Indeed they have. I think the last round of payments went out on 10th Oct and nothing since then. I received my "Your Rewards Checking account $250 bonus is on its way" on 10th Oct but no cash in the a/c yet. may be they have moved to a monthly cycle.Was this more than a couple of weeks ago? DOC has some very recent DPs (especially over the past few days) for the Amex checking bonus. Amex seems to have recently slowed down on the alert emails and the bonus crediting

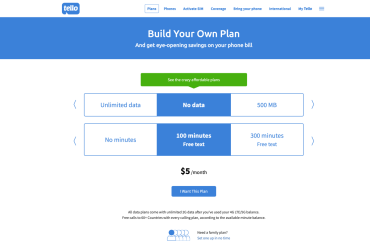

[YMMV] American Express $250 Checking Bonus

American Express is offering a $250 bonus when you open a new personal checking account and complete the following requirements…www.doctorofcredit.com

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

PointsLife1

Member

- Joined

- Jan 30, 2020

- Posts

- 197

Yes borderline with the 35K cert but I believe you can top up 15K on top and that covers most Australian properties at least. Overseas a different story but $650.00 annual fee just too much now when already lifetime.I was thinking do that when my Bevy comes up for renewal next Feb. But the 35k annual cert is no longer an attractive option. I already have the Marriott Biz which I might keep instead as it doesn't count for 5/24. I'm going to hit the limit of 5 active Amex lending products either end of this year or sometime next year, so will need to cull some cards on the way and might add charge cards instead,

Now what to do with my Surpass? Hilton 3rd down on my chains (Marriott and IHG) 1st and 2nd.

anyonebutqantas

Member

- Joined

- Jan 22, 2023

- Posts

- 395

Yes borderline with the 35K cert but I believe you can top up 15K on top and that covers most Australian properties at least. Overseas a different story but $650.00 annual fee just too much now when already lifetime.

Now what to do with my Surpass? Hilton 3rd down on my chains (Marriott and IHG) 1st and 2nd.

You might be surprised what you can get for circa 35k - for example the brand new W Macau can be redeemed for 38k. Great value.

Hi, a question for those with the Hilton Aspire card. I just got the email and not sure how to interpret the Terms:

3. $400 Hilton Resort Credit

Hilton Honors Aspire Card Members approved prior to October 19, 2023 will receive up to $250 in statement credits per membership year for eligible purchases made directly with participating Hilton Resorts through December 31, 2023. Starting January 1, 2024, Card Members can receive up to a total of $200 in statement credits semi-annually (January through June; and July through December), for up to $400 back annually for eligible purchases made directly with participating Hilton Resorts on their Card Account.

Does it mean we can still use the $250 until Dec 2023 AND then also have another $200 from Jan 2024 - Jun 2024 and $200 from Jul 2024 - Dec 2024 to use? $650 is wishful thinking and seems too good to be true...

3. $400 Hilton Resort Credit

Hilton Honors Aspire Card Members approved prior to October 19, 2023 will receive up to $250 in statement credits per membership year for eligible purchases made directly with participating Hilton Resorts through December 31, 2023. Starting January 1, 2024, Card Members can receive up to a total of $200 in statement credits semi-annually (January through June; and July through December), for up to $400 back annually for eligible purchases made directly with participating Hilton Resorts on their Card Account.

Does it mean we can still use the $250 until Dec 2023 AND then also have another $200 from Jan 2024 - Jun 2024 and $200 from Jul 2024 - Dec 2024 to use? $650 is wishful thinking and seems too good to be true...

That's correct. The Aspire has always been a money maker if you spend a lot at Hilton resorts. It arguably gets even better for those people. Worse for most other people though. I definitely don't stay at Hilton resorts twice per year. If there were more than one in Australia, it might be better value.Does it mean we can still use the $250 until Dec 2023 AND then also have another $200 from Jan 2024 - Jun 2024 and $200 from Jul 2024 - Dec 2024 to use? $650 is wishful thinking and seems too good to be true...

Franko Costa

Active Member

- Joined

- Aug 18, 2011

- Posts

- 830

It's finally here! I just received my ITIN. My FICO score is 735 and I have 3 amex cards (Inc 1 charge) from GT.

I will apply for the CSP and then start applying for business ink and amex business cards. I like the CSR, but I already have enough travel credits plus I don't think I would be using points to redeem on the travel portal anyway.

I understand I could apply for an ink card every 3 months and hitting the min spend will be no issue for me.

How do I link my ITIN to my FICO? Any advice in card would be well received

I will apply for the CSP and then start applying for business ink and amex business cards. I like the CSR, but I already have enough travel credits plus I don't think I would be using points to redeem on the travel portal anyway.

I understand I could apply for an ink card every 3 months and hitting the min spend will be no issue for me.

How do I link my ITIN to my FICO? Any advice in card would be well received

Wife was approved for 1st AMEX GT on 18th October, hasn't arrived at friends address yet in Boston.If you didn't already know, if you wait 10 days after approval, you should be able to call up Amex and get them to post the card (or a replacement) directly to you in Australia.

With regards to calling up AMEX and asking for a delivery replacement card to Aus, is ithe 10 days after approval - 10 business days or 10 calendar days?

Also read somewhere upthread that they may ask for Notarycam in this instance?

Congrats. What was the timeline for when you applied for the 2nd and 3rd GT AMEX cards? Do these count towards your 5/24 chase rule?It's finally here! I just received my ITIN. My FICO score is 735 and I have 3 amex cards (Inc 1 charge) from GT.

I will apply for the CSP and then start applying for business ink and amex business cards. I like the CSR, but I already have enough travel credits plus I don't think I would be using points to redeem on the travel portal anyway.

I understand I could apply for an ink card every 3 months and hitting the min spend will be no issue for me.

How do I link my ITIN to my FICO? Any advice in card would be well received

I noticed you said you opened a Chase checking account. I had a look at their application process and note that they ask if you are a USA citizen or have a green card, if you answer no to both then then you can't progress. How did you get around that?I am looking at the same. I do not have an SSN/ITIN. I have to open accounts with my passport and ID documents. I am waiting to see if I will get my Chase bonus & my Bank of America bonus.

My brother is a US Permanent Resident with an SSN, and we had signed up for the American Express Checking for the $250; awaiting the qualification email, hopefully.

He already had the C1, so he cannot open another one and claim this bonus.

There are a few options out there. We got a Chase pamphlet today where you can get $225 with a bonus code, and the normal is $200.

There are a few options out there, but they do require big deposits. Another could be Ally Bank.

I am actively looking for those with a $0 fee.

Additionally they ask for a US drivers license or State ID.

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,793

I was in LAX a few days ago. I got an old Samsung phone set up to be the USA app phone and downloaded the major banking apps.

I took a punt on a Citi Premier and was denied flat out, not even pending. They are sending a letter to my friend's address. I don't have time to do a recon call while I am overseas. They didn't pull any of the 3 credit scores so there is something else going on.

I took a punt on a Citi Premier and was denied flat out, not even pending. They are sending a letter to my friend's address. I don't have time to do a recon call while I am overseas. They didn't pull any of the 3 credit scores so there is something else going on.

Franko Costa

Active Member

- Joined

- Aug 18, 2011

- Posts

- 830

The rules with amex is you can get the 2nd after 5 days of the first and then the 3rd after 90 days and that's what I did.Congrats. What was the timeline for when you applied for the 2nd and 3rd GT AMEX cards? Do these count towards your 5/24 chase rule?

Yes the 5/24 rule is a pain hence why I will go with the Chase CSP and then business cards (which don't add to 5/24)

desafinado74

Active Member

- Joined

- Sep 13, 2015

- Posts

- 938

Let me know if you want me to get you a SIM card from the USA, as I’m here until December I could try and help you. Might be ways get a cheap sim, or sure. I’m getting my Verizon new

device delivered today, will have a sim/number I probably won’t use but won’t hold that number too long.

Im also using Google Voice when opening up bank accounts here, seems to work for the most part, I did have issues with Bank of America though and using it with Zelle.

Maybe there is an ESIM option you could also consider for this? And just apply it to your current device? Not sure it’s the only work around options I know.

How hard was it to open a BoFA checking account in the branch ? What kind of documents did they ask ? And how was the process with the Verizon account too ? Are non US citizens allowed to get a phone account ?

Opening in branch was easy.How hard was it to open a BoFA checking account in the branch ? What kind of documents did they ask ? And how was the process with the Verizon account too ? Are non US citizens allowed to get a phone account ?

Just need a passport; take a credit or debit card as a secondary ID or your driver's license I didn’t need proof of address she just took it from me. Chase wanted an address confirmation from a bill or a bank statement, a offer letter or similar from another bank doesn't work.

Verizon was easy. So, I did an application online, but they do require an SSN/ITIN, so even though you can complete the application online, you won't pass as it does require that SSN/ITIN that you cannot bypass. You need to call them to send you a new link that allows you to bypass the SSN/ITIN option, and from my understanding, they run the process and credit application through Nova on Transunion.

You will most likely need to talk with their credit management team, that is just to provide them with your passport and Visa. I am on the Visa Waiver so that one sufficed to confirm I was residing in the USA.

The operator remained on the line whilst I went through the entire process with credit management and once it was all done, I was approved and proceeded with the order as normal with them.

Are non US citizens allowed to get a phone account ?

I think with Verizon only you can do it online and over the phone, if you do it via AT&T you may need to go in store.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

10 calendar days I believe . Activate card received on Apple Pay . Wait for a while and then ask for replacement . Don’t think they will ask for notary cam . Just say you lost card .Wife was approved for 1st AMEX GT on 18th October, hasn't arrived at friends address yet in Boston.

With regards to calling up AMEX and asking for a delivery replacement card to Aus, is ithe 10 days after approval - 10 business days or 10 calendar days?

Also read somewhere upthread that they may ask for Notarycam in this instance?

How much are you paying for your Verizon line?Verizon was easy.

If it’s delivery by USPS then maybe give it a bit longer.Wife was approved for 1st AMEX GT on 18th October, hasn't arrived at friends address yet in Boston.

anyonebutqantas

Member

- Joined

- Jan 22, 2023

- Posts

- 395

How much are you paying for your Verizon line?

I would also be interested to know this.

Something like $96 a month. My first bill is due for $139, they charge you an activation fee of $35 and then all the Californian taxes, etc.How much are you paying for your Verizon line?

But when I signed up because I looked at a trade-in I got a monthly credit but you needed the highest plan to get the higher trade-in.

I am trying to find a way atm to dispose of the line and pay the phone out.

Plus they have a 60-day lock on iPhones as a fyi, carrier lock.

Post automatically merged:

I’m using Google voice, it’s connected to my brothers US line but I know that it doesn’t work well with some banks as well, they tend to not like VOIP lines, chase wont send me verification codes for transfers same as Bank of America.Is anyone using Tello? Any issues with Chase verification texts?

Last edited:

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Recent Posts

-

-

Sydney to Newcastle – Fulfilling a 31-Year Premier League Pilgrimage

- Latest: BriarFlyer

-

Currently Active Users

- Mqrko

- Growing Older

- Brissy1

- JessicaTam

- mrsterryn

- Equilibrium

- Scr77

- zig

- ddaritan

- Mother

- tassie6

- Larko1

- lakes8

- Harrison_133

- defurax

- Dmac59

- Rug

- jase05

- Mattg

- TerryDaktyle

- Leroy

- nthd_nthd

- Black Duck

- Anastascia

- markis10

- Intra

- CaptainPersia

- Bolter

- vyralmonkey

- Tan18_01

- MELso

- Isolar

- BriarFlyer

- aus_flyer

- larry40

- kookaburra75

- ChrisBNE

- flyingfan

- aaronm

- offshore171

- kerfuffle

- wentworthmeister

- SYD

- Austman

- muppet

- kpc

- joelby

- jrfsp

- austgap

Total: 1,615 (members: 91, guests: 1,524)