- Joined

- Aug 21, 2011

- Posts

- 16,752

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

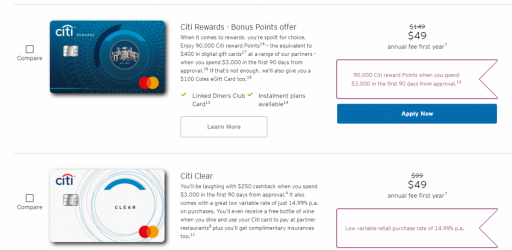

The Citi Rewards credit card seems to have a few different offers at the moment for new customers.

With the Velocity offer, you can earn 100,000 bonus Velocity points by spending at least $3,000 within 90 days. Normal annual fee is $199, reduced to $99 in the first year. Offer expires 30 June 2021.

Offer T&Cs:

www1.citibank.com.au

www1.citibank.com.au

With the Velocity offer, you can earn 100,000 bonus Velocity points by spending at least $3,000 within 90 days. Normal annual fee is $199, reduced to $99 in the first year. Offer expires 30 June 2021.

Offer T&Cs:

- To be eligible to receive 100,000 Velocity Points, you must apply for the Citi Rewards Card by 30 June 2021, then spend a minimum of $3,000 on eligible purchases using your new card within 90 days from approval. Eligible purchases exclude Cash Advances, Balance Transfers, Special Promotions, interest, fees, refunds, Chargebacks and spend on a Linked Diners Club Card. We will request your Velocity membership number from you via email within 8 weeks from meeting the spend criteria. The 100,000 Velocity Points will be credited to your Velocity account within 10 weeks from us receiving your Velocity membership number. Your Citi Rewards Card must remain open and in good standing for the Velocity Points to be awarded. If you do not provide us with your Velocity membership number within 14 weeks from us first requesting it, the Velocity Points will be forfeited. Membership of Velocity is your responsibility. Velocity membership and Points earn and redemption are subject to the Velocity Terms and Conditions, as amended from time to time, available at velocityfrequentflyer.com. Please note that if you have a balance transfer you will not be entitled to any interest free days on retail purchases. This means that all spend will be charged interest at the applicable annual percentage rate. This offer is valid until 30 June 2021. Post this advertised date; Citi reserves the right to continue, withdraw or change the offer at any time without notice.