iflyflat has published a blog post today saying you can now redeem your Commbank Awards Points to fly with nine new airline partners:

Has anyone received notification from CBA? Perhaps this info is embargoed and iflyflat has jumped the gun on the announcement.

Japan Airlines, United Airways and 7 more airlines are now accessible with CBA Awards Points.

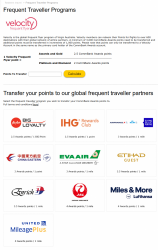

- Air Asia - Big points

- Air France / KLM - Flying Blue

- Eva Air - Infinity MileageLands

- China Eastern - Eastern Miles

- Etihad - Guest

- Malaysia Airlines - Enrich

- United Airlines - MileagePlus

- Japan Airlines - MileageBank

- Lufthansa - Miles & More

- Plus - IHG Rewards, the loyalty program of InterContinental Hotels Group, is also available as the bank's first hotel transfer partner.

Has anyone received notification from CBA? Perhaps this info is embargoed and iflyflat has jumped the gun on the announcement.

Japan Airlines, United Airways and 7 more airlines are now accessible with CBA Awards Points.