Rest assured, the form you submitted was

not a credit card application and your

credit score was not affected.

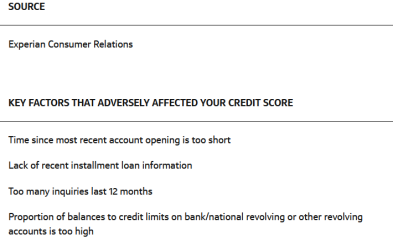

Here are the reasons why we couldn't match you with an offer:

- Based on your credit report from one or more of the agencies below, there are too many revolving accounts

Please make sure to save and/or print this notice for your records as it may not be available after this page expires or if you navigate to another page. For your security, this

page will expire after 20 minutes of no activity.

We know this isn't the answer you were hoping for, but we hope there is an opportunity to provide you with new products and services in the future.

Creditor: Capital One, N.A. P.O. Box 30280, Salt Lake City, UT 84130-0230