Looking to move away from only exclusively earning QFF points and came along this offer.

Does anyone know if you can opt-in for this offer (30k bonus points) and then apply for alternative card that is

not listed as per below, but then still receive the additional 30k points plus whatever you earn from the card itself?

ie. An ANZ Rewards Black card (not listed as per below), which awards 180k ANZ rewards points after meeting a minimum spend, which you can then use to convert to VFF points?

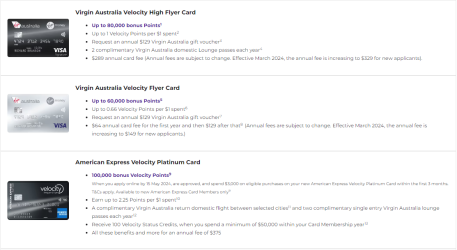

View attachment 372937

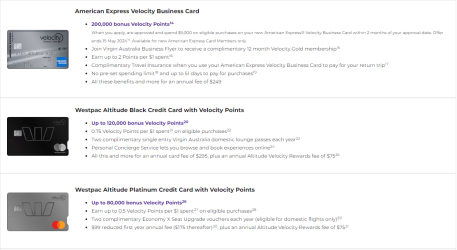

View attachment 372938

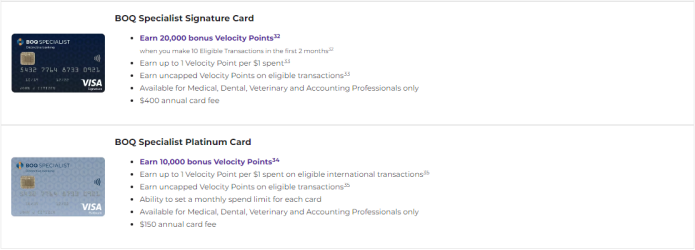

View attachment 372939

Reason for asking is to try to diversity points - ie. I can convert some of the ANZ points to VFF points, some to Asiamiles etc.

Would be good if the additional 30k points still applies (because even though it's not listed above, it's still a "VFF points earn").

If not, no big deal. The Westpac Altitude Platinum Credit Card with Velocity Points would work for me - only a $3k spend required and I can sign-in to get no annual fee.