Tropic

Active Member

- Joined

- Jan 29, 2017

- Posts

- 580

Oh well, one more wont hurt surely...There are thousands of such posts across all threads going back years with similar dire predictions

Last edited:

Oh well, one more wont hurt surely...There are thousands of such posts across all threads going back years with similar dire predictions

That phrase doesn’t appear in the email (not letter) despite the “ “."Trust Us" sounds like a desperate plea for a major business...

Brilliant idea. They could charge us for itI'm sure QF will start the "Lounge From Home" initiative soon, as the recent success of Work From Home due to COVID. Ie. You can lounge at your home as long as you like, before going to the airport.

but haven't QF actually lost ground.....I mean VA talking circa 36% share (above their 33% target) plus Rex have a ~5% so shirley QF have dropped their share of total pax?? It's one thing improved take off & arrival times, but I dare say they have lost a very marginal amount of pax in recent times.I repeatedly read these types of posts on AFF over and over yet their planes are taking off every hour of every day virtually full.

There are thousands of such posts across all threads going back years with similar dire predictions

Does market share matter if they are charging more than everyone else and filling their planes every day - ROI - its a company with shareholders looking at profits.but haven't QF actually lost ground.....I mean VA talking circa 36% share (above their 33% target) plus Rex have a ~5% so shirley QF have dropped their share of total pax?? It's one thing improved take off & arrival times, but I dare say they have lost a very marginal amount of pax in recent times.

QF will always be the dominant carrier here.

That's because they have a marketing team.That phrase doesn’t appear in the email (not letter) despite the “ “.

but haven't QF actually lost ground.....I mean VA talking circa 36% share (above their 33% target) plus Rex have a ~5% so shirley QF have dropped their share of total pax?? It's one thing improved take off & arrival times, but I dare say they have lost a very marginal amount of pax in recent times.

QF will always be the dominant carrier here.

Just these half baked poor semi excuses emails are not doing them any good IMO.

Ha ha agreed half baked poor semi excuses love itbut haven't QF actually lost ground.....I mean VA talking circa 36% share (above their 33% target) plus Rex have a ~5% so shirley QF have dropped their share of total pax?? It's one thing improved take off & arrival times, but I dare say they have lost a very marginal amount of pax in recent times.

QF will always be the dominant carrier here.

Just these half baked poor semi excuses emails are not doing them any good IMO.

That's because they have a marketing team.

cough reality hits againDoes market share matter if they are charging more than everyone else and filling their planes every day - ROI - it’s a company with shareholders looking at profits.

but haven't QF actually lost ground.....I mean VA talking circa 36% share (above their 33% target)

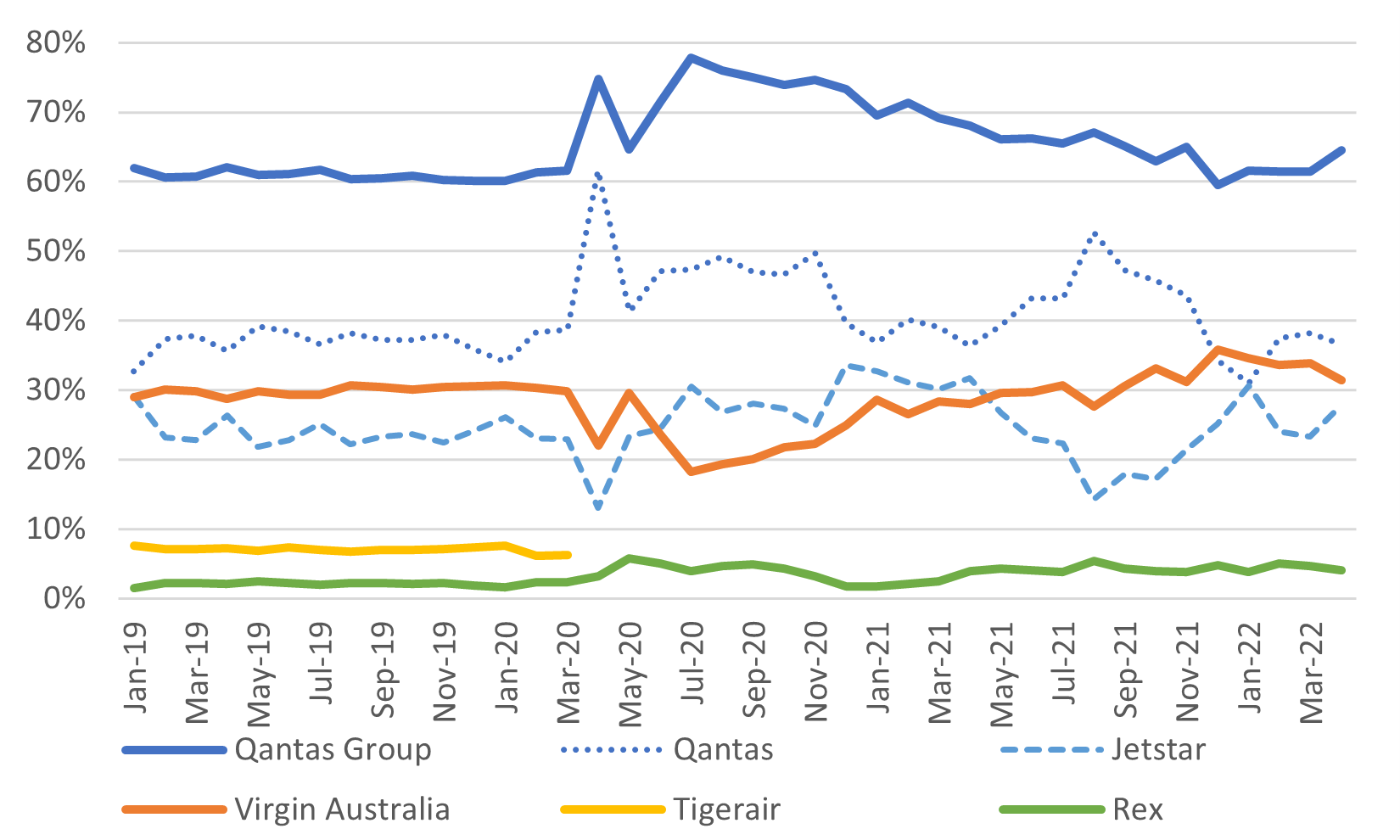

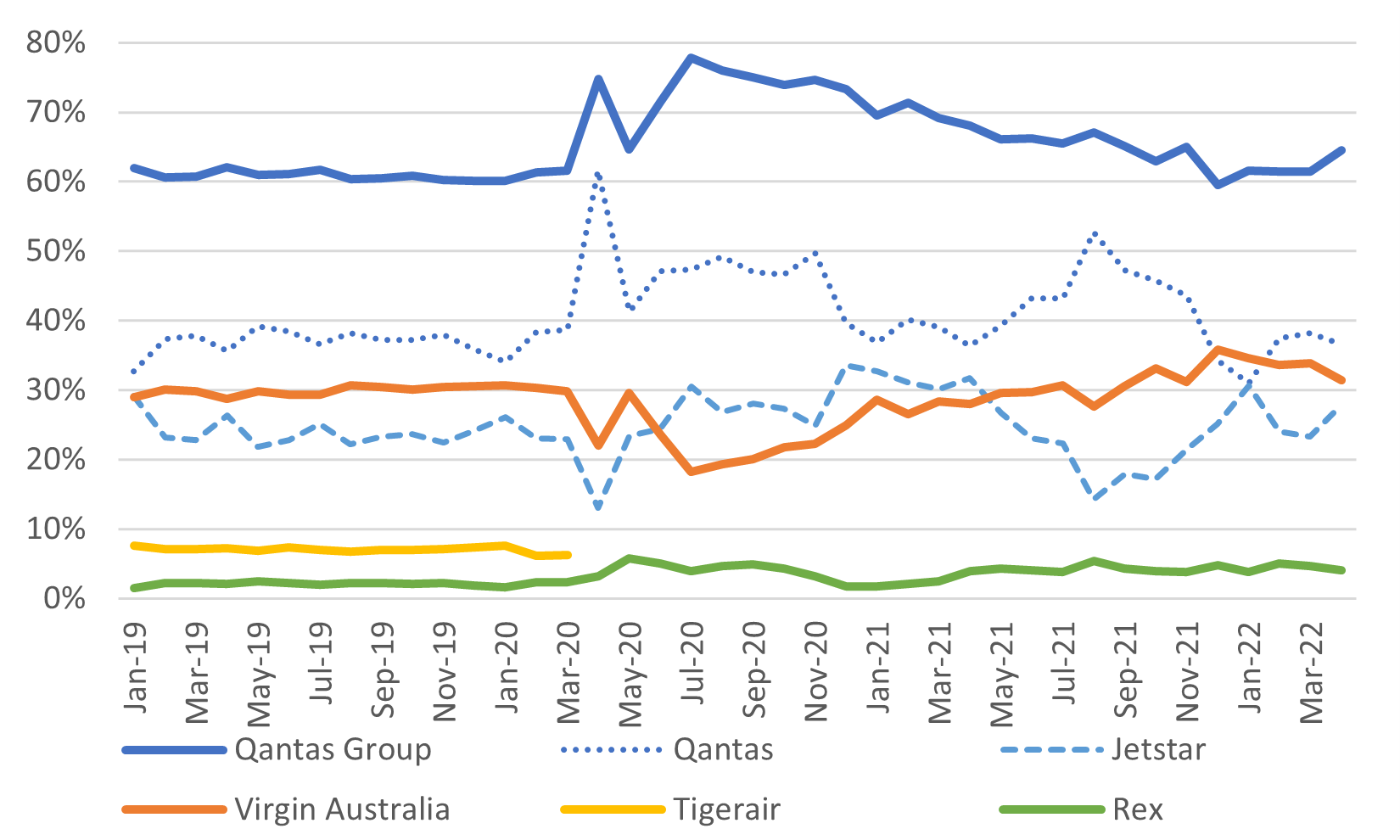

Depends what you take as your start point. If you take it from January 2019 it is virtually the same in March 2022 which really is an extraordinary achievement for VA with what they have gone through. But if you take it from July 2020 QF have gone from 80% to 65% until the end of your graph but VA from 20% to 30%.Share of what though? Discounted domestic flights?

Fare differences alone between the two airlines will more than make up for a few percentages of domestic market share.

Edit - where's your source for this?

The last I have is this graph which was from April. Trajectory was down for VA, QF was up.

Depends what you take as your start point. If you take it from January 2019 it is virtually the same in March 2022 which really is an extraordinary achievement for VA with what they have gone through. But if you take it from July 2020 QF have gone from 80% to 65% until the end of your graph but VA from 20% to 30%.

Your improvement for QF is just 2 quarters.

I am deciding but Finnair looks betterHonestly... this is rubbish.

Change airlines... challenging I know... but worth it in the long run... and very worth it!

Ooh roo

Willie

I'm asking for a source for the 36% stat used upthread.

AFF Supporters can remove this and all advertisements

Well you posted it and on AFF it means it is yours. So I took to google as well and first up was your graph extended to October of 22 and it is slightly different with no discernible differences between QF and VA as to market share.

Yep, QF a business not a charity so its all about ROI... but geeze those golden LTG handcuffs serve QF well... hard to worry about how QF treating you as a customer when being wracked by a Gollum-like obsession about getting that next precious SC to edge you ever so slightly closer to that golden Shangri-la in the distance.. and having been LTG a while not sure it was worth the walk... YMMV.Oh well, one more wont hurt surely...

Well you posted it and on AFF it means it is yours. So I took to google as well and first up was your graph extended to October of 22 and it is slightly different with no discernible differences between QF and VA as to market share.

As I said remarkable from the airline that went through bankruptcy.

View attachment 315660

PS the graph is from ACCC.

Oh, no - not data cherry picking?