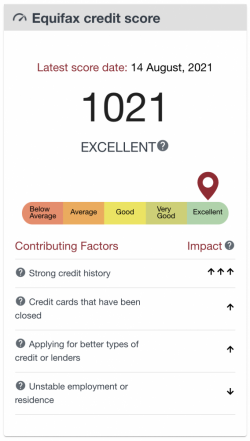

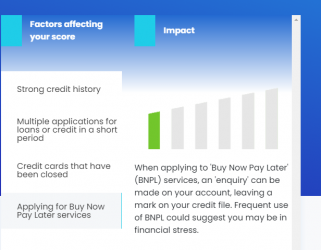

I have been churning about 6 cards a year for a bit over two years now. I also accidentally missed a payment last month. So their is no suprise that my credit score isn't great.

Whilst I do appreciate that it is your income level / ability to make payments that banks concentrate on, it was with some trepidation that I approached Nab for the third time in 2 1/2 years for a card. Clearly they can see that i have been churning plus my credit score is rubish. The last two cards with them were held for 2 months each. However, I got no questions about this. Instead they focused in on me providing proof that I had paid off my home mortgage (repaid recently).

My question is - do any experienced churners ever get asked about their activity and why they keep cancelling cards? Or is the issue that is simply not on the assessors list of issues to check?