http_x92

Active Member

- Joined

- Sep 29, 2020

- Posts

- 704

- Qantas

- Gold

- Virgin

- Red

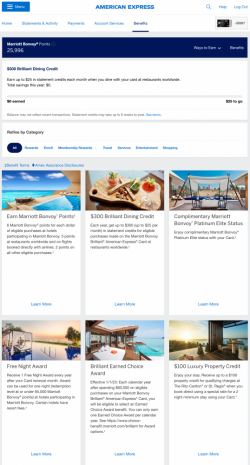

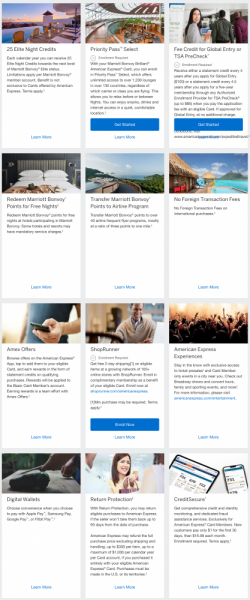

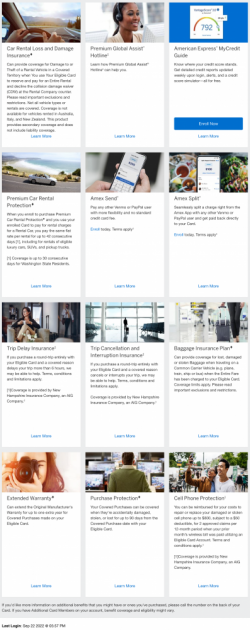

The Amex Marriott Bonvoy credit card changed its design today. The annual fee is now $US650; previously it was US$450. It comes with "enhanced" perks and benefits though - now giving a complimentary Platinum status with Marriott Bonvoy instead of Gold.

Marriott Platinum status that easily wow, hefty annual fee though considering some of us already have the Hilton Aspire. Platinum status is where big benefits are though, just $200 more. Useful.

Technically this means we could hold onto the card for 15 years and we are past halfway to lifetime Platinum, which is the highest lifetime membership we can get. Hmph.