blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,606

Can’t remember . Think I used my oz address . That’s what I have had listed for more than 3 years now . No issues .Did you have to prove UK residence?

Can’t remember . Think I used my oz address . That’s what I have had listed for more than 3 years now . No issues .Did you have to prove UK residence?

Probably not as I didn’t have any way to do so .Did you have to prove UK residence?

Ignore it, unless you carry a balance (which on those cards you really shouldn't ever), it has no material impact. I have several UK credit cards, I have no idea what the APRs are any more, they move around, but I don't carry balances (well, except for an exceptionally large amount I was somehow able to get approved for last year at 0% with zero fees, which seemed to make a welcome return, and store the resultant cash in 5%+ savings accounts, but that's just something for me to track in terms of making monthly payments until the 0% runs out - incidentally this makes my UK credit file look like I'm up to my eyeballs in debt and maxed out on several cards, so I won't be getting approved for anything else in a while, but it's pulling in ~$700 per month in interest, so...meh, problem for another day).Anybody have any experience of, or info about, this?

I have a UK BA Premium Amex. I've had it for a few years and before that a Platinum.

I have a £10k+ credit limit, have never spent more than about £6k on it in a month and always pay the full balance at the end of each month. My financial profile in the UK is quite low (could be the problem) and the only other account that I have is a (UK) mobile phone account with one of the big providers.

I have a UK HSBC account and credit card but it's registered to my Australian address.

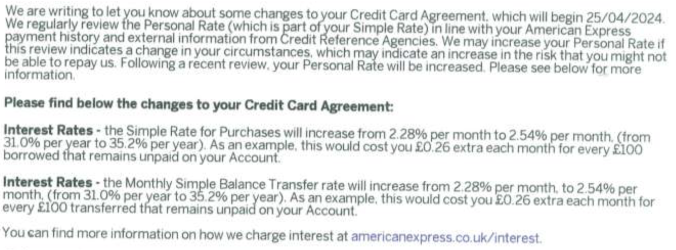

I have just received notice from Amex that my 'personal interest rate' is rising due to a review (of me) and that my risk profile has been assessed as higher.

Given that i pay the balance in full each month it is of no financial consequence but just wondered if anyone has any insights on this and whether there is anything that I need to think about 'heading off' before it snowballs into something with actual consequences

View attachment 373367

Thanks for the information. I was a little worried that this was a precursor to the random, unexplained account closures one hears about. No, I never carry a balance and was struggling to think of a reason that I may have given them to change itIgnore it, unless you carry a balance (which on those cards you really shouldn't ever), it has no material impact. I have several UK credit cards, I have no idea what the APRs are any more, they move around, but I don't carry balances (well, except for an exceptionally large amount I was somehow able to get approved for last year at 0% with zero fees, which seemed to make a welcome return, and store the resultant cash in 5%+ savings accounts, but that's just something for me to track in terms of making monthly payments until the 0% runs out - incidentally this makes my UK credit file look like I'm up to my eyeballs in debt and maxed out on several cards, so I won't be getting approved for anything else in a while, but it's pulling in ~$700 per month in interest, so...meh, problem for another day).

Your UK BA Amex - is that registered at a UK address? Because my understanding is that if it isn't, Amex won't sent the Avios to BAEC until it is? I don't currently hold that card, and never have outside of a UK address, so I have no idea - I've had UK MR cards registered to Aussie addresses which worked fine (although note recent T&C change), but atm I only have a UK Platinum, and only because they offered 100k MR to upgrade from the ARCC (free MR card)...was meant to be a Gold only offer, but despite holding a Gold (at the time), they would only let me apply the offer to ARCC, such is life.

Yeah you should be ok, you’d be advised pretty quickly if it was a review and the account probably suspended until they do their thing.Thanks for the information. I was a little worried that this was a precursor to the random, unexplained account closures one hears about. No, I never carry a balance and was struggling to think of a reason that I may have given them to change it

Yes, my BA Premium is registered to a UK address.

My BAEC account originally had the same UK address because the EC wasn't available in Australia. When it was, I changed it to my Australian address. At the time I had the UK Platinum Card. I closed that and got the BA card and the Avios weren't crediting to my BAEC account. Although the account numbers matched the addresses didn't. So I changed the BAEC back to my UK address and all was well.

The issue was the addresses not matching .... I'm not sure how I'd have gone if I changed the Amex to the Australian address (if that's even possible these days)

You did well with the Platinum offer ... I note it's only 40,000pts for a new card member sign-up

Yeah, it’s interesting because the Amex UK website still offers the “moving to a new country” facility and the FAQ still says it’s acceptable to retain your existing (UK) cardI got a T&C update late last year saying that as of X date it had to be a UK address -

I do wonder what’s brought this on; if it were a purely business decision, you would imagine that where a cardholder’s registered address is wouldn’t preclude NZ of all places.[……. ] I is registered in Australia, as that remained permissible for those who held it before a certain date last year - there’s is now a heavily restricted list of permitted countries, of which even NZ isn’t one, where you can keep the card as an existing cardholder).

Yes, I’d be reluctant to get rid of something that you can never get back; if you play your cards right they may offer you an ‘incentive’ to relinquish the cardI’m in two minds though, for now it’s (the ICC) a store of MR points and still has 1:1 transfers to SQ, but worse (3:2) to most others…the insurance I think is the same as the normal UK Platinum, either way it’s the primary reason I’ve kept it for years, much cheaper than purchasing an annual travel insurance policy, let alone CDW and everything else.

Global transfer is still a thing, so you can still move a UK card to overseas, although the UK card remains open - so I don’t know what they expect you to do with it, unless you have a UK address (thankfully I do).Yeah, it’s interesting because the Amex UK website still offers the “moving to a new country” facility and the FAQ still says it’s acceptable to retain your existing (UK) card

I do wonder what’s brought this on; if it were a purely business decision, you would imagine that where a cardholder’s registered address is wouldn’t preclude NZ of all places.

Yes, I’d be reluctant to get rid of something that you can never get back; if you play your cards right they may offer you an ‘incentive’ to relinquish the card

Is it a BAPP? I assume your BAEC address is still UK? Because there's some rule where if the addresses don't match and aren't UK based, the points won't transfer - I don't have any experience of this, I've always left my BAEC and any help BAPP cards UK domiciled.Interestingly I used my Australian address however under the country code it says UK. Now that has been fine I til card expiry and I believe that my new card has been sent....to my Australian Address however under the country code it will say UK .Now last time it took a few weeks but arrived ,!! Fingers crossed this will also ..but I am now wondering. Posted out on 7 November according to my e mail notification. I'll probably have to pay for additional post on arrival ....if it arrives! I hope it does....I love the 2 for 1with BA especially when you don't need to have your origin from UK. But will it arrive.....,

It's actually an Australian address but under country it's "UK" ..Avios gets transferred just fine and also 241 voucher. I need to.probabky return it to UK address. Yes it's BAEC.Is it a BAPP? I assume your BAEC address is still UK? Because there's some rule where if the addresses don't match and aren't UK based, the points won't transfer - I don't have any experience of this, I've always left my BAEC and any help BAPP cards UK domiciled.

Excellent, sounds like someone made a bank error in your favour, collect a heap of Avios and a 241. I'd leave it, unless it doesn't turn up - worst case, add it to Apple Pay before it expires then it should update automatically on your phone when a new card is issued to replace the expired one.It's actually an Australian address but under country it's "UK" ..Avios gets transferred just fine and also 241 voucher. I need to.probabky return it to UK address. Yes it's BAEC.

How can you earn Avios in Australia?There are far better ways to earn Avios in Australia.

Amex to QR Privilege ClubHow can you earn Avios in Australia?

Amex or Commbank to QR. The latter is a horrible earn rate though.How can you earn Avios in Australia?

Yes, understood. Can transfer from Amex too, but only to a QRPC account with same name. I read the comment to mean something else like accumulate through transactions through less obvious avenues like on pay.com.au.Amex or Commbank to QR. The latter is a horrible earn rate though.

You can also purchase them during promos or take out an Avios subscription, either via BA, IB, AY or QR (technically also EI, doable but slightly more complicated).

Fair. The UK BAPP Amex isn't worth it here, you need to have BAEC and Amex set to UK addresses for the points to tx, and there's the forex charge which wipes it out. Amex US from MR is probably the best way, there's yet another transfer bonus on as we speak (was 30% to BA/IB a few months back, IIRC right now it's 20% to QR).Yes, understood. Can transfer from Amex too, but only to a QRPC account with same name. I read the comment to mean something else like accumulate through transactions through less obvious avenues like on pay.com.au.

Thanks @QF_Flyer . You can also gift Avios to someone. That is you buy them on QRPC site.Fair. The UK BAPP Amex isn't worth it here, you need to have BAEC and Amex set to UK addresses for the points to tx, and there's the forex charge which wipes it out. Amex US from MR is probably the best way, there's yet another transfer bonus on as we speak (was 30% to BA/IB a few months back, IIRC right now it's 20% to QR).

As for an Aussie card, Platinum Charge is probably the one (assume they can tx to QR, I don't actually recall, I haven't had an Aussie MR earning card in years).

Edit: they do, Plat Charge is the best at 1.125/$1, but Explorer is 1/$1, which given the travel credit makes it a break even, is probably the best option in AU.

I just set one up - I used Lyca - esim - cost 10 pounds and its a pay as you go - no idea how long it will last if I hardly use it but it could be 12 months hopefully for the 10poundsMany people use TextNow to establish a virtual US phone number with which to receive a 2-factor code etc from Amex and other banks

Can anyone recommend a UK equivalent service for UK bank messages & codes?