Has anyone used pay.com.au?

I came across them via PointsHacks:

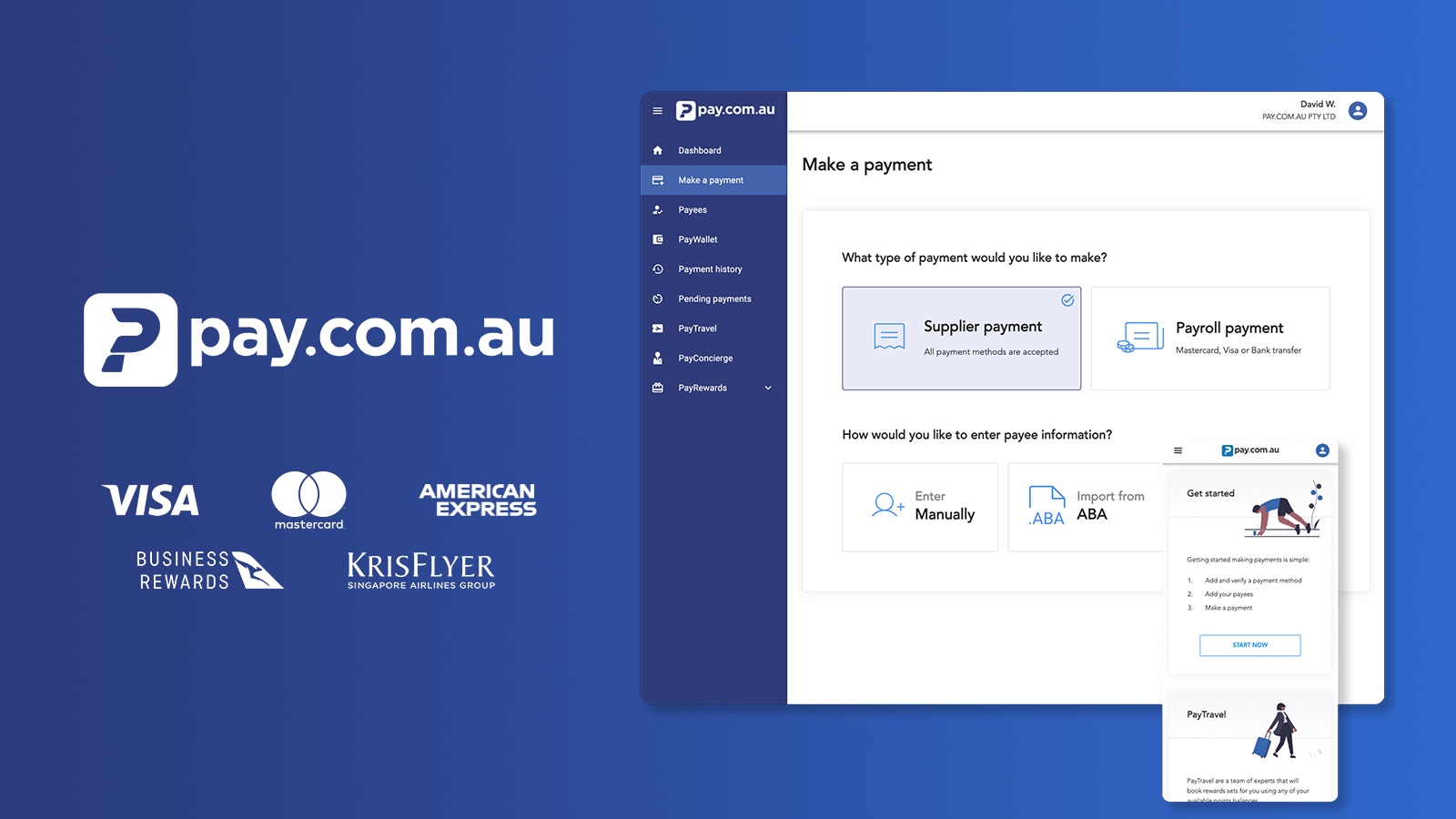

Pay.com.au allows businesses to earn PayPoints on their bank transfer and card transactions, which can then be converted into great rewards.

www.pointhacks.com.au

Their program seems a little more complex than Rewardspay but from my brief research it looks like if you spend $165/month to join their "Premium" plan then you will be charged 1.9% + gst for Amex purchases. This enables you to earn what you normally earn on your Amex (eg 2.25points/$ on the Platinum card).

Pay.com.au also has it's own separate rewards program where if you join their "VIP Premier" tier you receive 2 "Payrewards" points/$ spent for an additional 1.8% + gst cost. "Payrewards" points can be transferred to either QF or SQ at a rate of 2.5:1 so effectively 0.8 qf/sq points/$spent.

So in a real world example if you spent $100k and used your Amex Platinum card you'd get 225k Amex points which is 112.5k QF points or SQ miles and this would cost you $2090 including gst. You could also earn 200000 "Payrewards" points which is 80k QF points or SQ miles and this would cost you $1980 including gst.

Seems like Payrewards comes at a cost of 2.47c/point whereas Pay comes at a cost of 1.86c/point.