Doctore1003

Active Member

- Joined

- Jul 27, 2015

- Posts

- 994

Just looking at the RBA paper again. They estimate that surcharges are $1.2b per year, which will be fully eliminated, and that the cap on interchange fees will save businesses the same amount of $1.2b per year.It always astounds me how stupid some of these statements from government departments are. There is no way $1.2b is going to miraculously go from the payment ecosystem into the back pockets of everyday consumers. In what world does the RBA live in?!?

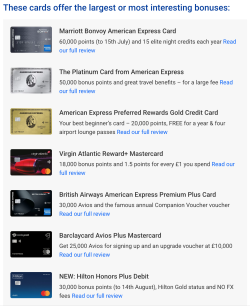

In all likelihood, banks will find a way to plug the gap (which could be devaluing reward points and there by increasing the costs of those consumers that use/benefit from them) and for retailers/merchants that currently surcharge but won't be able to, they'll just increase their prices.

Do they think that businesses (including banks) just willingly give up profits for the fun of it?!?

Domestic card issuers are expected to lose $900 million in revenue.

They also state the obvious: "Some issuers may choose to increase cardholder fees or reduce benefits such as rewards points, particularly on credit cards, to boost their profitability in response to reductions in interchange settings."

Last edited: