1 every 30 days is about the maximum velocity you can do with Chase, so anything slower than that should be fine.How long should one wait before applying for the second chase card ?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 931

How long should one wait before applying for the second chase card ? I had my first one approved in aug and the aspire around then as well .

Is it ok to have it delivered to planet express and then request chase to have a replacement sent to oz ?

Not sure but I was approved for the second card after 4 months. No idea about replacement. To be safe, I don't even ask Amex to ship here except one time I told them I lost my card and in Australia.

- Joined

- Feb 23, 2015

- Posts

- 6,871

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

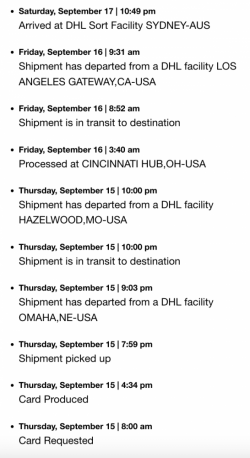

Data point: no issue requesting a replacement card one day after expected arrival at MyUS (i.e. 10 days after approval). ID verification was very simple using just the 3 digit CVC from another US Amex card.

Very impressed with how quickly the card was produced and shipped to Australia. DHL attempted delivery today, 1.5 business days after requesting it, however I wasn't home to receive it.

Last edited:

_TheTraveller_

Established Member

- Joined

- Dec 16, 2011

- Posts

- 1,578

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

Just got back from the US trying to open a bank account.

Chase - No

Cap 1 - No

Citibank - Yes

I didn't try BoA, or WF but in most instances they wouldn't open a checking account if I didn't have an ITIN/SSN or a non-bank form of proof of address. Citi accepted the amex statement as proof of address but he said needed to be >60 days.

Chase - No

Cap 1 - No

Citibank - Yes

I didn't try BoA, or WF but in most instances they wouldn't open a checking account if I didn't have an ITIN/SSN or a non-bank form of proof of address. Citi accepted the amex statement as proof of address but he said needed to be >60 days.

ahh, did Chase and Cap1 not open an account for you at all? or needed an ITIN/SSN?Just got back from the US trying to open a bank account.

Chase - No

Cap 1 - No

Citibank - Yes

I didn't try BoA, or WF but in most instances they wouldn't open a checking account if I didn't have an ITIN/SSN or a non-bank form of proof of address. Citi accepted the amex statement as proof of address but he said needed to be >60 days.

_TheTraveller_

Established Member

- Joined

- Dec 16, 2011

- Posts

- 1,578

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

ahh, did Chase and Cap1 not open an account for you at all? or needed an ITIN/SSN?

Cap 1 said they'll only open an account for a foreigner/alien resident with they have an ITIN/SSN.

Chase they want proof of address that isn't from a bank.

I'm guessing Cap 1 would have wanted proof of address as well.

I guess it would just depend on the banks tolerance. I would have liked to get a chase checking account but alas they said no

Which city/state branches did you try?Cap 1 said they'll only open an account for a foreigner/alien resident with they have an ITIN/SSN.

Chase they want proof of address that isn't from a bank.

I'm guessing Cap 1 would have wanted proof of address as well.

I guess it would just depend on the banks tolerance. I would have liked to get a chase checking account but alas they said no.

_TheTraveller_

Established Member

- Joined

- Dec 16, 2011

- Posts

- 1,578

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

I was in NYC. I didn't have time to visit multiple branches. I have heard that if one branch didn't do it, maybe another would but their answers seemed pretty reasonable.Which city/state branches did you try?

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

Received a notice from irs to pay $40 tax and $41 penalty for non payment for 2020 tax year . I’m guessing this is a result of applying for itin through ein express . Are they supposed to pay this tax on our behalf ?

Any tips on having penalties waived and tax paid ?

I could not use The online payment function .

Any tips on having penalties waived and tax paid ?

I could not use The online payment function .

How/where did you receive the notice? I might be in the same boat.Received a notice from irs to pay $40 tax and $41 penalty for non payment for 2020 tax year . I’m guessing this is a result of applying for itin through ein express . Are they supposed to pay this tax on our behalf ?

Any tips on having penalties waived and tax paid ?

I could not use The online payment function .

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

Just yesterday . Took 2 months to arrive.How/where did you receive the notice? I might be in the same boat.

Why not aim for the Chase Hyatt card itself. One of the biggest perk is you get 1 night free every year and 5k spend gets you 2 nights. Spend 15k and you get another Cert and total 11 nights. Comes in handy if you are aiming for Globalist.What's your current set up? I think CSP/CSR is valuable because of the transfer out option to Hyatt. Tremendous value compared to Marriott and Hilton.

I got the CSP card ages ago and had no issues adding it to my apple wallet. However, the CSP card was my second chase card after the chase Hyatt cardI've tried many different ways, even different computers and even created new email addresses, no luck so far. Very weird.

ithongy

Member

- Joined

- Mar 3, 2009

- Posts

- 274

Do not apply if you are at or over 5/24. No matter how good your credit score is, Chase will decline your application.1 every 30 days is about the maximum velocity you can do with Chase, so anything slower than that should be fine.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

I got it .regular post unless you request courierThinking about getting the Amex Gold card to compliment my Amex Hilton Aspire, did anyone get this card and is it delivered via courier or regular post?

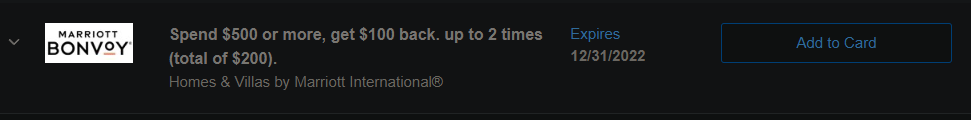

Be sure to look out for an elevated sign up bonus. Current best offer is 90K MR. There's also the Resy 75K + 20% back on restaurants up to $250. Uscreditcardguide.com & doctorofcredit.com have more info.Thinking about getting the Amex Gold card to compliment my Amex Hilton Aspire, did anyone get this card and is it delivered via courier or regular post?

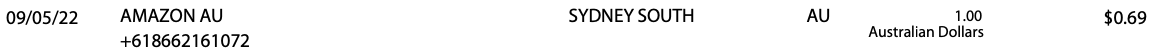

Beware, it appears Amex adds a spread of 1-3% on foreign currency transactions even on no foreign transaction fee cards.

For example:

On that same date, the mid-market rate was 0.680 according to xe.com and .6793 according to Oanda.

I have encountered something similar on Chase.

You also lose money converting AUD to USD as you never get the mid-market rate.

It is for these reasons that I'm sceptical of the value of using American cards for day to day spend outside of the sign up bonus period. Even if you earn more than Australian cards, you probably lose as much, if not more, on the currency spreads.

For example:

On that same date, the mid-market rate was 0.680 according to xe.com and .6793 according to Oanda.

I have encountered something similar on Chase.

You also lose money converting AUD to USD as you never get the mid-market rate.

It is for these reasons that I'm sceptical of the value of using American cards for day to day spend outside of the sign up bonus period. Even if you earn more than Australian cards, you probably lose as much, if not more, on the currency spreads.

Beware, it appears Amex adds a spread of 1-3% on foreign currency transactions even on no foreign transaction fee cards.

For example:

View attachment 296088

On that same date, the mid-market rate was 0.680 according to xe.com and .6793 according to Oanda.

I have encountered something similar on Chase.

You also lose money converting AUD to USD as you never get the mid-market rate.

It is for these reasons that I'm sceptical of the value of using American cards for day to day spend outside of the sign up bonus period. Even if you earn more than Australian cards, you probably lose as much, if not more, on the currency spreads.

I agree it doesn't make sense to use a US card in Australia, but there are very few (if any) no annual fee + no FX fee credit cards in Australia and I find it helpful to use my US card when travelling overseas.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Recent Posts

-

-

-

-

USA Entry - CBP Mobile Passport control app [MPC]

- Latest: SeatBackForward

-

Currently Active Users

- drcam

- Gudetama

- Noel Mugavin

- sudoer

- Steady

- offshore171

- aleadoux

- lowan74

- qq2233

- sader

- Willpanzer

- markis10

- jimmywise

- brrmmm

- stm1sydney

- Harrison_133

- Mr_Orange

- blackcat20

- Kefci2000

- jrfsp

- Scr77

- Vic

- 60spud

- MELso

- Bundy Bear

- brissie

- FF98

- AdamHal

- am0985

- Beer_budget

- dazzaj_71

- TomVexille

- cpatters

- Shirazclub

- Fridge

- andye

- Pele

- TheDefenestrator

- Nanachi

- burmans

- ShelleyB

- KIZI

- http_x92

- Superhappykid

- Tiki

- redwoodw

- 05flyer

- Jonova

- kerfuffle

- AustraliaPoochie

Total: 1,247 (members: 92, guests: 1,155)