- Joined

- Aug 21, 2011

- Posts

- 16,792

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

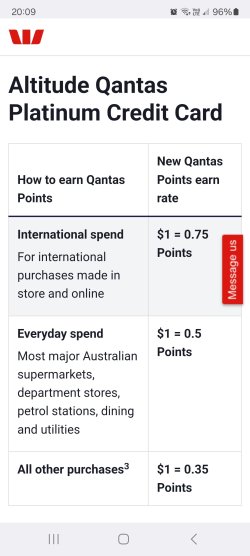

Westpac is making changes to Altitude, Qantas and Velocity point earn rates on its Platinum and Black credit cards, which take effect from 1 August:

www.westpac.com.au

www.westpac.com.au

These cards will also add monthly caps on the amount of spend that earns points at the full rate. After spending $5k/month on the Platinum cards, or $10k/month on the Black cards, the earn rate will halve.

The cards will introduce higher earning rates (compared to the new "all other purchases" rates - not necessarily compared to current earning rates) for international spend and with major supermarkets, department stores, petrol stations, dining and utilities.

Rewards changes

These cards will also add monthly caps on the amount of spend that earns points at the full rate. After spending $5k/month on the Platinum cards, or $10k/month on the Black cards, the earn rate will halve.

The cards will introduce higher earning rates (compared to the new "all other purchases" rates - not necessarily compared to current earning rates) for international spend and with major supermarkets, department stores, petrol stations, dining and utilities.