i feel smaller businesses will suffer in other ways, i'd guess same day/next day settlement could become more expensive or go all together which will hurt cashflow.Not going to happen. The RBA has all but ruled it out on p30 of the paper on the basis that (1) it means smaller merchants subsidise larger merchants because the latter is able to negotiate lower interchange rates than the former and (2) issuer costs are lower than the interchange rates, which means the current rates unnecessarily impose costs on merchants.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Card payment sucharges banned in Australia from 2026

- Thread starter Doctore1003

- Start date

MelbFlyer

Active Member

- Joined

- Jun 20, 2022

- Posts

- 862

- Qantas

- Silver

- Oneworld

- Ruby

No issues getting FF seats on Emirates directly or Singapore Air

Sorry should have been more elaborate - QFF and VFF programs where there's too many points floating around but not enough reward seats.

Unfortunately AMEX won't accept me as a customer even despite an excellent credit score and perfect payment history as well as virtually all other institutions accepting my applications - so transferring rewards points to Krisflyer or Skywards with my other cards will be at extremely poor rates.

My NAB Rewards card is 3 NAB rewards points to 1 KF/AM - hardly worth it.

I've also received my sign-up bonus already and those points have been transferred to VFF / an SQ business seat has been redeemed / is coming up.

100% what I think. Whilst the current system has served me well as a customer with the spend to make it work, I think these are all costs that are part of doing business.Exactly, that's how it should be, but the Government loves to meddle.

I used to get charged 1.1% for Visa/MC transactions and didn't pass on that cost either, it was simply a cost of doing business.

Cash was of course great, but some needs to go in the bank, and we'd go weekly to the bank, but that would take up 1 hour of my time and was always a risk of theft etc.

Some businesses now see these costs as part of their margins (like the cafe where I paid 3% the other day when I can get 1.9% on Square any day and on all payment forms). I’m not surprised they’re trying to retain them or get some ‘compensation’ for their loss from sympathetic and populist politicians.

Shame the current system won’t be economic after these ‘reforms’ but can’t expect banks to subsidise it either. They’re not a charity. End rant.

After further review of the changes, I agree with the changes to the transaction fees for the overall good of the community, 100%

From a personal perspective, if my points earning on transactions are heavily wound back (and I expect they will be), along with the other benefits removed, such as the included international travel insurance, chargeback, lounge access with some cards, etc, I'd bail on having a credit card, as for me, that is the only reason I have a credit card.

If they heavily increase the annual fees to cover the loss in transaction fees, I'd also jump ship.

I would be more than happy to use my debit cards moving forward, come 1st July 2026, as for me, there would be no worthwhile advantage.

Anyone else feel the same?

From a personal perspective, if my points earning on transactions are heavily wound back (and I expect they will be), along with the other benefits removed, such as the included international travel insurance, chargeback, lounge access with some cards, etc, I'd bail on having a credit card, as for me, that is the only reason I have a credit card.

If they heavily increase the annual fees to cover the loss in transaction fees, I'd also jump ship.

I would be more than happy to use my debit cards moving forward, come 1st July 2026, as for me, there would be no worthwhile advantage.

Anyone else feel the same?

Last edited:

Doctore1003

Established Member

- Joined

- Jul 27, 2015

- Posts

- 1,091

- Qantas

- Platinum

I think Amex will still be worth holding. The value of also having an accompanying Visa or MC credit card may be debatable. We’ll see!

It is highly likely Amex will follow suit, as has been suggested many times, as they have done in the past, because for many retailers, accepting an Amex, isn't a "must have", so they won't have any option if they want to stay in the game here.I think Amex will still be worth holding. The value of also having an accompanying Visa or MC credit card may be debatable. We’ll see!

If they don't, the transaction fee differences between VISA/MC & Amex, come 1st July, will then be substantial and questionable for retailers to accept.

There are plenty of good articles about this online, such as in The Australian or the AFR.

Last edited:

Sadly Amex will poleax MR in AU as they will have to meet MC & Visa on fees to merchants so there will be a much smaller fee pool from which to fund rewards. I think having a card going forward will depend on access to credit for those who need it & convenience in making large payments. Otherwise, not sure card issuers will be able to get away with the big AFs they’ve been charging.

LondonAussie

Member

- Joined

- Jan 25, 2022

- Posts

- 260

- Qantas

- Platinum

Interesting article in the AFR today:

- the RBA's proposals blindsided bank executives who weren’t expecting such a savage reduction in interchange fees

- Multiple bankers, not authorised to speak publicly, told the AFR the hit to interchange fee income could lead to the entire dismantling of card rewards and loyalty programs, and at the very least would see the value of rewards points and programs markedly cut

- at least one major bank is considering pulling the pin on Apple Pay as it is deemed a high-cost channel

- there will be unintended consequences and the full effect of the reforms and how they filter through the economy and payments system won’t be known for years

Apple Pay at risk as end of card reward programs as we know them looms

Far-reaching RBA proposals to change how credit card payment processing is paid for blindsided banking executives last week. The pushback is about to begin.www.afr.com

Archived here: http://archive.today/09cMP

So removing surcharges in Australia causes our banks to throw a tantrum and threaten to entirely dismantle rewards programs and remove Apple Pay!

Maybe the blindsided Aussie bankers should open their eyes to the rest of the world. Surcharges barely exist outside of Australia & NZ, and banks in other countries still offer rewards programs and Apple Pay.

SeatBackForward

Senior Member

- Joined

- Jun 20, 2006

- Posts

- 5,589

- Qantas

- LT Gold

- Oneworld

- Emerald

They're just sweating because they'll finally actually have to do some genuine value adding service. They've had their moment in the sun, charging fees for moving around something that should not have any value of itself...So removing surcharges in Australia causes our banks to throw a tantrum and threaten to dismantle rewards programs and remove Apple Pay!

Maybe the blindsided Aussie bankers should open their eyes to the rest of the world. Surcharges barely exist outside of Australia & NZ, and banks in other countries still offer rewards programs and Apple Pay.

I'm assuming you've seen what happened in the UK when these sorts of reforms were made, LondonAussieSo removing surcharges in Australia causes our banks to throw a tantrum and threaten to entirely dismantle rewards programs and remove Apple Pay!

Maybe the blindsided Aussie bankers should open their eyes to the rest of the world. Surcharges barely exist outside of Australia & NZ, and banks in other countries still offer rewards programs and Apple Pay.

Frequent flyer points per spend and benefits were slashed, dramatically.

LondonAussie

Member

- Joined

- Jan 25, 2022

- Posts

- 260

- Qantas

- Platinum

I'm not so sure. My BA Amex earns at a higher rate than my Qantas one did, and it earns Avios which are worth more to me than QFF points.I'm assuming you've seen what happened in the UK when these sorts of reforms were made, LondonAussie

Frequent flyer points per spend and benefits were slashed, dramatically.

Doctore1003

Established Member

- Joined

- Jul 27, 2015

- Posts

- 1,091

- Qantas

- Platinum

It’s more complex than that. There are many commercial factors that allow Amex to provide more perks to its cardholders, and its edge over the banks will continue.It is highly likely Amex will follow suit, as has been suggested many times, as they have done in the past, because for many retailers, accepting an Amex, isn't a "must have", so they won't have any option if they want to stay in the game here.

If they don't, the transaction fee differences between VISA/MC & Amex, come 1st July, will then be substantial and questionable for retailers to accept.

There are plenty of good articles about this online, such as in The Australian or the AFR.

I would argue it doesn't have an edge over Visa and MC, there are still businesses to this day that don't accept Amex and it's likely this will increase locally after 1st July.It’s more complex than that. There are many commercial factors that allow Amex to provide more perks to its cardholders, and its edge over the banks will continue.

More perks? Their annual charges are obscene, you are paying for those so called "perks".

Thoughts? Genuine question, as I've never seen the value in them, perhaps you can enlighten me

Interchange is the fee that the merchant's bank pays to the customer's bank. It is not the fee that merchants pay to accept cards. In the UK interchange on credit cards is limited to 0.3%, but merchants can still be paying transaction fees of 1-2%, just like in Australia.

In the UK Amex can be cheaper to accept than "premium" visas and MCs. Supposedly the UK supermarket chain Tesco lost a lot of money when they issued World Elite mastercards from Tesco Bank and cardholders spent large amounts on those cards in Tesco. Last week Mastercard launched a new level of cards above World Elite called Legend, no doubt to try and squeeze higher fees out of banks.

In the UK Amex can be cheaper to accept than "premium" visas and MCs. Supposedly the UK supermarket chain Tesco lost a lot of money when they issued World Elite mastercards from Tesco Bank and cardholders spent large amounts on those cards in Tesco. Last week Mastercard launched a new level of cards above World Elite called Legend, no doubt to try and squeeze higher fees out of banks.

clifford

Established Member

- Joined

- Jul 6, 2004

- Posts

- 4,167

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

I'd keep my fee free credit cards (if they stay fee free) and ditch any others, such as Amex. Let's wait and see what really happens with these proposals.Anyone else feel the same?

Doctore1003

Established Member

- Joined

- Jul 27, 2015

- Posts

- 1,091

- Qantas

- Platinum

I don’t know what you’re talking about. Amex’s most popular cards (Qantas Ultimate, Velocity Platinum, Explorer) are practically free if the travel credit / free flight cover spend you’d make each year anyway. Throw in some statement credits, and you’re actually ahead.Their annual charges are obscene, you are paying for those so called "perks".

Last edited:

Doctore1003

Established Member

- Joined

- Jul 27, 2015

- Posts

- 1,091

- Qantas

- Platinum

Interchange is the fee that the merchant's bank pays to the customer's bank. It is not the fee that merchants pay to accept cards. In the UK interchange on credit cards is limited to 0.3%, but merchants can still be paying transaction fees of 1-2%, just like in Australia.

In the UK Amex can be cheaper to accept than "premium" visas and MCs. Supposedly the UK supermarket chain Tesco lost a lot of money when they issued World Elite mastercards from Tesco Bank and cardholders spent large amounts on those cards in Tesco. Last week Mastercard launched a new level of cards above World Elite called Legend, no doubt to try and squeeze higher fees out of banks.

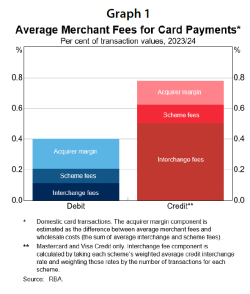

Assuming this refers to Aus, if merchants are paying 0.8% on average, why are hotels and restaurants charging us 2%?

transpactraveller

Member

- Joined

- Jul 25, 2017

- Posts

- 116

- Qantas

- Platinum

- Virgin

- Gold

Widespread rorting of surcharges are surely the reason they’re getting banned.

Equally I’m sure Qantas will replace it with a ‘payment processing fee’ or similar ‘booking fee’ to get around the surcharge ban.

I buy airline tickets in many different countries and it’s only the Australian airlines that add a payment surcharge. Even Ryanair doesn’t stoop that low!

Equally I’m sure Qantas will replace it with a ‘payment processing fee’ or similar ‘booking fee’ to get around the surcharge ban.

I buy airline tickets in many different countries and it’s only the Australian airlines that add a payment surcharge. Even Ryanair doesn’t stoop that low!

JohnK

Veteran Member

- Joined

- Mar 22, 2005

- Posts

- 44,436

Equally I’m sure Qantas will replace it with a ‘payment processing fee’ or similar ‘booking fee’ to get around the surcharge ban.

I buy airline tickets in many different countries and it’s only the Australian airlines that add a payment surcharge. Even Ryanair doesn’t stoop that low!

Air Asia, Nok Air have a payment fee/surcharge per person not card. I'm not sure if Thai or Bangkok Airways have similar.

When I book SQ flights there's a pay fee/surcharge. Even if I book SQ via Trip.com, Webjet, Expedia etc there's still a payment fee/surcharge.

I really struggle to understand why surcharges cannot be incorporated into the cost, for any business.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Pele

- Doug_Westcott

- swellington

- vbroucek

- bubblecapfish903

- tgh

- astrosly

- Peter D

- La Mouette

- ma1tr!x

- risaka

- RB001

- sydks

- Dmac59

- ians1949

- newmarket

- larry40

- cambriamarsh

- jase05

- Harrison_133

- Feintz

- sidcoffee

- rodkoguma

- 306

- fkcn

- burneracc

- funhaver

- LiamR

- CaptJCool

- Growing Older

- Grrr

- moa999

- New to this

- Jazzline

- Rugby

- butters_1313

- Steady

- dk_73

- Jonova

- Chrism13

- tielec

- Saab34

- brontes

- SJF211

- Daver6

- Equilibrium

- ddaritan

- PaulyB

- QFFHntrGthr

- FlyingFiona

Total: 1,555 (members: 75, guests: 1,480)