… I usually take them all to the supermarket and put $A1 through each of them to generate some activity once a year …

And I thought I was stingy, only putting a coffee on them every month or so.

… I usually take them all to the supermarket and put $A1 through each of them to generate some activity once a year …

A US paypal accountUpdate:

My green card arrived via DHL

Have it up and running

Created account, added to Apple pay and have been able to add to paypal and pay for a few things already

I have setup wise account and need to search back how to setup autopay

Question - to people who have AU Paypal did you just add to that account or create a new US PayPal account

Did you ever had the Amex Platinum Card in the past? Till when is the upgrade offer valid since 100k upgrade offer is amazing.I've recently had a successful application for the AMEX US Gold Card thanks again to @SWFR's link. I have a Green Card and a Bonvoy "basic" card.

I think the Green works well for me. I'm tempted to take the upgrade offer from Green to Platinum for 100K MR points. I figure with the $A down so low and the fees I'll incur to meet the SUB qualifying spend, it will work out to 1.2cpp which I think is pretty pedestrian but ...

Just seeking an opinion, if I do this, spend on the Gold and then downgrade the Platinum back down to Green in a year and cancel the Gold as Green more closely meets my needs, are there any issues I need to be mindful of and is this otherwise a workable strategy?

TIA for your help

Patience GrasshopperI have done a few small transactions to test the card and noticed a few anomalies

Thanks - I am going to understand this as wait till pending clears - very happy to doPatience Grasshopper

The $1.10 must be the verification charge done by the vendor which will disappear in few days.Got Wise working with the Amex and did a test transfer of $50 which seems to be received.

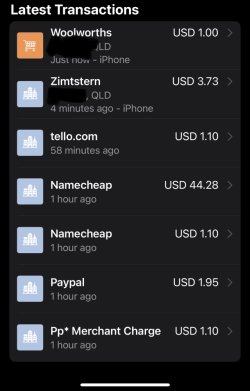

I have done a few small transactions to test the card and noticed a few anomalies

- Seems to have a fee of $1.10 per merchant - is this a pending charge as new card or new merchant to me - not seen this on AU cards - it is NOT on the amex website just the apple wallet app

- the woolworths item was AU$1.10 but flagged up as USD $1.00 - that is both on wallet and amex app - also still pending but conversion rate seems off - was wondering if it might be due to less than $1 as pending it rounds it up.

View attachment 340352

Haven’t had US Platinum card before. Am thinking of taking it up as it’s the same as the public SUB & I won’t need to make an application. I think the AF @ $A1k is outrageous otherwise. Might be worth taking it for a spin though.A US paypal account

Post automatically merged:

Did you ever had the Amex Platinum Card in the past? Till when is the upgrade offer valid since 100k upgrade offer is amazing.

If you haven't had the card before then the best strategy is to first signup for the card and then later on accept the upgrade offers on your other cards. The upgrade offers don't have the lifetime bonus condition so this way you can double dip.Haven’t had US Platinum card before. Am thinking of taking it up as it’s the same as the public SUB & I won’t need to make an application. I think the AF @ $A1k is outrageous otherwise. Might be worth taking it for a spin though.

Ok thought the restriction for future SUB was having had the card previously. Thanks for the heads up. I think I’ll look past the AF given that I’ll still be able to apply for it & get the SUB down the track.If you haven't had the card before then the best strategy is to first signup for the card and then later on accept the upgrade offers on your other cards. The upgrade offers don't have the lifetime bonus condition so this way you can double dip.

Just remember that the US Plat SUB has been as high as 150K + $200 back, so taking a 100K upgrade offer is quite the step down.Haven’t had US Platinum card before. Am thinking of taking it up as it’s the same as the public SUB & I won’t need to make an application. I think the AF @ $A1k is outrageous otherwise. Might be worth taking it for a spin though.

Yes you are right . You can’t get the SUB for a fresh application of you have had the card previously through an upgrade .Ok thought the restriction for future SUB was having had the card previously. Thanks for the heads up. I think I’ll look past the AF given that I’ll still be able to apply for it & get the SUB down the track.

Thanks for that insight - I agree, I think the economics for the SUB earn would improve somewhat from a pretty pedestrian result right now. I'll give that some thought before charging in.Just remember that the US Plat SUB has been as high as 150K + $200 back, so taking a 100K upgrade offer is quite the step down.

Interesting. I was looking at the USA website - neither the Premier MC nor the Premier World Elite MC have foreign transaction feesFor anyone with HSBC premier US, I recently applied via my US RM and got approved for HSBC Premier Credit card which comes with 35k points SUB (3k spend) and no AF. Not something to get excited about but I wanted to get it anyways as my options are currently limited. I put my AU address for card delivery and it has been shipped via DHL.

The points can be transferred to 11 hotel and airline partners including Qantas

Aug has been hectic - got 2 Amex Biz and 1 HSBC personal. I hope to stay under 5/24 to be eligible for chase cards some day.

A trip to the US and apply in a Branch would help.Chase Checking Account

How do you open the account (online or in person?)

I assume an ITIN or SSN is a mustA trip to the US and apply in a Branch would help.

Not sure. When I walked into a Citibank branch in California last year, they seemed happy to open a checking account for me using my passport as ID. I did have a Citi (basic savings type) account in Oz. However, they were about to close for the day and I couldn’t get back to follow up.I assume an ITIN or SSN is a must