Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

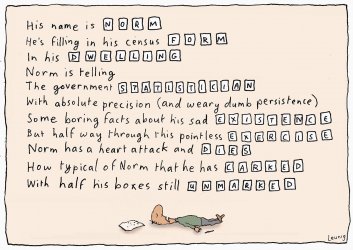

ATO is always going to be a much better source of income information, as census only asks about the last week vs a whole year. My income will be zero on census night as im wrapping up a contract and wont start next one before census night, so it will look like ive had no income, yet if held a week earlier or a couple of weeks later, completely different data.

Transport question in greater Sydney (and anywhere else in lockdown) will also severely under report usual travel given current covid restrictions, so not going to help with planning for post pandemic.

Seems odd they need to ask about military service, surely the ADF should have these records.

Transport question in greater Sydney (and anywhere else in lockdown) will also severely under report usual travel given current covid restrictions, so not going to help with planning for post pandemic.

Seems odd they need to ask about military service, surely the ADF should have these records.