ChrisMars

Established Member

- Joined

- Sep 16, 2017

- Posts

- 1,447

- Qantas

- Platinum

- Virgin

- Red

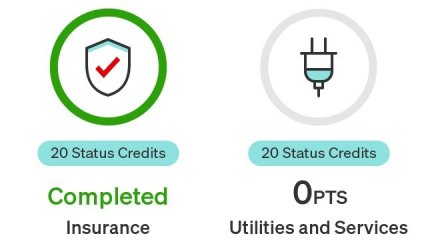

Which category does the survey falls into?That's what we don't know - not mentioned, but also not excluded. Waiting on the first person to cross over 1K credited in Oct to find out.