Hi everyone,

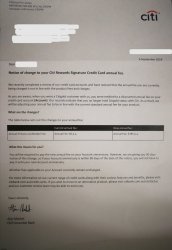

I have a Citi Signature card that I picked up during the fee free for life promo a couple of years ago. Given the changes to rewards and my changing travelling/spending patterns I am looking at changing the points earn from Citi Rewards to QFF, however I am worried that this might change the card conditions and therefore restart the annual fee. I am also looking at adding a secondary card to the account and have the same concern with this.

Has anyone tried either of these before without losing their fee free for life status?

Many thanks

Pete

I have a Citi Signature card that I picked up during the fee free for life promo a couple of years ago. Given the changes to rewards and my changing travelling/spending patterns I am looking at changing the points earn from Citi Rewards to QFF, however I am worried that this might change the card conditions and therefore restart the annual fee. I am also looking at adding a secondary card to the account and have the same concern with this.

Has anyone tried either of these before without losing their fee free for life status?

Many thanks

Pete