- Joined

- Aug 21, 2011

- Posts

- 15,078

- Qantas

- Platinum

- Virgin

- Platinum

- SkyTeam

- Elite Plus

- Star Alliance

- Gold

Has anyone noticed that the taxes & carrier charges on Qantas domestic award bookings are increasing from 1 January 2022 by around $7 per flight?

There doesn't seem to be any change to the Qantas-imposed carrier charge. Rather, Qantas is adding a $6.50 "Safety and Security Charge" to all domestic awards from 1 January, which is also adding slightly to the GST component bringing the total tax increase to $7.15 per passenger, per flight.

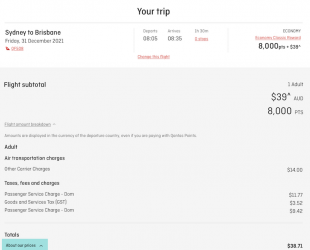

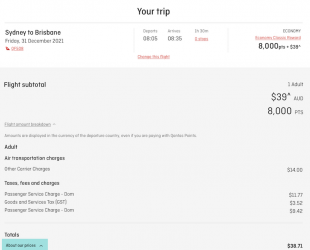

For example, this is the fare breakdown on a SYD-BNE Classic Flight Reward booking for 31 December 2021:

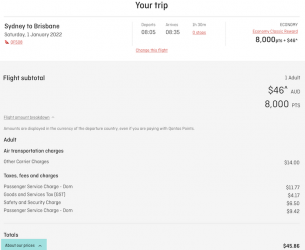

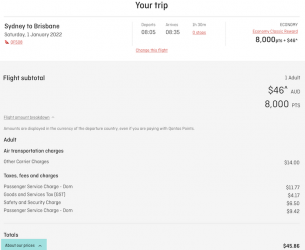

And on 1 January 2022:

Jetstar also seems to be affected, with domestic awards booked using Qantas points attracting $5.79 more in taxes from 1 January 2022.

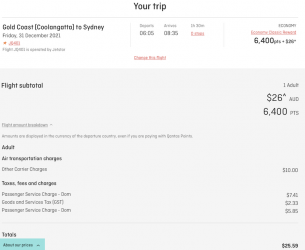

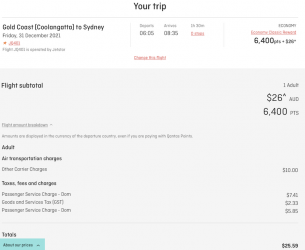

Here's an example of a Jetstar award flight on 31/12/21:

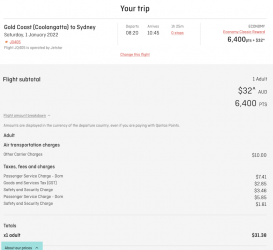

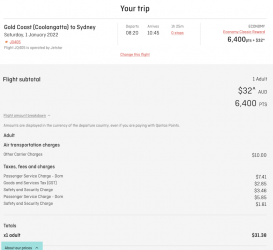

And another flight on 1/1/22, which has two added Safety and Security Charges and slightly higher GST as a result:

Virgin doesn't seem to be affected at all and Rex doesn't have a frequent flyer program, but I haven't noticed any changes in the Rex fare breakdown from 1 January. Anyone know what's going on?

The new Safety and Security Charge also appears to be included in paid Qantas & Jetstar airfares from 1 January, although it's included in the fare so only really an issue when making an award booking.

There doesn't seem to be any change to the Qantas-imposed carrier charge. Rather, Qantas is adding a $6.50 "Safety and Security Charge" to all domestic awards from 1 January, which is also adding slightly to the GST component bringing the total tax increase to $7.15 per passenger, per flight.

For example, this is the fare breakdown on a SYD-BNE Classic Flight Reward booking for 31 December 2021:

And on 1 January 2022:

Jetstar also seems to be affected, with domestic awards booked using Qantas points attracting $5.79 more in taxes from 1 January 2022.

Here's an example of a Jetstar award flight on 31/12/21:

And another flight on 1/1/22, which has two added Safety and Security Charges and slightly higher GST as a result:

Virgin doesn't seem to be affected at all and Rex doesn't have a frequent flyer program, but I haven't noticed any changes in the Rex fare breakdown from 1 January. Anyone know what's going on?

The new Safety and Security Charge also appears to be included in paid Qantas & Jetstar airfares from 1 January, although it's included in the fare so only really an issue when making an award booking.