- Joined

- Aug 21, 2011

- Posts

- 16,767

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

Qantas Business Rewards has launched a new global payments platform called Qantas Business Money.

According to the website, you can "make cheaper payments across the globe and save up to 70% compared to the big banks on conversion rates" and "set up global accounts in 11 different currencies instantly, without visiting a bank branch".

You earn 1 Qantas point for every AUD10 (or equivalent) converted to a foreign currency and there's a launch offer of 25,000 bonus points for converting AUD15,000 or equivalent within 60 days.

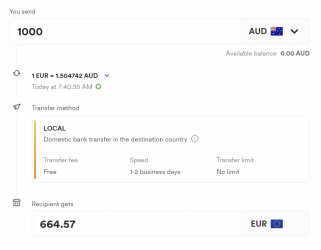

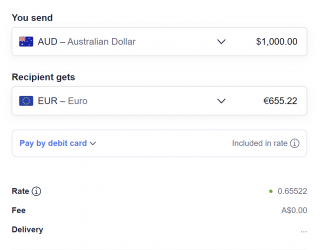

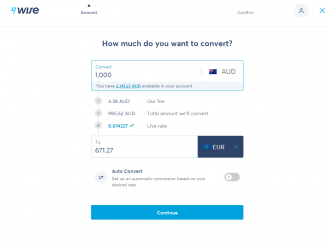

Has anyone looked into this and does it seem worthwhile? Personally I can't see this being a more competitive option than Wise for foreign currency transfers.

According to the website, you can "make cheaper payments across the globe and save up to 70% compared to the big banks on conversion rates" and "set up global accounts in 11 different currencies instantly, without visiting a bank branch".

You earn 1 Qantas point for every AUD10 (or equivalent) converted to a foreign currency and there's a launch offer of 25,000 bonus points for converting AUD15,000 or equivalent within 60 days.

Has anyone looked into this and does it seem worthwhile? Personally I can't see this being a more competitive option than Wise for foreign currency transfers.