh

- LionKing

Total: 2,188 (members: 85, guests: 2,103)