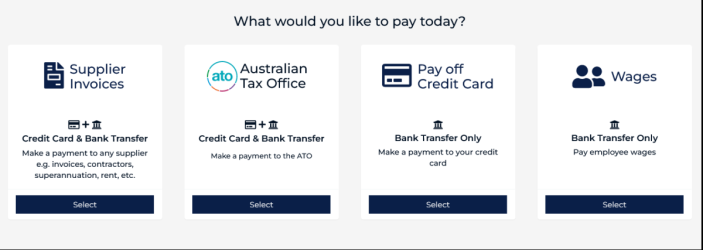

Just wanted to give you guys a heads up of my experience today. I've bought GCs to pay the ATO - sometimes more than I owe in error - much like a number on this thread have done over the years (either that or I've completely misunderstood).

I have been waiting for a refund to show up dated 1 September, I called my accountant this afternoon who investigated and told me the refunds have been cancelled & the ATO is holding onto all of these funds and couldn't give me a time frame to get them back. Just a word to the wise re this. I'm sure most have been paying tax bills and not making a habit of over-paying.

Interested to hear if anyone else has been caught up in all this.