RSD

Established Member

- Joined

- Feb 13, 2010

- Posts

- 3,212

- Qantas

- Platinum

Bit of a mixed day -

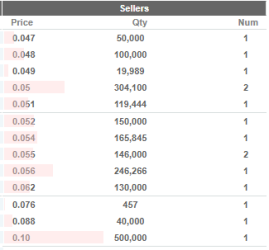

AUQ got line wiped a few times on its way from 4.3 to 4.7c then closed at 4.6c - the sell side has thinned out further.

FG1 didn't really do much despite announcing the discovery of a new high grade gold vein

HGO fell one pip on no news.

Lets see what Wall St delivers tonight - a fair bit of U.S. jobs data getting released at 22.30pm our time - will be interesting to see how real it looks given what happened last month.

AUQ got line wiped a few times on its way from 4.3 to 4.7c then closed at 4.6c - the sell side has thinned out further.

FG1 didn't really do much despite announcing the discovery of a new high grade gold vein

HGO fell one pip on no news.

Lets see what Wall St delivers tonight - a fair bit of U.S. jobs data getting released at 22.30pm our time - will be interesting to see how real it looks given what happened last month.