Doctore1003

Established Member

- Joined

- Jul 27, 2015

- Posts

- 1,092

- Qantas

- Platinum

There's a new bonus offer for Amex Platinum Charge of up to 200,000 bonus Membership Rewards points:

That’s 150,000 Bonus Membership Rewards Points when you apply online by 27 January 2021, are approved and spend $3,000 on your new Card within the first 3 months. Plus, an additional 50,000 Bonus Membership Rewards Points in Year 2 upon fee renewal. New Card Members only.

This card delivers many lifestyle and travel benefits, including:

To be eligible for the bonus points, you must not have held a card issued directly by Amex Australia in the last 18 months.

If your application is successful I'll receive 45,000 bonus points. Here's my referral link:

Thank you!

That’s 150,000 Bonus Membership Rewards Points when you apply online by 27 January 2021, are approved and spend $3,000 on your new Card within the first 3 months. Plus, an additional 50,000 Bonus Membership Rewards Points in Year 2 upon fee renewal. New Card Members only.

This card delivers many lifestyle and travel benefits, including:

- a $450 Travel Credit

- elite status with major hotel loyalty programs including Marriott Bonvoy, Hilton Honors, Accor Hotels and others

- complimentary Accor Plus membership valued at $395 p.a.

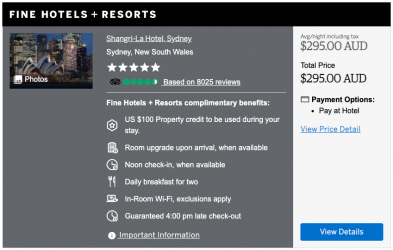

- access to the American Express Fine Hotels and Resorts program, which provides complimentary benefits at over 1,000 five-star properties worldwide valued at an average of $700 for a two-night stay

- earn 2.25 Membership Rewards points per $1 spent on everyday purchases

- transfer points to 10 airline partners, including both Qantas and Virgin Australia

- access to over 1,200 airport lounges in more than 130 countries, including Virgin Australia lounges, American Express lounges, Priority Pass, Plaza Premium and more (when they reopen)

- top-notch travel insurance cover

- Australian Financial Review Premium Digital subscription valued at $628 per year

- smartphone screen insurance, with up to $500 available twice a year for screen repairs (with a 10% excess)

- up to 4 free Additional Cards for family members - they can enjoy some the card benefits in their own right, like elite hotel status, travel insurance, and one Priority Pass membership.

To be eligible for the bonus points, you must not have held a card issued directly by Amex Australia in the last 18 months.

If your application is successful I'll receive 45,000 bonus points. Here's my referral link:

Thank you!

Last edited: