- Joined

- Jan 14, 2013

- Posts

- 6,601

- Qantas

- Qantas Club

- Virgin

- Red

- Oneworld

- Sapphire

- Star Alliance

- Silver

These points are from Sniip themselves. You will still earn points from AMEX.

OK - thank you - I'm not sure if it makes sense for me with either of my cards, either. If I look at what it's costing me per point, paying $43.50 for 2500 QFF points seems a better deal than paying $109.45 for 5609.45 points (5000 tax + 109.45 fee + 500 bonus ... edit: the Sniip online calculator on their website says that this transaction would earn 6386 pts although I can't see how they arrive at that number).

Buying wine seems to be a better deal if you can find the right bonus offer?

$5000 x 1.45% = $72.50 earns 2536 QFF points

edit forgot the extra 36 points on the surcharge

@MelbFlyer, I use Sniip regularly and have always received points on whatever card I'm using. You also receive points on the fee that Sniip charge as well. So, if your bill is, say $1,000 and Sniip charge 2.19% (which is usually what I get charged), this would be a total of $1,021.90.I've never used Sniip or any other 3rd party before to pay ATO bills and am considering it just to get some extra points before QFF makes CR seats more expensive.

I have a $5-6k bill for the ATO - I've added the bill using the BPay details and it's now showing in the app as a pending to pay bill.

I've added my credit card (ANZ Frequent Flyer Platinum) and in the final step just before payment, it doesn't give a breakdown of how many points I'd earn - only just the amount and processing fee etc).

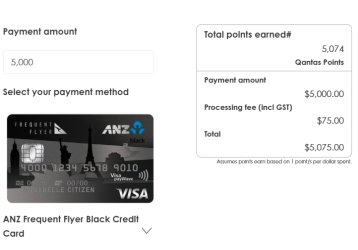

Does it usually give this breakdown in the app? I went on the Sniip website and the below breakdown was given (the card chosen in the dropdown list was the ANZ FF Black version, but I assume that I'll still earn some points on the ANZ FF Platinum version, unless Sniip only covers the cards within the dropdown list?).

Obviously I want to be 100% sure that I'll earn those couple of thousand QFF points from paying this bill, otherwise it would be >$75 wasted / I'd pay this bill via BPay instead.

View attachment 459557

@MelbFlyer, I use Sniip regularly and have always received points on whatever card I'm using. You also receive points on the fee that Sniip charge as well. So, if your bill is, say $1,000 and Sniip charge 2.19% (which is usually what I get charged), this would be a total of $1,021.90.

If using an Amex Platinum, I would receive 2,297 MR points (ER = 2.25).

If using the ANZ FF Platinum, you would likely receive 766 QF points (ER = 0.75).

Also, if you link your QF account, to your Sniip account, you should receive an extra 102 QF points (ER = 0.1)

Hopefully, this helps a little bit.

Not a problem, @MelbFlyer. I paid a PAYG installment via Sniip recently and didn't have any issues. You'll need to allow and extra day or two for the payment to reach the company that you're paying (as there's no an extra step involved).Thankyou @MG1!

I've just added my QFF details to Sniip and will try the smaller bill first as they're different ones - one is a PAYG instalment and the other will be a tax bill for the FY.

Hoping I get points from these bills.

Best of luck.Just paid a $1.3k ATO PAYG instalment via Sniip - will wait a few days to see if it earns points on my ANZ FF Platinum card.

My statement is due to be issued in a few days as well, hopefully this transaction will settle / clear before then and the points issued.

Won't be much, but better than zero points otherwise.

Thanks for the feedback. It seems Zip Pay locks your account automatically if you put too many transactions through. Originally I thought it was if you exceeded 4 or 5 x $1000 transactions per day, but now I'm thinking it is based on a 24 hour window. I'm still trying to work it out. If anyone does know the answer, it would be great if you could let me know as everytime your account is locked, it takes a few days to have it unlocked.So I'm unlucky enough to have a newish account that only got a $350 limit. Nonetheless, I have cycled about eight payments of $350 through it to the ATO over about five days and it didn't get locked. In about half of the cases, I paid off the balance immediately, and in the rest I did it the next day. Dunno if that data helps you at all.

Not a problem, @MelbFlyer. I paid a PAYG installment via Sniip recently and didn't have any issues. You'll need to allow and extra day or two for the payment to reach the company that you're paying (as there's no an extra step involved).

Best of luck.

Yes a month or 2 ago. Same rate for velocity now tooDid the pay.com.au transfer rate to QBR change recently?

A couple of months ago it was 2.5:1 - Payrewards to QBR.

Now it is 2:1!

Good to know - don't often hear about points increasing in value!Yes a month or 2 ago. Same rate for velocity now too

Because Amex can claim it is a fee for provision of a financial service (advancement of the credit), which does not attract GST. The other companies are not providing this service, but merely the facilitation of the payment, which does attract GST.No GST applicable. Tomorrow I will find out why.