MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,464

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

They did. They indicated a preference for banning surcharges, and limiting interchange fees.You don't find it odd then that they didn't canvass any policy options around capping merchant fees in their review last year?

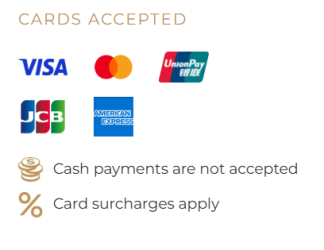

However, the legislation to regulate Amex etc hadn't passed Parliament at the time consultation kicked off so Amex's fees were not included. One thing at a time...