You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Superannuation Discussion + market volatility

- Thread starter JohnK

- Start date

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,628

Effectivelydouble taxation the new black @Brissy1 ? ?

So first cab off the rank must be franking credits.. mega bucks for the coffers of the fiscal fiend...

Corporate tax is a PAYE-D system where the “income tax” is “transferred” from the company to the individual shareholder

Spawned dividend washing

and

retirees from 2008 gained tax-free super so those “small refunds” became big refunds as None of the superannuation withdrawals “counted” in taxable income. It’s why the vast majority of seniors over 67 get a Seniors Health care card (super 100% excluded) but not an age pension (as only 10% of the super is excluded) aside all those public servants who are taxed from 60 onwards

I didn't know that. The famous "age of entitlement"... that would be 67...Seniors Health care card (super 100% excluded)

TheRealTMA

Senior Member

- Joined

- Jul 13, 2012

- Posts

- 8,372

- Qantas

- Platinum

My heart bleeds.Just had a visit from someone that fits into the >$3M category. Ran a small business working 80-90 hours a week and is not happy Jan

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,029

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

Well, that was the plan for compulsory super. Get the majority of peeps onto self-funded retirement and off the OAP.It’s why the vast majority of seniors over 67 get a Seniors Health care card (super 100% excluded) but not an age pension (as only 10% of the super is excluded)

Providing some chance of still accessing the Seniors Health Card wasn’t unreasonable.

However, I suspect the Venn diagram of peeps with $3+M in Super and earning less than ~$100k from non Super is wafer thin!

- Joined

- Jan 29, 2012

- Posts

- 16,019

- Qantas

- LT Gold

- Virgin

- Red

- Oneworld

- Emerald

[mod hat]

Political posts have been deleted and infractions given.

[/mod hat]

Political posts have been deleted and infractions given.

[/mod hat]

Ansett Nostalgic

Active Member

- Joined

- Jan 1, 2024

- Posts

- 615

Good luck travelling along the footpaths (no roads) with your private bodyguards (no police or justice system) and your personal doctor and nurse.

If you have a heart attack, hire some tradesmen to build a hospital for your treatment in the 15 minutes you have before the heart muscle dies.

I'm sure you will donate generously to charity to help the beggar retirees, illiterate poor children and disabled people who would otherwise get in your way.

If a foreign country decides to invade, form a militia with your friends.

Australia is an amazing country and part of that is because we pay taxes. Every 3 years, we get a (tax-funded) opportunity to express our wishes on how much those taxes are, who pays them and how they are spent.

Classic strawman posturing from you Andy. The idea that there will be no footpaths or police without this ridiculous tax increase is totally absurd.

We do not have a problem with a lack of tax revenue. The problem is excessive spending.

- Joined

- Jan 14, 2013

- Posts

- 6,594

- Qantas

- Qantas Club

- Virgin

- Red

- Oneworld

- Sapphire

- Star Alliance

- Silver

I accept there was more than a smidge of straw and hyperbole in the post but I was a bit taken aback by the idea that there was immorality in the expectation that citizens should expect taxation on their gains as part of belonging to society.

My feeling is that the tax burden lays heaviest on people's work and is relatively generous to those who invest their capital. I do think this has resulted in a level of intergenerational "unfairness" which as I have 4 children, I am acutely aware of.

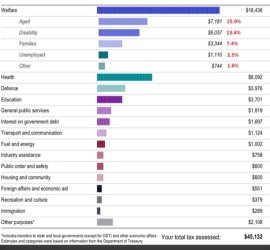

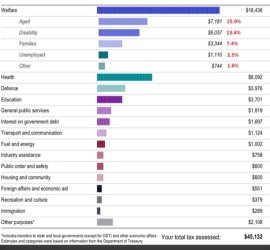

This is not helped by what seems to be a perception by some that tax is going to Centrelink for layabouts smoking bongs or wasteful quangoes and bureaucracy, whereas the major proportion is going to more worthy causes such as the age pension (fortunately not increasing exponentially in Australia thanks to Super), health, education, justice and defence

Many of the "worthy" causes could do with more money or alternatively if investors paid a relatively higher proportion, then maybe we could have tax cuts for workers and businesses.

(Ps: that's not my assessable tax at the bottom of the pic)

My feeling is that the tax burden lays heaviest on people's work and is relatively generous to those who invest their capital. I do think this has resulted in a level of intergenerational "unfairness" which as I have 4 children, I am acutely aware of.

This is not helped by what seems to be a perception by some that tax is going to Centrelink for layabouts smoking bongs or wasteful quangoes and bureaucracy, whereas the major proportion is going to more worthy causes such as the age pension (fortunately not increasing exponentially in Australia thanks to Super), health, education, justice and defence

Many of the "worthy" causes could do with more money or alternatively if investors paid a relatively higher proportion, then maybe we could have tax cuts for workers and businesses.

(Ps: that's not my assessable tax at the bottom of the pic)

Last edited:

tgh

Established Member

- Joined

- Apr 23, 2006

- Posts

- 3,762

My feeling is that the tax burden lays heaviest on people's work and is relatively generous to those who invest their capital

There is a common perception that rich folks became rich through inheritance or luck.

In my case the early years saw me working day and night , I seldom saw a kid during the week.

11+ hours on site, a couple of hours travel and then into the office after a hasty dinner to attempt to to win another job and keep my crew in work.

Our house guaranteed the working capital and the failure rate in my industry was very high as small players were sometimes seen as expendable.

Through those first 20 years we had no holidays and 0 security , I often became unwell on sunday nights as the phone started ringing and the decisions had to be made for the coming week.

This was a fairly normal existence for a young fellow seeking security for family and home in those days ; today the young builder nearby, educating 4 kids, is gone at 4 every morning and looks older every time we chat...

Of course over time we grew, saved every cent, paid for the house , financed our own business and stacked any spare money into super , a level of financial security eventually came and I retired in my 50's

The point of this long diatribe is that the risk profile for folks in business is usually ignored by those not involved.

IMO folks risking capital ( at whatever level) should receive favourable taxation treatment compared to the relative comfort of a secure salary and security of employment.

There is a common perception that rich folks became rich through inheritance or luck.

In my case the early years saw me working day and night , I seldom saw a kid during the week.

11+ hours on site, a couple of hours travel and then into the office after a hasty dinner to attempt to to win another job and keep my crew in work.

Our house guaranteed the working capital and the failure rate in my industry was very high as small players were sometimes seen as expendable.

Through those first 20 years we had no holidays and 0 security , I often became unwell on sunday nights as the phone started ringing and the decisions had to be made for the coming week.

This was a fairly normal existence for a young fellow seeking security for family and home in those days ; today the young builder nearby, educating 4 kids, is gone at 4 every morning and looks older every time we chat...

Of course over time we grew, saved every cent, paid for the house , financed our own business and stacked any spare money into super , a level of financial security eventually came and I retired in my 50's

The point of this long diatribe is that the risk profile for folks in business is usually ignored by those not involved.

IMO folks risking capital ( at whatever level) should receive favourable taxation treatment compared to the relative comfort of a secure salary and security of employment.

JohnK

Veteran Member

- Joined

- Mar 22, 2005

- Posts

- 44,436

Maybe introduce a 15% tax on all super pension withdrawals above the current income tax free threshold.

That would be extremely unfair.

Most may not agree about themselves, but I've paid more than enough tax this lifetime.

P.S. Can I still take out the reasonable benefit limit as lump sum or would that also be taxed?

Not my area of expertise but aren't rules around that now redundant?reasonable benefit limit

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,384

You can withdraw ALL of your super at retirement age Tax free, stash the cash in a safe, divest of all other assets, then go on old age pension.P.S. Can I still take out the reasonable benefit limit as lump sum or would that also be taxed?

Not quite.You can withdraw ALL of your super at retirement age Tax free, stash the cash in a safe, divest of all other assets, then go on old age pension.

You would need to declare the stash of cash in the safe as an asset to the government.

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,384

Not if you said you spent it or lost it all in a scam. They will have to raid your house first.You would need to declare the stash of cash in the safe as an asset to the government.

What about if the cash is buried in the back yard?

Better thing to spend it on is a much bigger house (or renovations) and use that as your main residence. Removes the risk of a nasty audit and a 'raid".Not if you said you spent it. They will have to raid your house first.

Edit: As an additional thought to this.....I wonder what the situation would be if you took that "stash of cash" and converted it to physical gold, and then had that gold melted down and turned into a tap, or something similar (a gold toilet seat perhaps), and installed that it your house. Would it be included in the main residence exemption test for the pension?

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,384

Lots of ways to "get rid" of cash

- Joined

- Aug 27, 2004

- Posts

- 17,951

- Qantas

- LT Gold

- Virgin

- Red

- Oneworld

- Sapphire

Like investing in an airline ... oops, sorry, wrong threadLots of ways to "get rid" of cash

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,384

In all of human history it has been consistently shown that it is very easy to lose cash.

I knew someone who actually did buried tins back in the days when Australia had death tax. Dug it up after the husband died, water had got in (FNQ) and turned wads into into solid lumps. I suggest use of inert metal (Au)Not if you said you spent it or lost it all in a scam. They will have to raid your house first.

What about if the cash is buried in the back yard?

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- DejaBrew

- opusman

- zig

- Forg

- kamchatsky

- Paul McClafferty

- richard.cohen90

- MooTime

- jakob

- drron

- Kristian

- cosi

- mviy

- Willie

- Aeryn

- Pele

- SJF211

- JK1964

- The Man in Blue

- Becstar101

- michaelk

- points

- cgichard

- KSC

- jase05

- Harrison_133

- edwin kwok

- pommyk

- Doug_Westcott

- fasola

- burneracc

- spellbound200

- Mattg

- TheRealTMA

- sudoer

- Foreigner

- brett-au

- asterix

- XavierP

- Scash

- TFL

- BenG

- Saab34

- dsotm

- YoungTraveller

- paddywide

- flyingfan

- Spizz

- Up in the clouds

- Trekky1

Total: 2,360 (members: 65, guests: 2,295)