You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 931

My Coles GC purchases just show as Coles (Supermarkets)

I heard people talked about Amex receiving level 3 data from some large merchants meaning they get more customer information including the line-item details of your purchase. It's similar to how they could show our flight details. I also heard this was more common on Visa/Mastercard so it's possible Chase could see what you buy. Hope they don't get much details from Australian merchants. I bought 2k worth of gift cards from giftcards.com.au on Amex and got the SUB. I wasn't worried though as I put more spend after and still met min spend without gift cards. Not sure if I want to risk it at Chase.

It seems to work that way for purchases in the US, However, I’m not aware that this is the case in Oz.I heard people talked about Amex receiving level 3 data from some large merchants meaning they get more customer information including the line-item details of your purchase.

Chase don't care about gift cards. It's only Amex.Not sure if I want to risk it at Chase.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,629

I did . Wish to apply for my spouse now . They quoted $397 after discount .Weren’t you using Sina B at EIN Express, or maybe you didn’t proceed with that?

On fiverr there is a service provide otafaxg charging A$126 . Do you think it’s a good idea ? Anyone use them ?

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,813

Last year I had a large mechanic bill and he didn’t take Amex. So I bought those Visa gift cards at Coles on the Amex I was trying to make a minimum spend. No problem and it was almost a year ago.It seems to work that way for purchases in the US, However, I’m not aware that this is the case in Oz.

Just tried for the Green Card via 2nd GT and got straight up declined.Thanks

I just got off the phone with new account. First, on my application they couldn't see my GT AU card info as it was a regular application?? according to the rep. Then I gave them my Amex AU account number.

5 minutes later, the rep stated that since I already have a US Platinum card (via GT last month) I wouldn't qualify for 2nd GT. Other options would be submitting 4506-C which I don't have.

Well, I wish I could get that Bonvoy Brilliant card with a great signup bonus.

I might try to apply for it again three months down the road using this same method, what are your suggestion or advise?

Yes, Oz GC have been working out okay for me. My understanding is that supermarket charges are not itemised/notified as they do in the USLast year I had a large mechanic bill and he didn’t take Amex. So I bought those Visa gift cards at Coles on the Amex I was trying to make a minimum spend. No problem and it was almost a year ago.

Last edited:

maybe they have updated their system not letting 2nd GTJust tried for the Green Card via 2nd GT and got straight up declined.

_TheTraveller_

Established Member

- Joined

- Dec 16, 2011

- Posts

- 1,592

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

maybe they have updated their system not letting 2nd GT

It's always been hit and miss. Even previously when others were permitted a 2nd GT without a FICO score, I tried at the 5-6 month mark was advised to wait until I had a FICO score before applying again.

I don't think the GT is the issue but I'm guessing the system might be trying to pull your CR based on your existing Amex profile.

Looking for advice from the brains trust - I have an ITIN application in progress and am aiming to get a Cap 1 Venture X in the next 6-12 months. My FICO score is currently 770 (around 30 short of "Excellent") through a single amex card. Would you recommend I:

(a) apply for another amex without an ITIN (so presumably using GT again) to (hopefully) boost the score,

(b) sit tight and apply for an amex when I get the ITIN in a few months' time, or

(c) attempt applying for the Cap 1 VX directly when I get the ITIN?

(a) apply for another amex without an ITIN (so presumably using GT again) to (hopefully) boost the score,

(b) sit tight and apply for an amex when I get the ITIN in a few months' time, or

(c) attempt applying for the Cap 1 VX directly when I get the ITIN?

_TheTraveller_

Established Member

- Joined

- Dec 16, 2011

- Posts

- 1,592

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

Looking for advice from the brains trust - I have an ITIN application in progress and am aiming to get a Cap 1 Venture X in the next 6-12 months. My FICO score is currently 770 (around 30 short of "Excellent") through a single amex card. Would you recommend I:

(a) apply for another amex without an ITIN (so presumably using GT again) to (hopefully) boost the score,

(b) sit tight and apply for an amex when I get the ITIN in a few months' time, or

(c) attempt applying for the Cap 1 VX directly when I get the ITIN?

A or B. Irrespective of whether you apply with an ITIN, the next time you apply for the card it should identify on other aspects other than the ITIN. If you want to be safe then go with B.

You should really read up on how C1 approves VX applicants. Irrespective of your credit score, you may still be denied. C1 doesn't look for people who have excellent credit scores but rather people who they can make money off. There are plenty DPs where people who have 800+ scores and perfect records who have been denied.

Thanks! Yes I've read about the random rejections, but I think it's one of the best everyday cards out there, so one worth risking a hard pull for. My normal spend is not huge and this card is effectively self sustaining thanks to the travel credit and bonus points.A or B. Irrespective of whether you apply with an ITIN, the next time you apply for the card it should identify on other aspects other than the ITIN. If you want to be safe then go with B.

You should really read up on how C1 approves VX applicants. Irrespective of your credit score, you may still be denied. C1 doesn't look for people who have excellent credit scores but rather people who they can make money off. There are plenty DPs where people who have 800+ scores and perfect records who have been denied.

ithongy

Member

- Joined

- Mar 3, 2009

- Posts

- 275

Chase WOH had 5x multipliers at grocery stores and needed to buy a mattress from Macy’s and spent over 3hrs on phone to sort it out, to purchase Macys GC.Chase don't care about gift cards. It's only Amex.

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 931

Does Cap 1 have that feature where you can temporarily turn the card off and on at will? I have only seen this on my Barclays Aviator.

Yes they do, same as Amex, Chase and Citi. Except the freeze on Amex expires in about 7 days I think.

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,813

Thanks. That’s a nice little feature to protect a card in transit from USA to Australia. My friend can send me a picture of the card details and I can lock it except when I am using it online. But it doesn’t look like I can add it to Apple Pay without the Cap 1 app and they don’t offer it in the Aussie App Store. Now I just have to figure out when I can do a $4000 USD minimum spend. I can’t go crazy on gift cards.Yes they do, same as Amex, Chase and Citi. Except the freeze on Amex expires in about 7 days I think.

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 931

Thanks. That’s a nice little feature to protect a card in transit from USA to Australia. My friend can send me a picture of the card details and I can lock it except when I am using it online. But it doesn’t look like I can add it to Apple Pay without the Cap 1 app and they don’t offer it in the Aussie App Store. Now I just have to figure out when I can do a $4000 USD minimum spend. I can’t go crazy on gift cards.

That's what I normally do when they are in transit. Don't expect much from Cap1 about adding to wallet even when you have their app. I had an issue adding the card to GooglePay and had to call them. Took a bit to be transferred to the correct department. I believe it was something like online technical support dept. I changed the phone in January and had the same issue and couldn't be bothered to call them again. Hope it works differently for you on Apple Pay.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,629

desafinado74

Active Member

- Joined

- Sep 13, 2015

- Posts

- 949

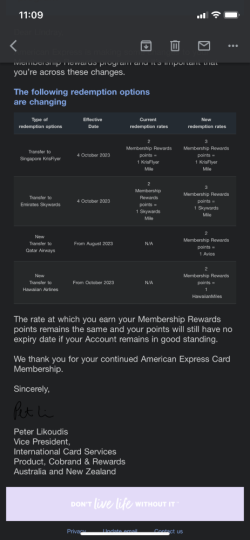

Shocking BS. Totally disinterested with Aussie cards now.US Amex looks even more attractive after Aus Amex MR devaluation

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Archipelago

- blackcat20

- Pete Ramsay

- HMcM

- 01ellioc

- QFFHntrGthr

- JJysmell

- mrsterryn

- larry40

- ShelleyB

- kelvedon

- New to this

- mouseman99

- RooFlyer

- kamchatsky

- cove

- Stay No Stay

- Assassin

- Tindersinder

- hydrabyss

- axkhanna1

- AviationNZ

- Bundy Bear

- shadowground

- pbl22

- Tiki

- Denali

- 747sp

- dajop

- Saab34

- ayebee

- flyingfan

- nthd_nthd

- jrfsp

- Pete98765432

- Tooner

- cambriamarsh

- MVM

- Brissy1

- nige_perth

- billmurray

- Harrison_133

- hutch

- Recycling

- benoles

- adenda

- Skwinky

- Oubline

- Oscarq

- Doctore1003

Total: 1,670 (members: 65, guests: 1,605)