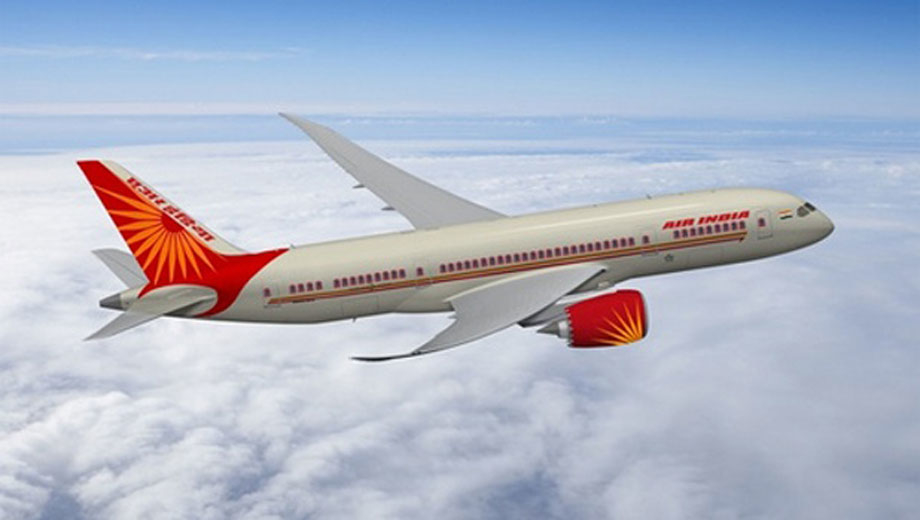

Tata Sons in talks with Singapore Airlines for joint Air India bid

Tata Group to go ahead with the bid irrespective of the outcome of the joint venture

The bid will be through their Vistara JV.

Not surprised if they do go through with the bid, both have plenty of reserves (aka 'bail out' in SQ's case).