- Joined

- Jul 5, 2015

- Posts

- 439

I know we have the "how to obtain a US credit card" thread in the AFF.

However I wonder if anyone's found a tool where I can enter my yearly credit card spend (eg let's say $100k AUD) across the various categories (restaurants, hotels, airlines, other) and the tool would calculate what credit cards across Australia and America would return in points when considering my category spend. But then also the calculate the transfer rate if I sent all the points to their various hotel and airline loyalty partners (to ideally determine which partner has the best transfer rate based on my total points earned in a year).

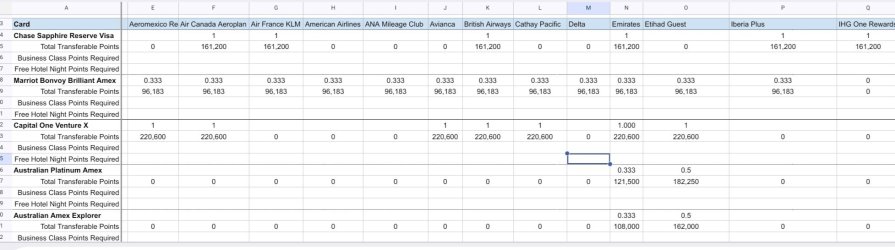

I've built this manually in GSheets for a number of Australian and US credit cards (for Chase, Capital One, Amex, Bonvoy etc) to see what the total points balance would be across all their transfer partners.

However, my next challenge is reviewing the two dozen airline partners of these cards for specific flight routes (eg SYD to LAX) to see how much in points and taxes it'd cost across each airline. To determine which credit card to apply for because it has the best transfer rate to the best airline, that has the best availability for the best type of seat for my routes.

I'm currently working with Gemini to review information, but I wondered if anyone has a better way to do this? Or if you think I'm over complicating things?

However I wonder if anyone's found a tool where I can enter my yearly credit card spend (eg let's say $100k AUD) across the various categories (restaurants, hotels, airlines, other) and the tool would calculate what credit cards across Australia and America would return in points when considering my category spend. But then also the calculate the transfer rate if I sent all the points to their various hotel and airline loyalty partners (to ideally determine which partner has the best transfer rate based on my total points earned in a year).

I've built this manually in GSheets for a number of Australian and US credit cards (for Chase, Capital One, Amex, Bonvoy etc) to see what the total points balance would be across all their transfer partners.

However, my next challenge is reviewing the two dozen airline partners of these cards for specific flight routes (eg SYD to LAX) to see how much in points and taxes it'd cost across each airline. To determine which credit card to apply for because it has the best transfer rate to the best airline, that has the best availability for the best type of seat for my routes.

I'm currently working with Gemini to review information, but I wondered if anyone has a better way to do this? Or if you think I'm over complicating things?