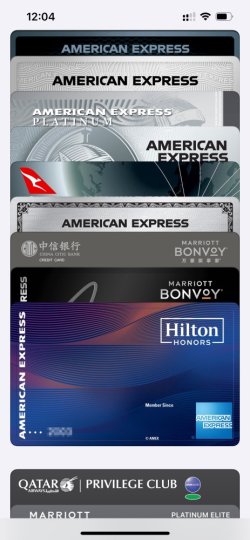

Apple wallet? May require you to delete the card and re-add it but can’t say for sure

I’m in two minds about the card. The airline credit in $50 lots is hopeless. It would be better for me to use the Gold Card or an airline branded one

Stay in Hiltons but almost never a Resort

PP I get from my Aussie Amex Plat.

So it’s really just another USD$100 to retain Diamond status

For another $100 it’s the Bonvoy Brilliant which gets you Platinum and therefore Lounge Access. And the side benefits seem more achievable if resident outside the US

I have, at least, until January to decide when my AF is due

. And always reluctant to give stuff up because you may never get it back