You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wise debit card

- Thread starter neils2004

- Start date

VPS

Senior Member

- Joined

- Apr 2, 2011

- Posts

- 9,794

- Qantas

- LT Gold

- Virgin

- Gold

Yes I have and it's great. If you haven't already got one I can refer you.Hi,

Has anyone had experience using a Wise debit card internationally ?

Thinking of obtaining one for use in Europe and the UK.

There are already a couple of threads

Join Transferwise and get a free international transfer

I've been using my Transferwise account for a few months now. Has been a great solution to my USD AUD transfers and customers. They have a referral offer which provides the new customer (you) with the following: Friends using your link to sign up will receive a discount on their first...

TransferWise Borderless Account

Hi team, I saw this and thought people might be interested: TransferWise Borderless account I haven't had the time to go through the detail yet but it does appear promising.

www.australianfrequentflyer.com.au

www.australianfrequentflyer.com.au

I've got one, but only used it a few times to receive GBP and USD into UK and US Wise accounts. What is the advantage of the Wise debit card over using an ING fee free debit card or a credit card like the Coles Rewards Mastercard both of which don't charge any international currency fees?

ZigZagWanderer

Member

- Joined

- Feb 9, 2021

- Posts

- 171

What are the exchange rates like? 'no fees' exchanges are usually a con because they hit you with anything from 2% to 4% difference from the spot rate. Can anyone tell me how much they differ?

VPS

Senior Member

- Joined

- Apr 2, 2011

- Posts

- 9,794

- Qantas

- LT Gold

- Virgin

- Gold

You don't have to worry about small transactions and I suspect the exchange rate is better.I've got one, but only used it a few times to receive GBP and USD into UK and US Wise accounts. What is the advantage of the Wise debit card over using an ING fee free debit card or a credit card like the Coles Rewards Mastercard both of which don't charge any international currency fees?

egWhat are the exchange rates like? 'no fees' exchanges are usually a con because they hit you with anything from 2% to 4% difference from the spot rate. Can anyone tell me how much they differ?

I just put in $3,000 AUD to convert to UK Pounds use xe.com send money at it was 1650.84 - the same with wise was 1,683.78

The other advantage is you can transfer money to another currency when it's a favourable exchange rate and then spend in that currency.

I currently have 5 currencies on there and if I want to buy a friend something from Amazon UK it automatically takes it out as pounds.

You can also have three virtual cards which is good for online shopping.

A friend just received a large inheritance from the UK and it saved hundreds of pounds compared to banks

Last edited:

You don't have to worry about small transactions and I suspect the exchange rate is better.

eg

I just put in $3,000 AUD to convert to UK Pounds use xe.com send money at it was 1650.84 - the same with wise was 1,683.78

The other advantage is you can transfer money to another currency when it's a favourable exchange rate and then spend in that currency.

I currently have 5 currencies on their and if I want to buy a friend something from Amazon UK it automatically takes it out as pounds.

You can also have three virtual cards which is good for online shopping.

A friend just received a large inheritance from the UK and it saved hundreds of pounds compared to banks

Post automatically merged:

Thanks. This is the info I was curious about.

Just be careful about dynamic currency conversion, as you would with any card. I had one where the merchant automatically converted the USD amount to my home currency (which I had zero balance in), and then wise converted that amount to USD to charge to the USD balance I had. I was out about 7%, but successfully challenged as I did not authorise the charge in my home currency.

FishFood

Member

- Joined

- Mar 2, 2022

- Posts

- 471

- Qantas

- Silver

- Virgin

- Platinum

- Oneworld

- Ruby

- SkyTeam

- Elite Plus

I've used it a few times, mainly to get cashout at ATMs.

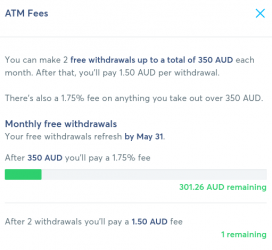

You can reload it using payid which is instant and very convenient, you get two free ATM withdrawals a month.

Overall I'm quite happy

You can reload it using payid which is instant and very convenient, you get two free ATM withdrawals a month.

Overall I'm quite happy

Costs nothing to open an account with them, so you can check the rates yourself.What are the exchange rates like? 'no fees' exchanges are usually a con because they hit you with anything from 2% to 4% difference from the spot rate. Can anyone tell me how much they differ?

you wont get a better rate than anywhere else except for Visa/MC daily rates.

Unless you want to hedge for your travels not much point using Wise, its main benefit is cheaper curency transfers, not using a debit card.

- Joined

- May 4, 2013

- Posts

- 166

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

I've just got a question about their fees, if I may.

Their website says that you can withdraw £200 per month and up to two withdrawals free per month. Is that just cash withdrawals? Or does it include purchases?

Their website says that you can withdraw £200 per month and up to two withdrawals free per month. Is that just cash withdrawals? Or does it include purchases?

FishFood

Member

- Joined

- Mar 2, 2022

- Posts

- 471

- Qantas

- Silver

- Virgin

- Platinum

- Oneworld

- Ruby

- SkyTeam

- Elite Plus

That is just for cash withdrawals. I have made a couple of card purchases and only the 500k IDR withdrawal counted towards the limitI've just got a question about their fees, if I may.

Their website says that you can withdraw £200 per month and up to two withdrawals free per month. Is that just cash withdrawals? Or does it include purchases?

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 12,447

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

Just bumping this thread and if someone can confirm that Wise DOES NOT rebate local ATM fees?That is just for cash withdrawals. I have made a couple of card purchases and only the 500k IDR withdrawal counted towards the limit

View attachment 277636

If so it’s actually worse for ATM withdrawals compared to ING, UBank etc. Similarly, if you already one of those debit cards, they’re as good or better also?

So as mentioned earlier, the key benefit of Wise is international transfers?

I used the wise debit card overseas last month and can confirm that you do get charged 3rd party ATM fees when doing cash withdrawals which are not rebated.

This card (and revolut) smoke all other credit and debit cards issued from retail banks when used for tap and go purchases like a normal debit card. Their exchange rate is by far better than retail banks.

This card (and revolut) smoke all other credit and debit cards issued from retail banks when used for tap and go purchases like a normal debit card. Their exchange rate is by far better than retail banks.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 12,447

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

Thanks. That’s a pity. Think I’ll close the account I just opened… No benefit over two free cards I already have.I used the wise debit card overseas last month and can confirm that you do get charged 3rd party ATM fees when doing cash withdrawals which are not rebated.

Have you used 28° MC or debit cards from ING and UBank? They’re pretty much spot on the prevailing VISA or MC rate (no additional international transaction fee) - so not much difference to the spot rate. Wise appears to charge around 0.4% fee.This card (and revolut) smoke all other credit and debit cards issued from retail banks when used for tap and go purchases like a normal debit card. Their exchange rate is by far better than retail banks.

I don’t have them but I understand that MacBank, BankWest and Coles MC are all equally good as those mentioned above.

From what I can see, Wise is definitely good for money transfers in and out.

On a recent trip to New Caledonia I found the Wise rate was more than the Mastercard rate on my Coles Mastercard. So I would have been better off using my Coles Mastercard for the transactions.I used the wise debit card overseas last month and can confirm that you do get charged 3rd party ATM fees when doing cash withdrawals which are not rebated.

This card (and revolut) smoke all other credit and debit cards issued from retail banks when used for tap and go purchases like a normal debit card. Their exchange rate is by far better than retail banks.

Pete98765432

Member

- Joined

- Apr 3, 2013

- Posts

- 308

- Qantas

- Platinum

- Virgin

- Red

The Wise card is handy when paying for petrol at the pump in countries that use offline PIN verification such as France. With my other Australian cards the PIN is not accepted and I have to go into the shop and have card authorised before pumping. The Wise card & PIN is accepted at the pump as the PIN is encrypted on the card's chip.

The downside to this is you cannot change the PIN, although you can select your PIN when ordering the card.

The downside to this is you cannot change the PIN, although you can select your PIN when ordering the card.

VPS

Senior Member

- Joined

- Apr 2, 2011

- Posts

- 9,794

- Qantas

- LT Gold

- Virgin

- Gold

I'm sure I've changed my PIN - I can check if you likeThe Wise card is handy when paying for petrol at the pump in countries that use offline PIN verification such as France. With my other Australian cards the PIN is not accepted and I have to go into the shop and have card authorised before pumping. The Wise card & PIN is accepted at the pump as the PIN is encrypted on the card's chip.

The downside to this is you cannot change the PIN, although you can select your PIN when ordering the card.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- dajop

- kevrosmith

- first_pheend

- JoshuaL1997

- JB001

- Stanley Lambchop

- logicallysynced

- Human

- papeto

- SOPOOR

- Cottman

- There'sOnlyOneJimmy

- redwoodw

- burmans

- jase05

- 1erCru

- kristian7

- Harrison_133

- Matt_01

- meadowfield

- Willie

- SYD

- stepheng

- BrianQQ

- kpc

- Ktan89

- pyffii

- points

- RooFlyer

- sydks

- nj12

- ChaoLong

- Foz

- Justinf

- Rugby

- AFAFA

- Hawk529

- Flyfrequently

- Forg

- http_x92

- moffat39

- BCons

- yld200

- defurax

Total: 4,753 (members: 50, guests: 4,703)