You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AFF Member Stock Discussion

- Thread starter samh004

- Start date

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,552

Was alerted to it as a possible buy but I note some headwinds re its US forays.

Mr_Orange

Senior Member

- Joined

- Jun 17, 2013

- Posts

- 5,858

And a headwind in the chart too.Was alerted to it as a possible buy but I note some headwinds re its US forays.

We listened to the Judo Bank presentation this morning. It got JDO up during the trading day.

Had a slew of letters from CBA and Commsec while we were away in the US. Had to go to a bank branch to do a KYC. Strange because we have been with Commsec since they took over Sanford Securities many years ago. Lucky we had our family trust deed on our IPads.

Thinking about dumping a few non performers.

Was buying some FRI as they were tanking yesterday.That is the Perth apartment developer Finbar.

Had a slew of letters from CBA and Commsec while we were away in the US. Had to go to a bank branch to do a KYC. Strange because we have been with Commsec since they took over Sanford Securities many years ago. Lucky we had our family trust deed on our IPads.

Thinking about dumping a few non performers.

Was buying some FRI as they were tanking yesterday.That is the Perth apartment developer Finbar.

Last edited:

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,552

Sell IAG at $9?

Mr_Orange

Senior Member

- Joined

- Jun 17, 2013

- Posts

- 5,858

After a very quick look and if you have a reasonable profit locked in, perhaps, yes.Sell IAG at $9?

Last edited:

tgh

Established Member

- Joined

- Apr 23, 2006

- Posts

- 3,767

Sell IAG at $9?

Why ? ie….You own shares to buy and sell seeking taxable cash return OR you own shares for organic growth dividends and minimal taxation...

I remind y'all that my broker sold out his entire holding of CBA @ $140 , advised all his clients to do the same as they could then get back in when it fell back to a hundred….

Disclaimer :...As a responsible fund manager I did sell a few at $160 as a woozy gutless butt covering exercise...

Why ? ie….You own shares to buy and sell seeking taxable cash return OR you own shares for organic growth dividends and minimal taxation...

I remind y'all that my broker sold out his entire holding of CBA @ $140 , advised all his clients to do the same as they could then get back in when it fell back to a hundred….

Disclaimer :...As a responsible fund manager I did sell a few at $160 as a woozy gutless butt covering exercise...

TheRealTMA

Senior Member

- Joined

- Jul 13, 2012

- Posts

- 8,426

- Qantas

- Platinum

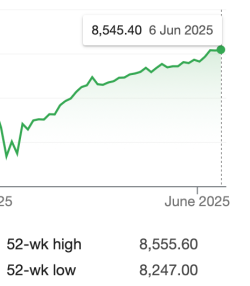

I'm annoyed with myself that I didn't buy more XERO at $140 during the Trump induced slump. Now up 33% since then.

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,552

Depends on the stock. Also there are other reasons - Might be better opportunities elsewhere?You own shares to buy and sell seeking taxable cash return OR you own shares for organic growth dividends and minimal taxation...

CBA +12.5% since $160

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,552

When I migrated from MYOB and discovered how good a product it was/is, I bought some XRO in May 2022XERO at $140

No dividends though. Might be overpriced now.

TheRealTMA

Senior Member

- Joined

- Jul 13, 2012

- Posts

- 8,426

- Qantas

- Platinum

IIV said it was well overpriced at $140.When I migrated from MYOB and discovered how good a product it was/is, I bought some XRO in May 2022

No dividends though. Might be overpriced now.

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,552

XRO not able to make a mark in the US and I think its maturing in Aus - with subscriber growth slowing. The increased profitablility due to putting prices up rather than growing subscriber base.

Would most Xero subscribers be happy paying > $1K per year?

Would most Xero subscribers be happy paying > $1K per year?

- Joined

- Apr 14, 2013

- Posts

- 707

They have had 3 price increases in a very short time. They are also pricing themselves out of the micro business with 1-2 employees due to stp and superannuation functions not offered on the lower plans. Not sure how it will impact the bottom line. Quickbooks and other competitors are winning the small clients.XRO not able to make a mark in the US and I think its maturing in Aus - with subscriber growth slowing. The increased profitablility due to putting prices up rather than growing subscriber base.

Would most Xero subscribers be happy paying > $1K per year?

TheRealTMA

Senior Member

- Joined

- Jul 13, 2012

- Posts

- 8,426

- Qantas

- Platinum

Not promoting Xero but they have a 90% off four month subscription at the moment so good time to trial it if cloud based accounts interest you. Payroll for one employee included in base subscription now, annoying, should allow for at least two.XRO not able to make a mark in the US and I think its maturing in Aus - with subscriber growth slowing. The increased profitablility due to putting prices up rather than growing subscriber base.

Would most Xero subscribers be happy paying > $1K per year?

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,552

Already using Xerogood time to trial it if cloud based accounts interest you

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,552

Well @Quickstatus that is nice.

We know market downturns occur and we have been in the market since I was seventeen so that is 58 years of investing.

We know market downturns occur and we have been in the market since I was seventeen so that is 58 years of investing.

SeatBackForward

Senior Member

- Joined

- Jun 20, 2006

- Posts

- 5,637

- Qantas

- LT Gold

- Oneworld

- Emerald

This aligns with my experience also. Use them to manage two small business but the price increases are rapidly make me wonder what for. The one thing XERO seems to do well is integrate with other apps, so connecting to Stripe, Wise etc is one of the main reasons I'm sticking with them..They have had 3 price increases in a very short time. They are also pricing themselves out of the micro business with 1-2 employees due to stp and superannuation functions not offered on the lower plans. Not sure how it will impact the bottom line. Quickbooks and other competitors are winning the small clients.

anyway, off topic for a Stock discussion.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.