TheCollecter

Intern

- Joined

- Apr 25, 2025

- Posts

- 83

- Qantas

- Gold

You are spot on... when you setup a Square that you buy at office works etc for $60, one of the 1st questions in the setup process is do you want to add a surcharge! That's restaurants and the like using that service (and it wasn't coded for them in the past as you say - it was hard in the old days!)... but in online shopping in AU the surcharge has been there for 20 years...What really kicked it up into high gear was when the payment service providers starting building the surcharge system into the payment terminal software. Before that it was a hassle to add it on and far fewer places did it. But once it was in the software it became much easier and the providers started advertising that it was "free" for the business, cause now it was an extra cost for the customer.

Then they started bundling in extra services into the cost as well...

Many online AU sites to this day at checkout say Visa/MasterCard 0% surcharge, Amex 3%

In summary:

1. Whosoever pays Amex 3% wants their head read,

2. If you can absorb the 1.2-1.4% Visa/MasterCard surcharge, and you are dumb enough to pay Amex 3%, then your Amex surcharge should be max 1.8% as you are happy to absorb 1.2% in your costs already on Visa/MasterCard - meaning you are creaming Amex customers to line your own pockets

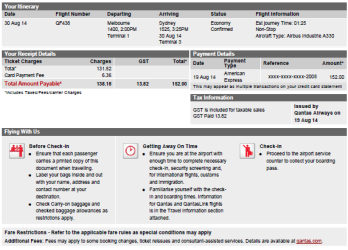

Who remembers when Qantas charged a credit card fee of $7 per pax? Not based on cost, just a cash grab? Qantas overhauls its card payment surcharges but not everyone is a winner