Mr He

Member

- Joined

- Mar 2, 2017

- Posts

- 139

- Qantas

- Gold

- Virgin

- Gold

- Oneworld

- Emerald

Seems there hasn’t been a thread here on AFF that is all about foreign credit cards. A cardaholic myself, I’m very interested in seeing all kinds of credit cards with different designs and perks (if any), and I bet I’m not the only one. Australian credit cards, generally speaking, are not so exciting when it comes to designs and/or perks. And that’s probably one reason why the thread “Strategy to obtain US Amex” has become one of the longest-running, most-discussed in Credit Cards, Banking & Finance.

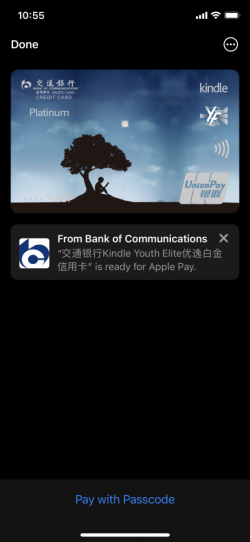

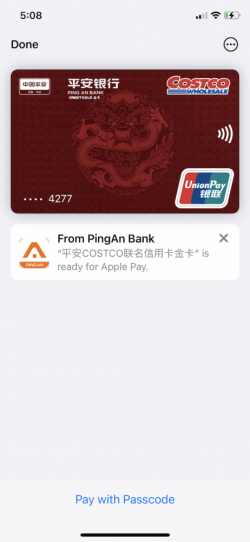

I remember the other day when a friend came to my place for dinner and I showed him some of my China-issued UnionPay credit cards, he was impressed by the diverse designs and co-branded options. And among them all, he said he liked the Amazon Kindle co-branded credit card issued by Banks of Communications. Fair enough as that friend loves reading books! I will post it in due time if this thread at least catches someone's eye

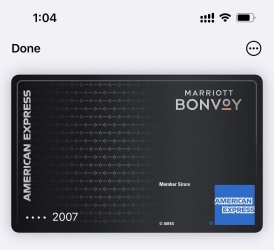

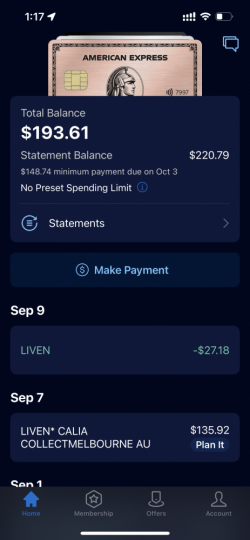

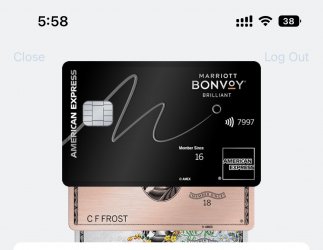

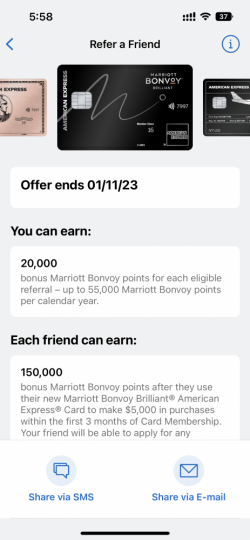

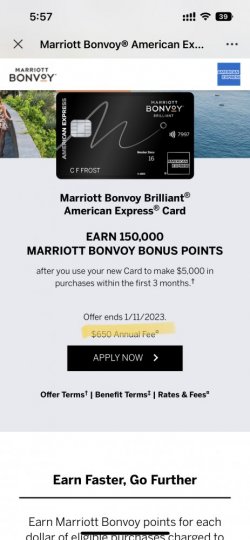

Having said that, I would like to start a thread where everyone can share their overseas, non-Australia-issued credit cards. Remember to blur sensitive information though (thanks goodness with more and more issuers beginning to print card numbers on the back it’s now much easier, worry-free to post). I will start with my five Amex US-issued credit/charge cards first.

I remember the other day when a friend came to my place for dinner and I showed him some of my China-issued UnionPay credit cards, he was impressed by the diverse designs and co-branded options. And among them all, he said he liked the Amazon Kindle co-branded credit card issued by Banks of Communications. Fair enough as that friend loves reading books! I will post it in due time if this thread at least catches someone's eye

Having said that, I would like to start a thread where everyone can share their overseas, non-Australia-issued credit cards. Remember to blur sensitive information though (thanks goodness with more and more issuers beginning to print card numbers on the back it’s now much easier, worry-free to post). I will start with my five Amex US-issued credit/charge cards first.