YMMV but i have made two TI claims for hotels after delay -one with credit card insurance and one with a stand alone policy, and both times the excess was charged. So we really only got a very small refund for the accommodation we had to arrange.

And again, exactly yes, this is what we do too now. Same deal - I buy the flights on Amex because of good cancellation cover

Depending on which Amex - the Amex Platinum Card (charge) coverage for Delayed flights is excellent.

We had a trip where we were booked LHR - SYD via SIN - but had booked BA LHR- SIN, and QF SIN-SYD (BA all the way on the way over, but QF offered for the final leg at the same price - so more SC). Around midday on the day of departure we are sitting in the Champagne bar at Harrods when we get the SMS from Qantas that the QF departure from SIN is delayed, from around 9pm until 6 or 7am the next day. As the BA flight was not delayed, we were going to have a gap, and would need a hotel.

Unsure of what or where QF would book, or how proactive they would be (seeing as the flight is originally delayed leaving LHR, so most impacted pax would be dealt with at origin), looked at the Amex policy provisions. Delay after 4 hours - $700 per person, nil excess, two of us travelling and both covered, so up to $1,400. Check out what is available in Singapore for the night, and want to minimise delays and make the most of hte unexpected strop-over. Found a package offered by the Sofitel - suite, chauffer transfer to/from SIN and a bottle of Champagne - about $1,000, and bookable on Amex (essential). Done.

When we arrived at SIN, we were met y a QF service representative with the normal delay letter (essential for insurance). They had arranged a hotel, but we just said that we weren't sure what would be arranged after we received the delay notification, and had made our own arrangements. Let them know where we would be in case of further delay, and headed into town.

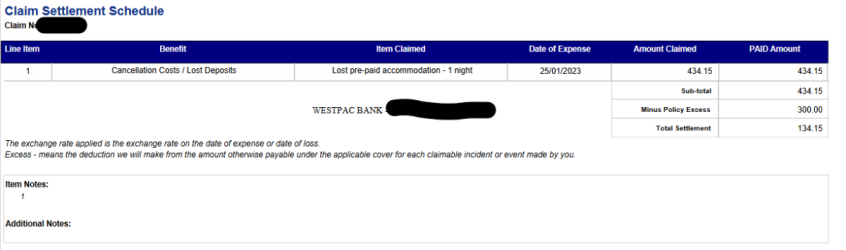

Has a nice walk around the water, great sleep, then early start back for breakfast in the lounge. Submitted the claim along with the letter to Amex, and was paid without question. Didn't press the EU361 (tried with Qantas, and they claimed it didn't apply, despite the fact that we were ticketed on the one PNR out of EU) as we got a nice stop over courtesy of Amex.

As a side, I had to make a decision before we left. My passport was due to expire about 3 months after our return. UK doesn't require 6 months validity, just that the passport is valid, that was the only place we were going, so the passport was good to go. However, the flights to and from both had a transit in SIN. We had no plans to stop, but SIN does require 6 months passport validity. I decided to renew early just in case there was some need to enter SIN - and was very glad I did. After that experience, I think I would make sure of always having 6 months validity in case of diversions or the unexpected (I might make an exception if only going to NZ, as I don't think that would ever result in a diversion to anywhere else).