Several non Australian airlines also have surcharges for tickets originating in Australia. Further afield, Scoot reintroduced their credit card fees in Singapore, following the lead of the very soon to be defunct Jetstar Asia But it’s not a common practice like it is in AU.I buy airline tickets in many different countries and it’s only the Australian airlines that add a payment surcharge. Even Ryanair doesn’t stoop that low!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Card payment sucharges banned in Australia from 2026

- Thread starter Doctore1003

- Start date

LondonAussie

Member

- Joined

- Jan 25, 2022

- Posts

- 251

- Qantas

- Platinum

According to ChatGPT - I laughed at the "consumer friendly" part!

- Australia stands out as a country where credit and debit card surcharges are both permitted and widespread, making it consumer-friendly in everyday transactions.

- EU and UK lead with a ban on surcharges for both credit and debit cards, creating a transparent pricing environment.

- In the U.S. and Canada, credit card surcharges are common, while debit card surcharges are rare for everyday purchases.

- In many other countries, credit card surcharges are common for high-end cards or international cards, with surcharges being applied more often in tourism-related sectors (e.g., travel agencies, airlines). Debit card surcharges are rare. Everyday purchases generally don’t attract surcharges.

Mwenenzi

Established Member

- Joined

- May 17, 2006

- Posts

- 3,356

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

New Zealand.

All the larger banks in NZ are Au owned. ANZ Westpac. Commonwealth Bank trades as Auckland Saving Bank.

www.rnz.co.nz

www.rnz.co.nz

In my experience in store/restaurant NZ surcharging is less common than in AU.

All the larger banks in NZ are Au owned. ANZ Westpac. Commonwealth Bank trades as Auckland Saving Bank.

Surcharges on in-store payments, including PayWave, to be banned

"Shoppers will no longer be penalised for their choice of payment method, whether that's tapping, swiping or using their phone's digital wallet," Commerce Minister Scott Simpson says.

Many people in NZ buy on-line. Even for groceries. Guess banks/credit card providers got to the govt to keep the online fees (~robbery).The government plans to ban surcharges on card payments in-store, saving shoppers from being stung with surprise fees when paying with contactless technology.

Commerce and Consumer Affairs Minister Scott Simpson announced the change on Monday afternoon, declaring: "That pesky note or sticker on the payment machine will become a thing of the past."

"Shoppers will no longer be penalised for their choice of payment method, whether that's tapping, swiping or using their phone's digital wallet."

Legislation is expected to be introduced to Parliament by the end of the year, with the ban to kick into effect no later than May 2026. The proposed law would cover most in-store payments made using Visa and Mastercard debit and credit cards, as well as EFTPOS, but not online purchases or other international card schemes.

<snip>

In my experience in store/restaurant NZ surcharging is less common than in AU.

""The proposed law would cover most in-store payments made using Visa and Mastercard debit and credit cards, as well as EFTPOS, but not online purchases or other international card schemes."

Last edited:

- Joined

- Apr 25, 2011

- Posts

- 940

- Qantas

- LT Silver

- Virgin

- Red

Air NZ charges fees as well. Maybe it's a South Pacilfic thingWidespread rorting of surcharges are surely the reason they’re getting banned.

Equally I’m sure Qantas will replace it with a ‘payment processing fee’ or similar ‘booking fee’ to get around the surcharge ban.

I buy airline tickets in many different countries and it’s only the Australian airlines that add a payment surcharge. Even Ryanair doesn’t stoop that low!

I visited last year and was told by a Kiwi mate that eftpos is ‘free’ but credit cards are surcharged at the merchant’s discretion.

I went to Queenstown where surcharging on CC was on par with AU - guess that it’s a tourist town so they can get away with it. Possibly not in some places.

I think ultimately unsecured lending to consumers does have its costs including the cost of consumer protections and the cost of running a business which is increasingly the focus of scammers & where consumers expect card issuers to be one step ahead of these bad actors.

It is self serving of me to advocate continuation of a system which has served me well though: these ‘features’ need to be funded from somewhere like interchange. If it’s forced down too much like is being proposed, the card schemes will need to do away with some of this investment for AU customers after all, we are a small market.

I know politicians of all persuasions need to win elections so will tell us what we want to hear. Is the cost impost so high that we want to lose these important protections while we’re arguing the card schemes would have got their initial investment in the payments network back long ago. I think that’s missing an important aspect.

I went to Queenstown where surcharging on CC was on par with AU - guess that it’s a tourist town so they can get away with it. Possibly not in some places.

I think ultimately unsecured lending to consumers does have its costs including the cost of consumer protections and the cost of running a business which is increasingly the focus of scammers & where consumers expect card issuers to be one step ahead of these bad actors.

It is self serving of me to advocate continuation of a system which has served me well though: these ‘features’ need to be funded from somewhere like interchange. If it’s forced down too much like is being proposed, the card schemes will need to do away with some of this investment for AU customers after all, we are a small market.

I know politicians of all persuasions need to win elections so will tell us what we want to hear. Is the cost impost so high that we want to lose these important protections while we’re arguing the card schemes would have got their initial investment in the payments network back long ago. I think that’s missing an important aspect.

Interchange is hardly the only way CC providers make money, what about the exorbitant interest rates they charge! I suspect the very low interchange fee suggested by the RBA may have been a bit of an ambit claim to show they were serious and final agreed rate may be slightly higher.

What happened last time they ‘reformed’ the system and reduced interchange.

The card issuers are the ones who stand to make interest revenue from revolvers (and the loan write offs when some of these accounts go bad) not the card schemes who we all look to honour the protections we have as consumers.

I’m not an apologist for the issuers but they do need to make an economic return too. They’re not charities. Just don’t want it to be at my expense just like the majority here on AFF who want to make the most of the system. I don’t think to mess with interchange will make any meaningful difference to the misuse of credit. Issuers can find the generosity such as interest fee periods because there are lots of people paying interest which makes it economical to offer this feature.

The card issuers are the ones who stand to make interest revenue from revolvers (and the loan write offs when some of these accounts go bad) not the card schemes who we all look to honour the protections we have as consumers.

I’m not an apologist for the issuers but they do need to make an economic return too. They’re not charities. Just don’t want it to be at my expense just like the majority here on AFF who want to make the most of the system. I don’t think to mess with interchange will make any meaningful difference to the misuse of credit. Issuers can find the generosity such as interest fee periods because there are lots of people paying interest which makes it economical to offer this feature.

- Joined

- Feb 19, 2009

- Posts

- 3,790

- Qantas

- Platinum

- Oneworld

- Emerald

- Star Alliance

- Gold

I’m sure they make enough from this, but do the big spenders and points chasers on premium cards ever pay interest? I’ve had everything on statement balance auto pay for over a decade.Interchange is hardly the only way CC providers make money, what about the exorbitant interest rates they charge! I suspect the very low interchange fee suggested by the RBA may have been a bit of an ambit claim to show they were serious and final agreed rate may be slightly higher.

transpactraveller

Member

- Joined

- Jul 25, 2017

- Posts

- 101

- Qantas

- Platinum

- Virgin

- Gold

The last time I was in NZ I got told it was a surcharge on credit cards if you used paywave but free if you insert your card, and free to use a debit card.I visited last year and was told by a Kiwi mate that eftpos is ‘free’ but credit cards are surcharged at the merchant’s discretion.

The banks don’t make money on churning either but it never about individual card holders, it’s a numbers game. Plenty of people do pay that exorbitant interest!I’m sure they make enough from this, but do the big spenders and points chasers on premium cards ever pay interest? I’ve had everything on statement balance auto pay for over a decade.

Mwenenzi

Established Member

- Joined

- May 17, 2006

- Posts

- 3,356

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

off topic

Just the credit card processors - banks being very greedy

Yes. With some shops/food places an extra fee to use paywave (0.5%?). Hence the hand written signs "paywave not accepted" or "paywave extra x %)The last time I was in NZ I got told it was a surcharge on credit cards if you used paywave but free if you insert your card, and free to use a debit card.

Just the credit card processors - banks being very greedy

OZDUCK

Established Member

- Joined

- Aug 1, 2010

- Posts

- 4,699

And in a nicely timed announcement, the NZ government has announced plans to ban in-store surcharges on debit or credit cards.

New Zealand.

All the larger banks in NZ are Au owned. ANZ Westpac. Commonwealth Bank trades as Auckland Saving Bank.

Surcharges on in-store payments, including PayWave, to be banned

"Shoppers will no longer be penalised for their choice of payment method, whether that's tapping, swiping or using their phone's digital wallet," Commerce Minister Scott Simpson says.www.rnz.co.nz

Many people in NZ buy on-line. Even for groceries. Guess banks/credit card providers got to the govt to keep the online fees (~robbery).

In my experience in store/restaurant NZ surcharging is less common than in AU.

What is their reasoning for not wanting to ban surcharges online? You can't use cash or eftpos online. Does NZ still do POLI and want to encourage insecure payments?

Don't be so quick to celebrate. The report states:And in a nicely timed announcement, the NZ government has announced plans to ban in-store surcharges on debit or credit cards.

The proposed ban will not include online payments or transactions made using foreign-issued cards, prepaid, travel and gift cards.

So Queenstown can keep charging us.

LondonAussie

Member

- Joined

- Jan 25, 2022

- Posts

- 251

- Qantas

- Platinum

What a complicated mess. Like ATM withdrawals in the EU, they can charge different fees depending on the type of card you have, and foreign-issued cards usually get charged fees while an EU-issued card will get a fee-free withdrawal.

At least the EU & UK's surcharge ban is simple and our foreign cards don't get surcharged there.

At least the EU & UK's surcharge ban is simple and our foreign cards don't get surcharged there.

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,598

So there’s annual card fee to cover “asset maintenance services” AND And the technology fee…

And a Disbursement Fee (read CC surcharge fee)

The profit gouged from the actual exchange rate itself (by offering the X rate that favours them not you as the customer)

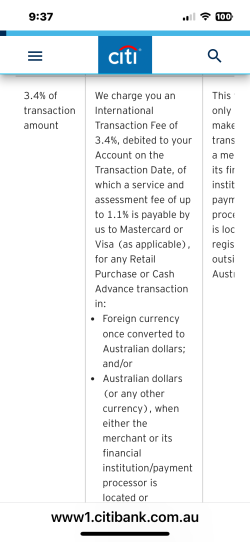

And a 3.5% foreign exchange fee if the merchant is non-Australian (which I notice I escape if I use Qantas hotels (so far JQ too) as they bill in Australia

And a transfer points fee (to move your points into FF account)

And interest charges if you pay late

What with the technology as it is, iisr be dirt cheap to electronically move money around and here we are with pricey charges on electronic transactions and zero cost for cash handling (go figure that one out)

And a Disbursement Fee (read CC surcharge fee)

The profit gouged from the actual exchange rate itself (by offering the X rate that favours them not you as the customer)

And a 3.5% foreign exchange fee if the merchant is non-Australian (which I notice I escape if I use Qantas hotels (so far JQ too) as they bill in Australia

And a transfer points fee (to move your points into FF account)

And interest charges if you pay late

What with the technology as it is, iisr be dirt cheap to electronically move money around and here we are with pricey charges on electronic transactions and zero cost for cash handling (go figure that one out)

Agree, there’s a strong case it should be cash that’s surcharged but imagine the uproar from the media about the impact on pensioners.What with the technology as it is, iisr be dirt cheap to electronically move money around and here we are with pricey charges on electronic transactions and zero cost for cash handling (go figure that one out)

LondonAussie

Member

- Joined

- Jan 25, 2022

- Posts

- 251

- Qantas

- Platinum

Is that just Amex or regular Visa/Mastercard as well in Australia?And a 3.5% foreign exchange fee if the merchant is non-Australian

In the UK, most cards are now 0% foreign currency fee except for Amex

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,598

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Larko1

- cgichard

- Chatswood

- fletty

- Lochrockinbeats

- dajop

- Wanderlust_tim

- Haplo

- Denali

- smsh63

- exceladdict

- billmurray

- wohoo

- zig

- Clayton

- Scarlett

- Jay684

- mms498

- leesionn

- bjhearne

- Melka

- JohnM

- Franko Costa

- darv

- crosscheck

- cartz

- wenglock.mok

- Bill Bosworth

- TheRealTMA

- Black Duck

- tazzo

- clifford

- flightsonpoints

- Austman

- #flying

- pjm99au

- Ttwines

- points

- Stone

- Matt_H

- L2.

Total: 1,357 (members: 50, guests: 1,307)